Rhode Island Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

Are you presently inside a situation that you require papers for either company or specific purposes virtually every day time? There are a lot of authorized document web templates available online, but finding versions you can depend on isn`t effortless. US Legal Forms offers 1000s of develop web templates, just like the Rhode Island Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will), that happen to be published to meet state and federal needs.

When you are previously familiar with US Legal Forms site and possess a merchant account, basically log in. Afterward, you may obtain the Rhode Island Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) template.

If you do not have an profile and need to start using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is to the appropriate metropolis/state.

- Take advantage of the Review key to review the shape.

- Browse the description to actually have selected the proper develop.

- In case the develop isn`t what you`re searching for, make use of the Lookup field to discover the develop that meets your needs and needs.

- When you discover the appropriate develop, simply click Acquire now.

- Pick the costs program you would like, fill in the specified details to make your account, and pay money for the transaction making use of your PayPal or Visa or Mastercard.

- Decide on a practical file structure and obtain your version.

Get all of the document web templates you might have bought in the My Forms menu. You can obtain a additional version of Rhode Island Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) anytime, if required. Just select the necessary develop to obtain or printing the document template.

Use US Legal Forms, the most considerable assortment of authorized kinds, to save time and steer clear of errors. The support offers expertly created authorized document web templates which can be used for a selection of purposes. Create a merchant account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

An Affidavit of Gift of Motor Vehicle (SU 87-65) is required in addition to the Vehicle Gift Letter. A separate plate gift letter must be used for non-immediate family members.

To apply for an RI DMV vehicle title transfer, you need: A completed Application for Title (Form TR-2/TR-9) A completed Use Tax Return (Form T-334-2) The vehicle title certificate. Proof of a vehicle identification number (VIN) inspection (if you purchased the vehicle from a different state) Proof of a valid RI residency.

An Affidavit of Gift of Motor Vehicle (SU 87-65) is required in addition to the Vehicle Gift Letter. A separate plate gift letter must be used for non-immediate family members.

The current registration in the name of the deceased person is required. An original death certificate is required. The DMV will make a photocopy and return the original to you. Sign the vehicle over to yourself by printing and signing your name in both the buyer and seller areas on the back of the title.

Gifting a Car 101: Make Sure You Can Afford the Gift Tax Depending on where you live and who you're giving the car to, you may be responsible for paying a gift tax. If you do have to pay taxes on your gifted vehicle, the state uses the vehicle's fair market value to calculate the amount you have to pay.

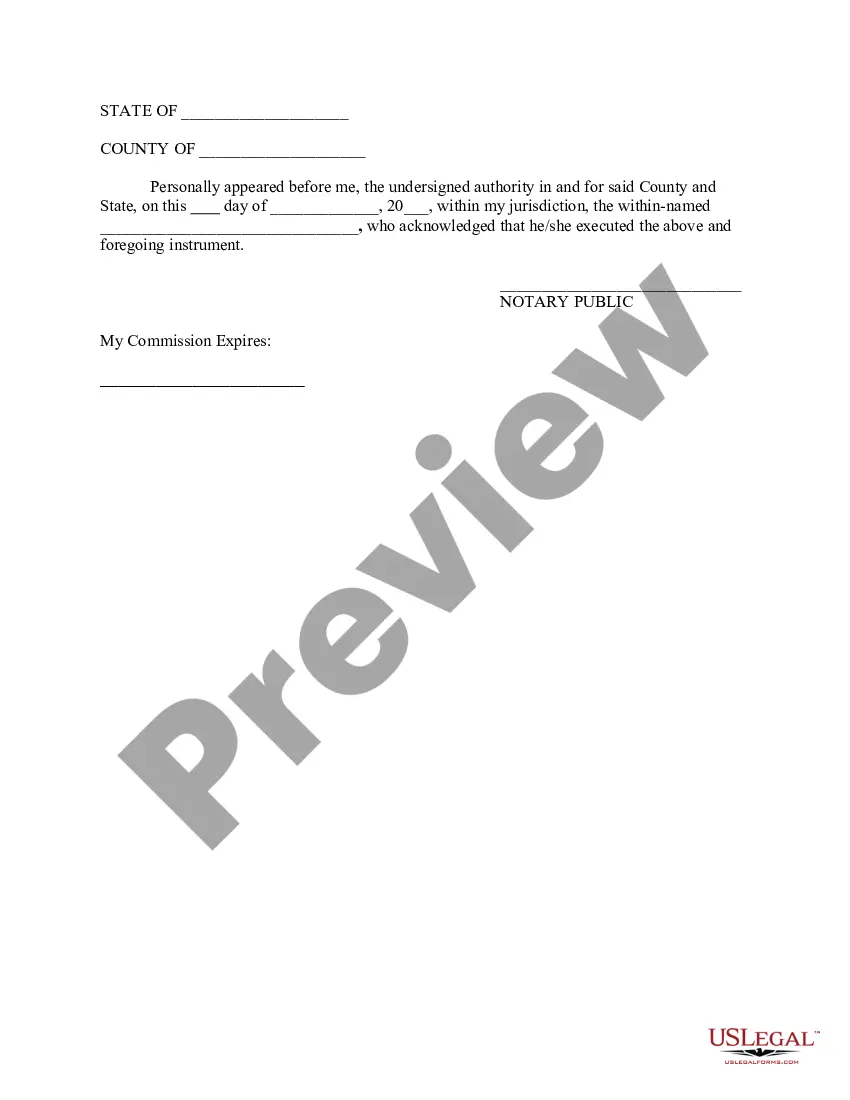

Private Party Sale. Seller must sign the back of the title (if model year of vehicle is 2001 or newer). If two owners on title, both parties must be present during registration, if not, signature of the absent party must be notarized on Application for Registration.

The person gifting the car and the recipient must both sign this document, and it should include the vehicle's make, model, and VIN. Additionally, have the current odometer reading and the vehicle's sale price (set to $0 in the case of a gift or if you inherited a car).

If a person dies intestate, and the person owned a vehicle, the person's spouse automatically becomes the owner of the vehicle. If the decedent owned more than one vehicle, the surviving spouse may choose one of the vehicles.