Rhode Island Bill of Sale of Mobile Home with or without Existing Lien

Description

How to fill out Bill Of Sale Of Mobile Home With Or Without Existing Lien?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a selection of legal document forms that you can download or print.

By utilizing the website, you can access countless forms for commercial and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Rhode Island Bill of Sale of Mobile Home with or without Existing Lien within moments.

If you possess a subscription, Log In and retrieve the Rhode Island Bill of Sale of Mobile Home with or without Existing Lien from the US Legal Forms library. The Download button will appear on every document you view.

Complete the transaction. Utilize your Visa, Mastercard, or PayPal account to finish the transaction.

Select the format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Rhode Island Bill of Sale of Mobile Home with or without Existing Lien. Every template you include in your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you require. Access the Rhode Island Bill of Sale of Mobile Home with or without Existing Lien through US Legal Forms, one of the most extensive libraries of legal document templates. Utilize numerous professional and state-specific templates that satisfy your business or personal requirements and specifications.

- Ensure you have selected the appropriate document for your city/state.

- Click the Preview button to review the document's details.

- Examine the document summary to confirm that you have chosen the right one.

- If the document does not meet your criteria, use the Search field at the top of the page to find the one that does.

- If you are satisfied with the document, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your information to create an account.

Form popularity

FAQ

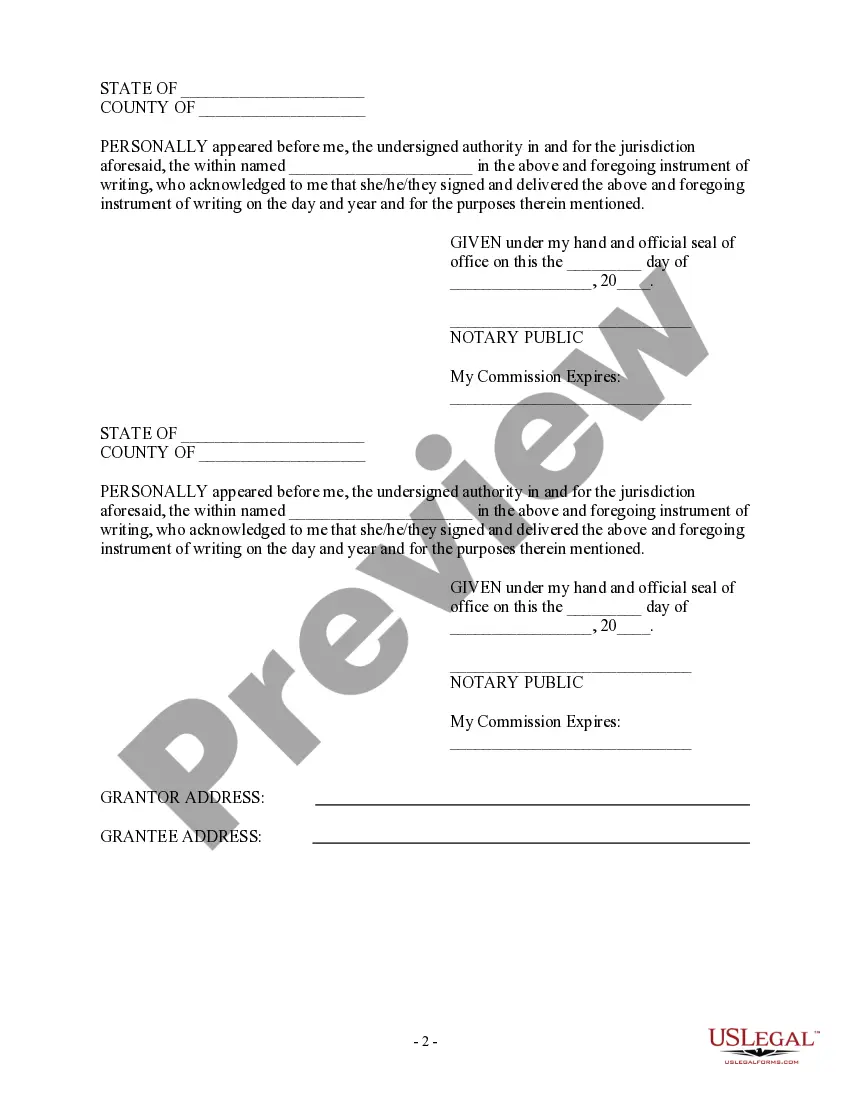

Notarization for a bill of sale is not generally required in Rhode Island. It depends on the circumstances and the preferences of the parties involved. For a Rhode Island Bill of Sale of Mobile Home with or without Existing Lien, notarization can help avoid disputes and provide proof of the transaction. Consider using US Legal Forms to create a compliant and secure bill of sale, with or without notarization, tailored to your needs.

In Rhode Island, a bill of sale does not necessarily need to be notarized for it to be valid. However, notarization can provide an added layer of security and authenticity, especially for a Rhode Island Bill of Sale of Mobile Home with or without Existing Lien. Notarizing the document can benefit future transactions and lend credibility in case of disputes. Always check with local regulations to confirm specific requirements.

Yes, you can obtain a bill of sale without a title. In cases where a title is lost or unavailable, a Rhode Island Bill of Sale of Mobile Home with or without Existing Lien can serve as a formal document to convey ownership. This document might require additional information to establish the seller's ownership. It's important to ensure that both parties agree on the terms outlined in the bill of sale.

Moving a mobile home without a title is challenging, as most states require a title for transport. You may need to obtain a replacement title from the applicable state authority to ensure a smooth process. Having a Rhode Island Bill of Sale of Mobile Home with or without Existing Lien in place can also make the transition easier for the new owner during the move.

The scrap value of a mobile home can vary significantly based on its size, materials, and condition. Generally, you could expect a range of a few hundred to several thousand dollars, depending on these factors. If you're considering salvage options, ensure that you have a proper Rhode Island Bill of Sale of Mobile Home with or without Existing Lien before proceeding with the sale.

Selling a used mobile home without land is possible and often involves finding a buyer who wants to move the home to their own property. You should prepare a Rhode Island Bill of Sale of Mobile Home with or without Existing Lien to outline the terms of the sale. Consider reaching out to local mobile home dealers or online marketplaces for potential buyers.

Mobile homes began receiving titles in the early 1970s when the National Highway Traffic Safety Administration established regulations. These regulations required all mobile homes built after June 15, 1976, to have a title. Understanding these requirements can help you create a proper Rhode Island Bill of Sale of Mobile Home with or without Existing Lien for your transaction.

To sell your mobile home without a title, you must first obtain a replacement title from the state. In Rhode Island, you can contact the Department of Motor Vehicles to request a duplicate. Once you secure the title, you can draft a Rhode Island Bill of Sale of Mobile Home with or without Existing Lien to finalize the sale.

Yes, the name on the bill of sale should match the name on the title for a smooth transaction. Discrepancies can cause complications when transferring ownership of the mobile home. Having matching names on the Rhode Island Bill of Sale of Mobile Home with or without Existing Lien ensures clarity and prevents potential disputes. Always verify this information before finalizing your sale.

In Rhode Island, a mobile home title is often referred to as a Certificate of Ownership. This document serves as the official proof of ownership for a mobile home. When dealing with the Rhode Island Bill of Sale of Mobile Home with or without Existing Lien, having the Certificate of Ownership is essential to ensure that any liens can be properly managed. Remember, it’s crucial to keep this document secure for future reference.