Rhode Island Demand Bond is a type of financial instrument that serves as a guarantee for payment in the state of Rhode Island. It acts as a contract between a bond issuer, typically the state or a municipal authority, and the bondholder. The bondholder can request the repayment of the principal amount (or face value) of the bond at any time, hence the term "demand" bond. Rhode Island Demand Bonds can be issued to finance various projects or initiatives undertaken by the state or its municipalities. These may include infrastructure development, construction projects, public utilities, or other similar ventures. The bonds typically have a fixed interest rate and a specific maturity date, although the demand nature provides more flexibility for early redemption. There are different types of Rhode Island Demand Bonds, each catering to specific needs and circumstances. Some notable types include: 1. General Obligation Demand Bonds: These bonds are backed by the full faith and credit of Rhode Island, meaning that the state's taxing power is used to repay the bondholders. They are considered low-risk investments and often have more competitive interest rates. 2. Revenue Demand Bonds: These bonds rely on the revenue generated by a specific project or source, such as tolls, user fees, or lease payments. The repayment of these bonds is contingent upon the success and profitability of the associated revenue-generating entity. 3. Municipal Demand Bonds: Issued by local municipalities within Rhode Island, these bonds finance various local projects such as schools, water treatment facilities, or public transportation. They provide an opportunity for local investors to support and benefit from developments within their communities. Rhode Island Demand Bonds offer several benefits to both investors and the state. Investors can enjoy a reliable source of income through regular interest payments and the flexibility to redeem their investment whenever necessary. Meanwhile, the state can fund vital projects without relying solely on taxation or other forms of borrowing, fostering economic growth and improving public infrastructure. In conclusion, Rhode Island Demand Bonds are versatile financial instruments that allow investors to secure their funds while supporting the development of the state. Whether in the form of general obligation, revenue-backed, or municipal bonds, they provide a valuable avenue for investors to contribute to Rhode Island's progress.

