A Rhode Island Consulting Agreement with a Former Shareholder refers to a legal contract established between a consulting service provider and a former shareholder of a company based in Rhode Island. This agreement outlines the terms and conditions that govern the provision of consulting services by the former shareholder to the company on a contractual basis after their cessation of shares ownership. The agreement includes key provisions that are essential to safeguard the interests of both parties involved. These provisions typically cover the scope and duration of the consulting services, compensation arrangements, intellectual property rights, confidentiality, non-compete clause, and dispute resolution. The scope of the consulting services outlines the specific tasks and responsibilities that the former shareholder will undertake. This section ensures clarity and prevents any potential disputes arising due to ambiguous expectations. The duration of the agreement specifies the period during which the consulting services will be provided, ensuring that both parties are aware of the commitment required. Compensation arrangements within the agreement establish the financial terms for the consulting services. It outlines the payment structure, including the consultancy fees, reimbursement of expenses, and any other relevant financial considerations. These compensation terms must be agreed upon by both parties to avoid disputes in the future. Intellectual property rights are usually addressed in this agreement to clarify the ownership of any work product or proprietary information generated during the consulting engagement. The former shareholder may retain ownership of any pre-existing intellectual property they bring to the agreement, while any new intellectual property created during the consultancy may be subject to specific terms outlined in the agreement. In instances where the former shareholder may have access to the company's confidential and sensitive information, the agreement will typically contain provisions to safeguard such information. These provisions may include non-disclosure and non-use clauses to prevent the former shareholder from sharing or utilizing the company's confidential information for personal gain. A non-compete clause may also be included in the agreement, restraining the former shareholder from engaging in competitive activities that could harm the company's business interests. This clause ensures that the former shareholder does not use their knowledge of the company to compete against it within a specified timeframe and geographical area. Finally, the agreement may include a dispute resolution mechanism, such as arbitration or mediation, to address any potential disagreements or breaches of the contract in an efficient and fair manner. Different types of Rhode Island Consulting Agreements with a Former Shareholder may vary depending on factors such as the industry, specific consulting services required, and the unique circumstances of the former shareholder's involvement with the company. These agreements may be classified based on the duration of the contract, compensation structure, and specific terms and conditions tailored to the needs of both parties.

Rhode Island Consulting Agreement - with Former Shareholder

Description

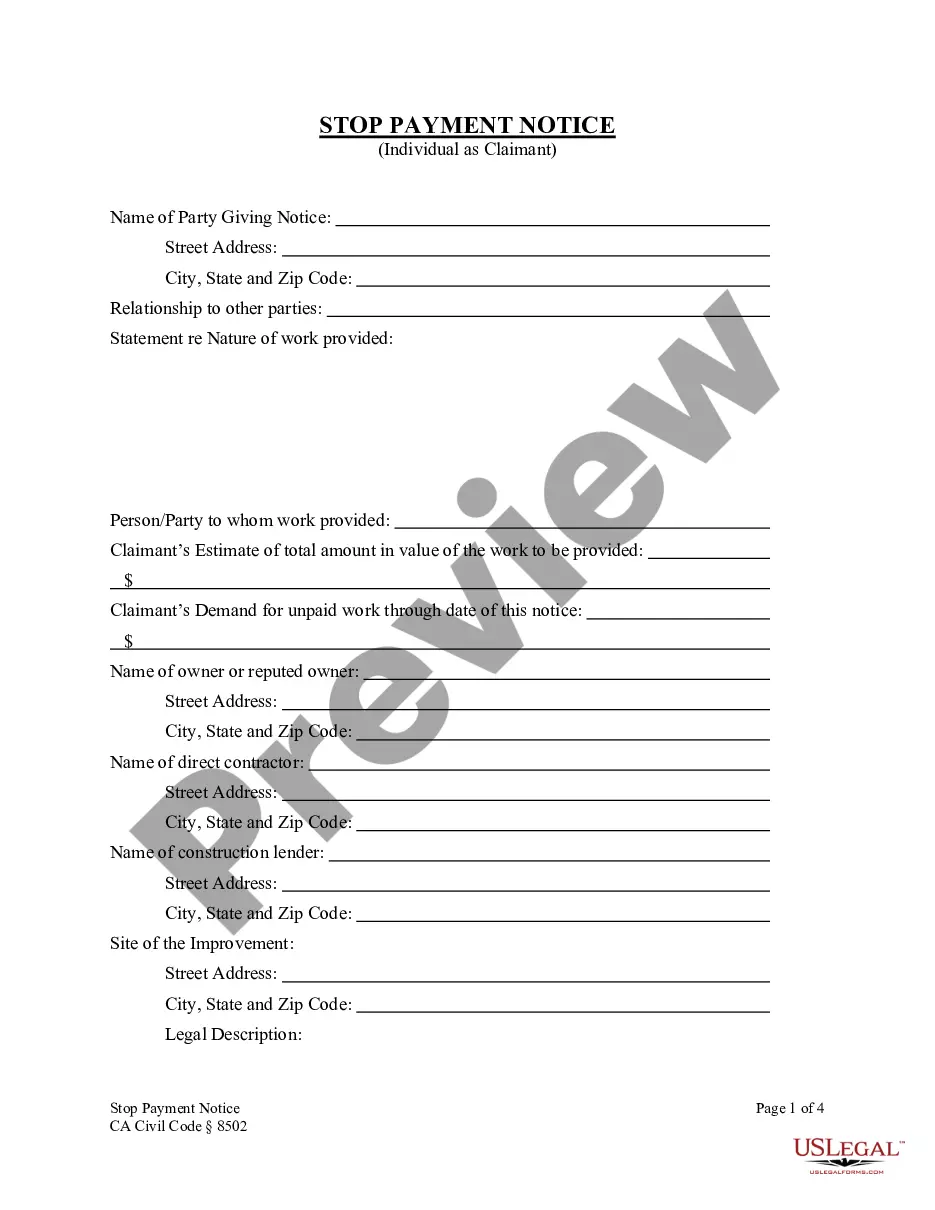

How to fill out Rhode Island Consulting Agreement - With Former Shareholder?

Are you within a position in which you will need documents for either company or person uses just about every working day? There are tons of lawful record web templates available online, but locating versions you can depend on is not effortless. US Legal Forms delivers a large number of kind web templates, much like the Rhode Island Consulting Agreement - with Former Shareholder, that are written to meet federal and state needs.

If you are presently familiar with US Legal Forms site and also have an account, merely log in. Following that, you are able to acquire the Rhode Island Consulting Agreement - with Former Shareholder template.

Unless you provide an accounts and need to begin to use US Legal Forms, abide by these steps:

- Discover the kind you need and ensure it is for that proper area/county.

- Use the Preview key to examine the form.

- Browse the information to ensure that you have chosen the correct kind.

- In the event the kind is not what you`re looking for, take advantage of the Lookup field to find the kind that meets your requirements and needs.

- When you get the proper kind, click on Get now.

- Opt for the costs program you want, complete the desired info to create your money, and purchase the transaction with your PayPal or credit card.

- Pick a handy data file file format and acquire your version.

Get all the record web templates you have purchased in the My Forms menus. You can aquire a extra version of Rhode Island Consulting Agreement - with Former Shareholder any time, if needed. Just click on the essential kind to acquire or print out the record template.

Use US Legal Forms, probably the most substantial variety of lawful forms, in order to save time as well as stay away from errors. The service delivers professionally manufactured lawful record web templates that you can use for a range of uses. Make an account on US Legal Forms and commence producing your way of life a little easier.