Rhode Island Exchange Agreement for Real Estate refers to a legal contract entered into by parties involved in the exchange of real property located in Rhode Island. It outlines the terms and conditions of the transaction, ensuring that all parties' rights and obligations are clearly defined and protected. The primary purpose of a Rhode Island Exchange Agreement is to facilitate the exchange of real estate between two or more parties through a process known as "like-kind exchange" or "property swap." This enables property owners to defer capital gains taxes by exchanging their property for another property of equal or greater value, without incurring a tax liability at the time of the exchange. There are different types of Rhode Island Exchange Agreements for Real Estate, depending on the nature and structure of the exchange. Some common types include: 1. Simultaneous Exchange: This is the most straightforward type of exchange agreement, where both parties agree to complete the exchange simultaneously. The properties are transferred at the same time, and the transaction is completed in one closing. 2. Delayed Exchange: In a delayed exchange, also known as a Starker exchange or a 1031 exchange, there is a time gap between the sale of the relinquished property and the acquisition of the replacement property. The seller has a specific time frame, usually 180 days, to identify and acquire the replacement property. 3. Reverse Exchange: In a reverse exchange, the process is reversed compared to a traditional exchange. The buyer acquires the replacement property first and then sells the relinquished property within a specific time frame. This type of exchange is often more complex and requires more careful planning. Regardless of the type of exchange agreement, there are certain key elements that must be included in a Rhode Island Exchange Agreement for Real Estate: — Identification of the parties involved: The agreement should clearly identify all parties to the exchange, including the buyer, seller, and any intermediaries or facilitators involved in the transaction. — Description of the properties: The agreement needs to provide a detailed description of both the relinquished property (property being sold) and the replacement property (property being acquired), including their addresses, legal descriptions, and any other relevant details. — Purchase price and terms: The agreement should outline the purchase price, terms of payment, and any other financial arrangements agreed upon by the parties. — Timeframes: The agreement should specify the deadlines and time frames within which various stages of the exchange must be completed, such as identification of replacement property and closing dates. — Tax implications and disclaimers: It is crucial to include provisions that address the tax implications of the exchange and disclaim any responsibility or liability for tax advice. Parties should seek professional tax advice to ensure compliance with applicable tax laws. In conclusion, a Rhode Island Exchange Agreement for Real Estate is a legally binding contract that enables property owners to exchange their real estate holdings while deferring capital gains taxes. There are various types of exchange agreements, including simultaneous, delayed, and reverse exchanges, each with its own requirements and complexities. It is crucial to involve legal and tax professionals to ensure compliance and protection of all parties involved.

