The Rhode Island Direct Deposit Form for Bank America is a document that allows individuals in Rhode Island to authorize the direct deposit of their income or other funds into their Bank of America account. This form serves as a convenient and efficient way for individuals to electronically receive their funds, eliminating the need for physical checks or manual deposits. The Rhode Island Direct Deposit Form for Bank America is designed to collect crucial information related to the individual's banking details and direct deposit preferences. The form typically requires the individual to furnish their full name, address, home phone and/or mobile phone number, Social Security number, email address, and Bank of America account number. Additionally, the form may ask for the individual's employer or payer information, including the company name, address, and contact details. This ensures that the funds are properly directed to the correct account and verified with the employer. Bank of America may offer different types or versions of the Rhode Island Direct Deposit Form to cater to various needs or situations. Some potential variations may include forms tailored for government employees, retirees, or specific types of income sources such as Social Security or pension payments. Other possible variations may be available for individuals who wish to split their direct deposit between multiple accounts, to automatically allocate a certain percentage or fixed amount to savings, or to allocate funds to different Bank of America accounts. By successfully completing the Rhode Island Direct Deposit Form for Bank America, individuals can enjoy the advantages of direct deposit, such as faster access to funds, increased convenience, reduced risk of misplacing or losing physical checks, and the ability to automate their finances. Overall, this form streamlines the process of receiving funds electronically and simplifies personal financial management.

Rhode Island Direct Deposit Form for Bank America

Description

How to fill out Direct Deposit Form For Bank America?

You can spend time on the internet looking for the legal document template that meets the federal and state requirements you desire.

US Legal Forms provides numerous legal forms that have been verified by professionals.

It is easy to download or print the Rhode Island Direct Deposit Form for Bank America from the service.

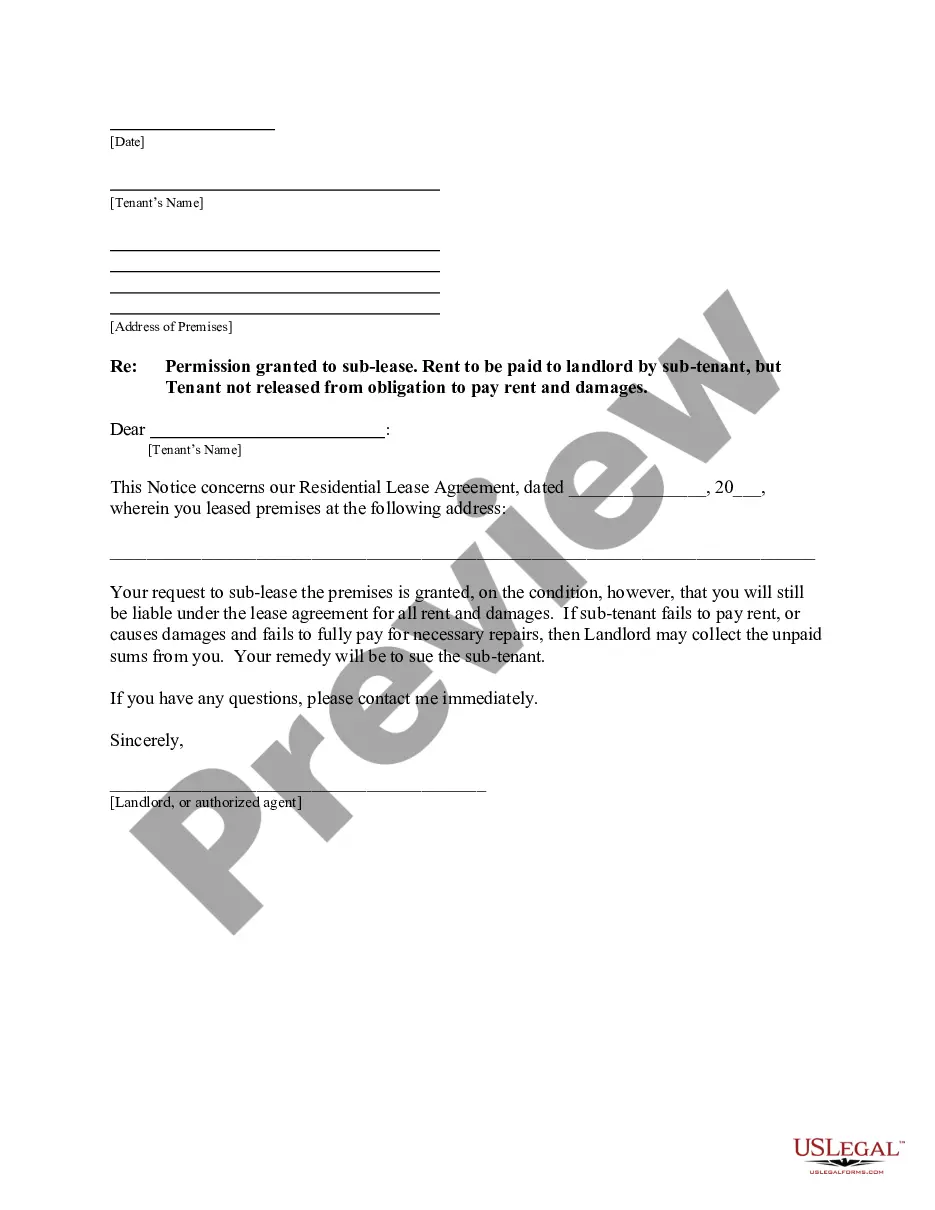

If available, utilize the Preview option to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- After that, you can fill out, modify, print, or sign the Rhode Island Direct Deposit Form for Bank America.

- Every legal document template you obtain is yours indefinitely.

- To retrieve another copy of the purchased form, go to the My documents tab and click the corresponding option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/region of your choice.

- Review the form information to confirm you have chosen the right form.

Form popularity

FAQ

Use our pre-filled form Or you can download a blank Direct Deposit/Automatic Payments Set-up Guide (PDF) and fill in the information yourself. For accounts with checks, a diagram on the form shows you where you can find the information you'll need.

What is a Direct Deposit Authorization Form? Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

You can find this form on Bank of America's website. Alternatively, you can sign in to Online Banking and download a preprinted Bank of America direct deposit form. This form takes the place of a Bank of America voided check. Give the direct deposit form to your employer for processing.

Step 1: Choose an account. On EasyWeb, go to the Accounts page.Step 2: Select the direct deposit form. On the Account Activity page, select Direct deposit form (PDF) to download and open a copy of your form.Step 3: Access the form. If you're using Adobe Reader, the form will open in a new window.

Sign In to Online Banking. Click on any of your accounts. Select View and Print Payroll Direct Deposit from the right navigation. Select the account you want to deposit your payroll to from the dropdown, then click on View and Print and your customized form will be presented to you.

Bank of America offers direct deposit for its customers. Here's how to set up direct deposit for your Bank of America checking or savings account.

Get a direct deposit form from your employer Ask for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks, including the Capital One and Bank of America direct deposit forms.