Rhode Island Demand Bond

Description

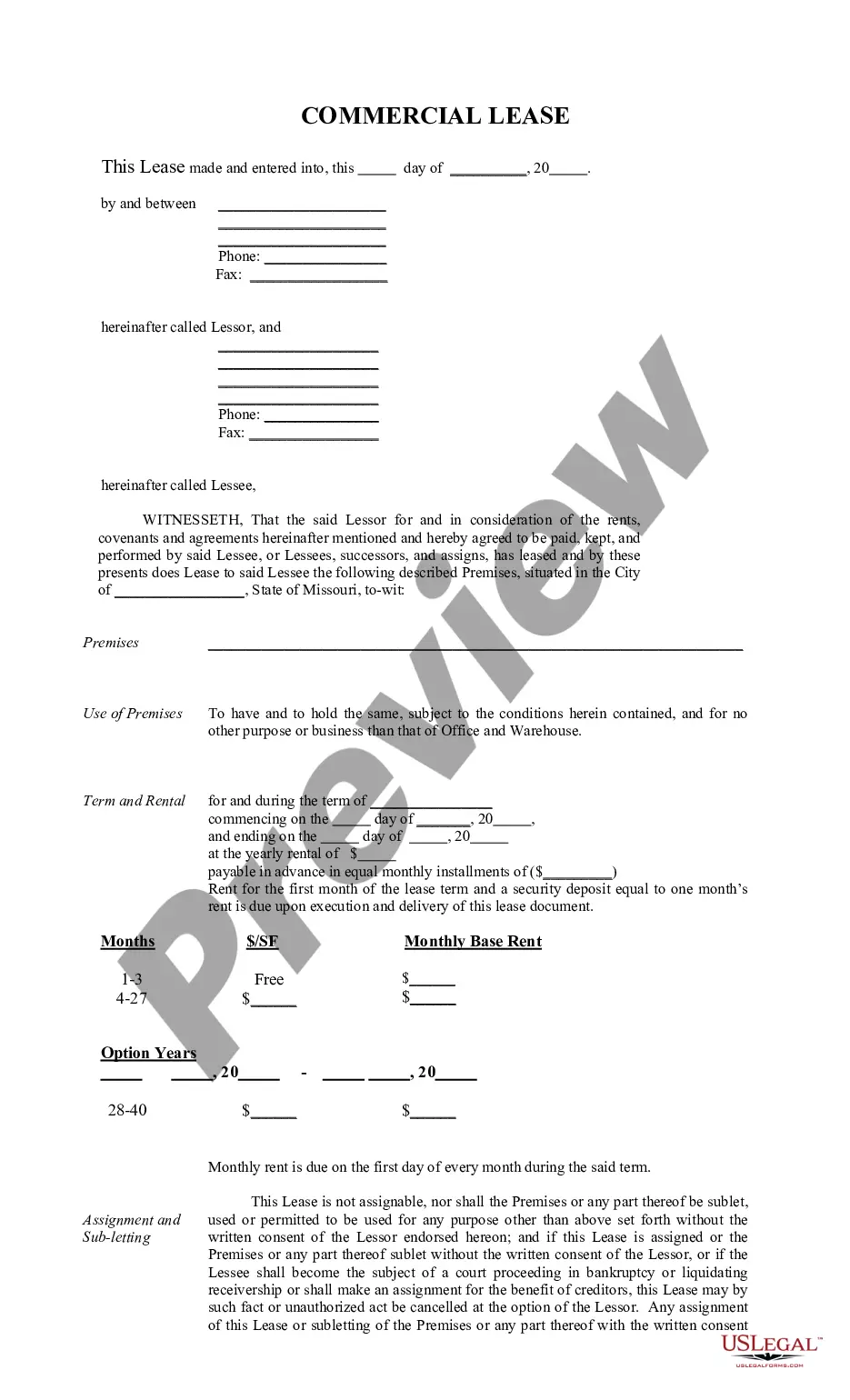

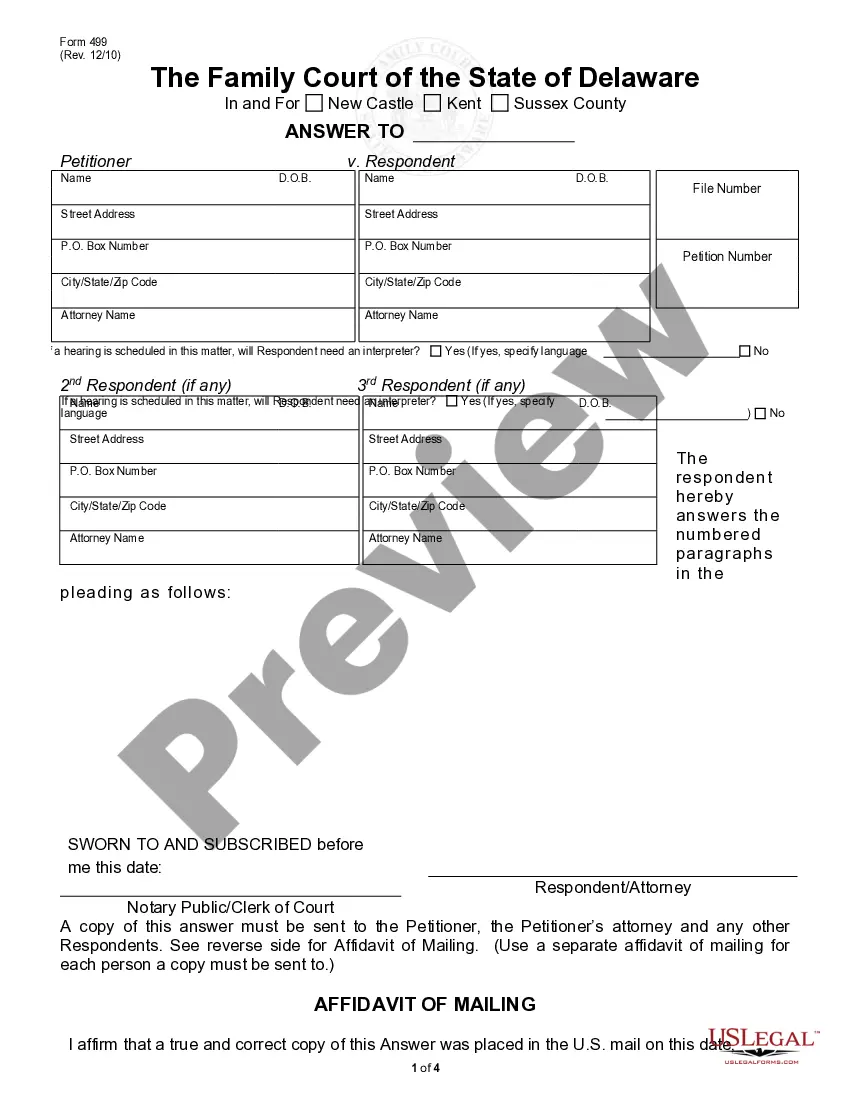

How to fill out Rhode Island Demand Bond?

Discovering the right legitimate file design can be a have a problem. Naturally, there are tons of web templates available on the Internet, but how do you obtain the legitimate develop you require? Take advantage of the US Legal Forms website. The services delivers a large number of web templates, for example the Rhode Island Demand Bond, which can be used for business and private requires. Each of the forms are inspected by experts and meet state and federal specifications.

Should you be previously authorized, log in in your account and then click the Acquire switch to obtain the Rhode Island Demand Bond. Use your account to search through the legitimate forms you have bought previously. Go to the My Forms tab of your own account and obtain an additional duplicate of the file you require.

Should you be a whole new customer of US Legal Forms, listed here are straightforward guidelines so that you can follow:

- Initially, be sure you have selected the right develop to your city/region. You are able to check out the shape using the Preview switch and look at the shape description to ensure it is the best for you.

- If the develop does not meet your preferences, use the Seach field to get the right develop.

- When you are sure that the shape would work, select the Acquire now switch to obtain the develop.

- Opt for the rates plan you desire and enter the essential information. Build your account and purchase an order with your PayPal account or charge card.

- Opt for the file format and acquire the legitimate file design in your device.

- Total, edit and print out and signal the attained Rhode Island Demand Bond.

US Legal Forms is the biggest catalogue of legitimate forms where you can discover numerous file web templates. Take advantage of the company to acquire expertly-made documents that follow status specifications.

Form popularity

FAQ

Surety bonds also come with the following cons for contractors: A bonded contractor must pay for the bond and will also be responsible for paying valid bond claims. A lapse in a bond can result in a license suspension or the invalidation of a contract. Required renewals can add ongoing expenses.

Demand bonds are long-term debt issuances with demand ("put") provisions that require the issuer to repurchase the bonds upon notice from the bondholder at a price equal to the principal plus accrued interest.

There are two main categories of surety bond: Contract Bonds and Commercial Bonds. Contract bonds guarantee a specific contract. Examples include Performance Bonds, Bid Bonds, Supply bonds, Maintenance Bonds, and Subdivision Bonds. Commercial Bonds guarantee per the terms of the bond form.

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

Is the security an on-demand bond or guarantee? An on-demand security bond is an unconditional obligation to pay when a demand has been made. A surety bond or performance guarantee requires certain conditions to be met before payment is made. Some contracts provide standard form security documents.