Rhode Island Exchange Agreement for Real Estate

Description

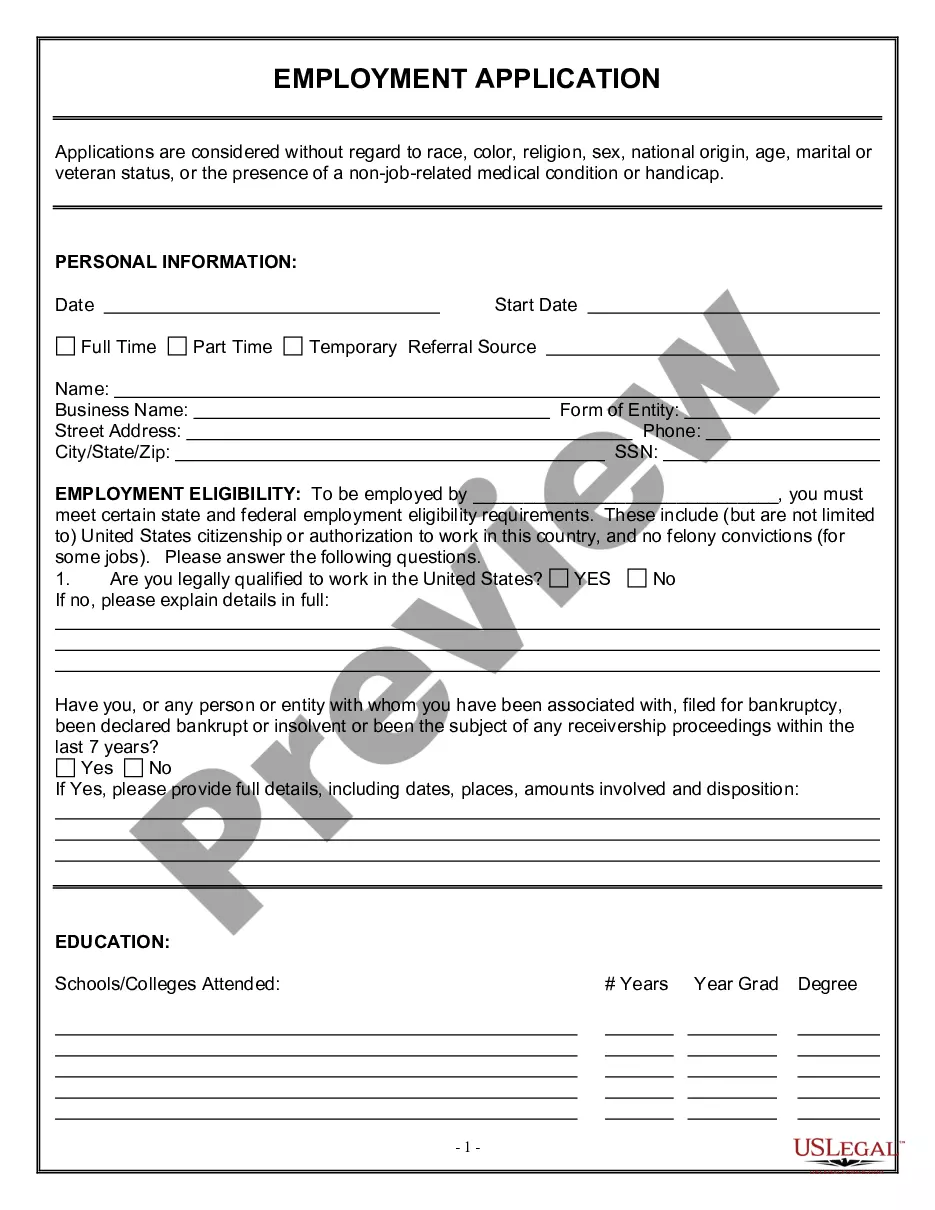

How to fill out Rhode Island Exchange Agreement For Real Estate?

Discovering the right lawful papers design can be quite a have a problem. Of course, there are plenty of layouts accessible on the Internet, but how do you find the lawful kind you need? Make use of the US Legal Forms web site. The support provides 1000s of layouts, such as the Rhode Island Exchange Agreement for Real Estate, that can be used for company and personal demands. Every one of the varieties are checked out by professionals and meet up with federal and state needs.

In case you are presently authorized, log in for your profile and click on the Down load option to find the Rhode Island Exchange Agreement for Real Estate. Use your profile to check throughout the lawful varieties you might have purchased formerly. Check out the My Forms tab of your profile and get yet another backup from the papers you need.

In case you are a new user of US Legal Forms, listed below are simple guidelines so that you can comply with:

- First, make certain you have selected the correct kind for the area/county. You may look through the shape while using Preview option and look at the shape information to make certain this is the best for you.

- If the kind is not going to meet up with your needs, utilize the Seach discipline to get the proper kind.

- When you are positive that the shape is acceptable, click on the Get now option to find the kind.

- Select the costs prepare you desire and type in the necessary information. Design your profile and pay for the transaction using your PayPal profile or Visa or Mastercard.

- Opt for the submit file format and down load the lawful papers design for your device.

- Full, revise and printing and sign the received Rhode Island Exchange Agreement for Real Estate.

US Legal Forms may be the greatest library of lawful varieties in which you will find different papers layouts. Make use of the company to down load skillfully-created files that comply with state needs.