Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm.

From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

DISSOLUTION BY ACT OF THE PARTIES

A partnership is dissolved by any of the following events:

* agreement by and between all partners;

* expiration of the time stated in the agreement;

* expulsion of a partner by the other partners; or

* withdrawal of a partner.

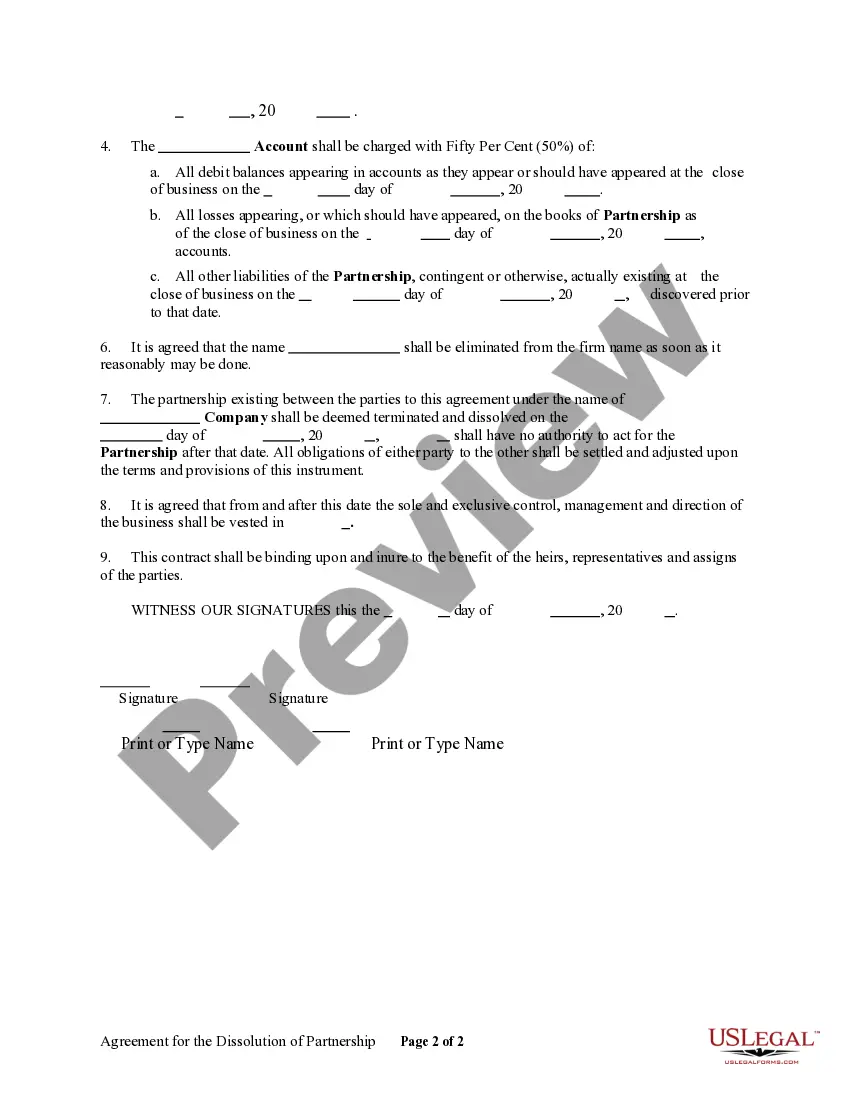

The Rhode Island Agreement for the Dissolution of a Partnership is a legally binding document that outlines the terms and conditions under which a partnership can be dissolved in the state of Rhode Island. This agreement governs the process of terminating the business relationship between partners and provides guidance on the distribution of assets, settlement of liabilities, and other important matters. The agreement typically begins by stating the names of the partners, the name of the partnership, and the date of the agreement. It explicitly mentions the intention of the partners to dissolve the partnership and specifies the effective date of dissolution. This allows for clarity on when the dissolution becomes legally binding and when the partnership ceases to exist. The agreement further details the manner in which the partnership affairs will be wound up. It outlines the responsibilities and duties of each partner during the winding-up process and sets a timeline for the completion of various tasks. These tasks may include notifying clients and suppliers, collecting accounts receivable, settling outstanding debts, and liquidating assets. In terms of asset distribution, the agreement defines how the partnership's assets and liabilities will be allocated among the partners. This includes the division of profits, losses, and capital contributions. The partners may agree to divide the assets in equal shares or allocate them based on predetermined percentages, depending on their initial agreement or any subsequent amendments. Additionally, the agreement may address any remaining obligations and liabilities of the partnership, including taxes, pending lawsuits, or ongoing contractual commitments. It may specify how these matters will be handled after the dissolution, potentially assigning responsibilities to specific partners or outlining a process for resolving disputes. Rhode Island recognizes different types of partnerships, each with specific requirements and considerations for dissolution. These may include general partnerships, limited partnerships, and limited liability partnerships. While the general principles of the agreement may be similar across these partnerships, the specific terms and clauses can vary based on the legal structure and obligations associated with each type. In conclusion, the Rhode Island Agreement for the Dissolution of a Partnership is a comprehensive legal document that governs the termination of a partnership in Rhode Island. It outlines the steps for winding up the partnership's affairs, distributing assets and liabilities, and settling any remaining obligations. It is essential for partners to carefully consider and negotiate the terms of this agreement to ensure a fair and smooth dissolution process.