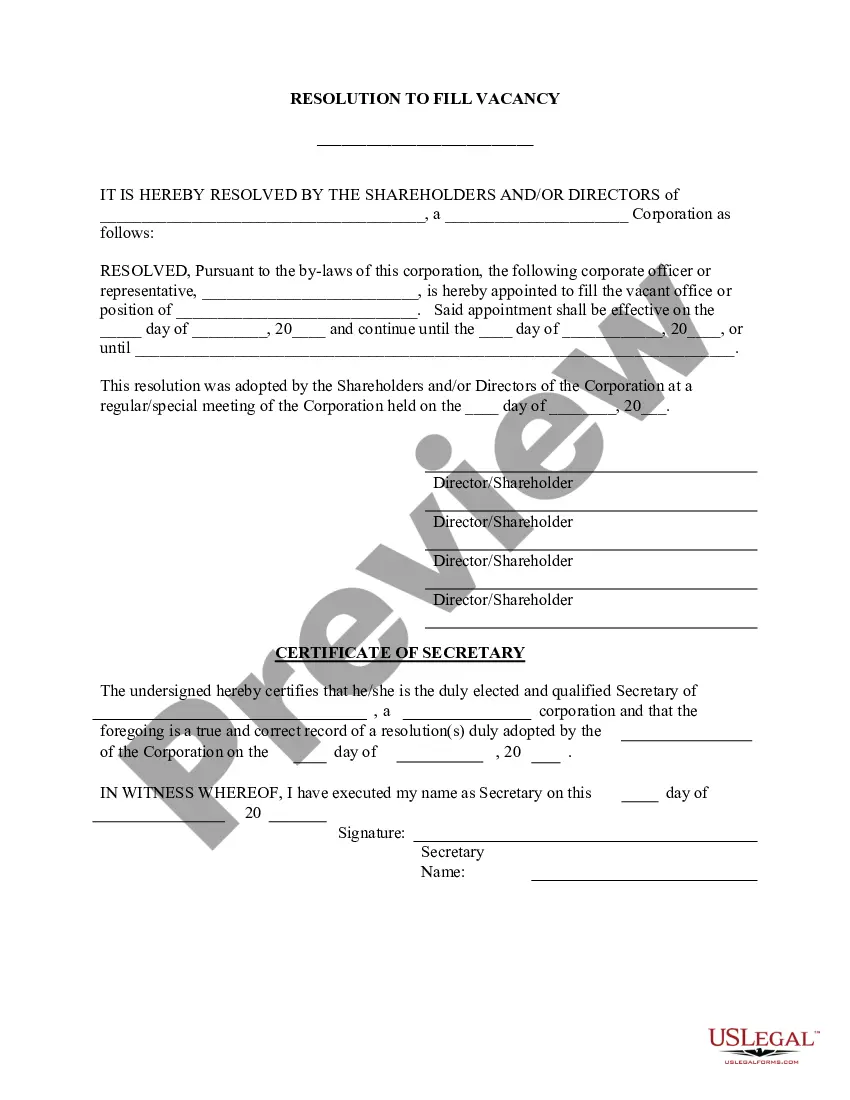

This form is a sample letter in Word format covering the subject matter of the title of the form.

Subject: Rhode Island Sample Letter for Bonus Dear [Employee's Name], We are pleased to inform you that, based on your outstanding performance and dedication to your job, we have decided to award you a special bonus as a token of appreciation. This letter serves as a Rhode Island Sample Letter for Bonus, addressing the specific regulations and guidelines applicable within the state of Rhode Island. Rhode Island legislation provides certain provisions regarding bonus payments, ensuring fair compensation for employees. It is important to note that these regulations may vary based on the specific circumstances of each bonus. However, the general principles laid out by the state are as follows: 1. Voluntary Bonus: If the bonus is purely discretionary and decided by the employer without any prior contractual obligation, it falls under the category of a voluntary bonus. In this case, there is no state requirement for providing a bonus. However, employers are encouraged to communicate the bonus details to the employee in writing to ensure transparency and avoid any potential misunderstanding. 2. Contractual Bonus: If the bonus is contractually promised or stated in an employment agreement, the employer is obligated to fulfill the contractual terms unless certain conditions are not met. This type of bonus may include monetary rewards based on performance metrics, sales targets, or other predefined criteria. 3. Bonus Denial or Reduction: Rhode Island law permits employers to deny or reduce a bonus if there is a legitimate reason to do so. For example, if an employee fails to meet performance goals, violates company policies, or engages in any misconduct, the employer may choose to withhold or reduce the bonus amount. In such cases, it is crucial to clearly state the grounds for bonus denial or reduction, ensuring transparency and fairness. When drafting a Rhode Island Sample Letter for Bonus, it is important to specify the following key details: 1. Bonus Amount: Clearly state the bonus amount being awarded to the employee to avoid any confusion or ambiguity. 2. Purpose: Explain the purpose of the bonus, whether it is intended as a reward for achievements, exceptional performance, or as an incentive to motivate further productivity. 3. Conditions: If there are any conditions attached to the bonus, such as being subject to specific goals, targets, or milestones, clearly outline these requirements in the letter. 4. Bonus Calculation: If the bonus is calculated based on a specific formula or percentage, provide a brief explanation or refer to the relevant document where the calculation methodology is described in detail. 5. Payment Method: Explain how the bonus will be disbursed, whether it will be included in the regular paycheck or provided as a separate payment. 6. Tax Implications: Remind the employee that the bonus may be subject to taxes and that appropriate deductions will be made in compliance with state and federal tax laws. Remember, this Rhode Island Sample Letter for Bonus is only a guideline and should be tailored to meet the specific circumstances and requirements of your organization. Seek advice from legal professionals if needed to ensure compliance with all applicable federal and state laws. Congratulations once again on your well-deserved bonus! We appreciate your hard work and commitment to our organization. Should you have any questions or require further information, please feel free to contact the Human Resources department. Sincerely, [Your Name] [Your Title/Position] [Company Name] [Company Address] [City, State, ZIP] [Phone Number] [Email Address]Subject: Rhode Island Sample Letter for Bonus Dear [Employee's Name], We are pleased to inform you that, based on your outstanding performance and dedication to your job, we have decided to award you a special bonus as a token of appreciation. This letter serves as a Rhode Island Sample Letter for Bonus, addressing the specific regulations and guidelines applicable within the state of Rhode Island. Rhode Island legislation provides certain provisions regarding bonus payments, ensuring fair compensation for employees. It is important to note that these regulations may vary based on the specific circumstances of each bonus. However, the general principles laid out by the state are as follows: 1. Voluntary Bonus: If the bonus is purely discretionary and decided by the employer without any prior contractual obligation, it falls under the category of a voluntary bonus. In this case, there is no state requirement for providing a bonus. However, employers are encouraged to communicate the bonus details to the employee in writing to ensure transparency and avoid any potential misunderstanding. 2. Contractual Bonus: If the bonus is contractually promised or stated in an employment agreement, the employer is obligated to fulfill the contractual terms unless certain conditions are not met. This type of bonus may include monetary rewards based on performance metrics, sales targets, or other predefined criteria. 3. Bonus Denial or Reduction: Rhode Island law permits employers to deny or reduce a bonus if there is a legitimate reason to do so. For example, if an employee fails to meet performance goals, violates company policies, or engages in any misconduct, the employer may choose to withhold or reduce the bonus amount. In such cases, it is crucial to clearly state the grounds for bonus denial or reduction, ensuring transparency and fairness. When drafting a Rhode Island Sample Letter for Bonus, it is important to specify the following key details: 1. Bonus Amount: Clearly state the bonus amount being awarded to the employee to avoid any confusion or ambiguity. 2. Purpose: Explain the purpose of the bonus, whether it is intended as a reward for achievements, exceptional performance, or as an incentive to motivate further productivity. 3. Conditions: If there are any conditions attached to the bonus, such as being subject to specific goals, targets, or milestones, clearly outline these requirements in the letter. 4. Bonus Calculation: If the bonus is calculated based on a specific formula or percentage, provide a brief explanation or refer to the relevant document where the calculation methodology is described in detail. 5. Payment Method: Explain how the bonus will be disbursed, whether it will be included in the regular paycheck or provided as a separate payment. 6. Tax Implications: Remind the employee that the bonus may be subject to taxes and that appropriate deductions will be made in compliance with state and federal tax laws. Remember, this Rhode Island Sample Letter for Bonus is only a guideline and should be tailored to meet the specific circumstances and requirements of your organization. Seek advice from legal professionals if needed to ensure compliance with all applicable federal and state laws. Congratulations once again on your well-deserved bonus! We appreciate your hard work and commitment to our organization. Should you have any questions or require further information, please feel free to contact the Human Resources department. Sincerely, [Your Name] [Your Title/Position] [Company Name] [Company Address] [City, State, ZIP] [Phone Number] [Email Address]