Rhode Island Demand for Collateral by Creditor refers to a legal provision that grants a creditor the right to demand collateral from a debtor in the state of Rhode Island. This demand is usually made when a debtor defaults on their loan or fails to meet their repayment obligations. The demand for collateral is a crucial aspect of loan agreements and allows creditors to ensure that they have a backup source of repayment in case the debtor is unable to fulfill their obligations. Typically, the collateral is an asset (such as real estate, vehicles, electronics, or valuable possessions) that the debtor pledges to the creditor as security for the loan. There are several types of Rhode Island Demand for Collateral by Creditor, including: 1. Secured Loans: This type of demand for collateral occurs when a creditor requires the debtor to provide collateral before granting them a loan. The collateral acts as a form of security for the loan, reducing the risk for the lender and potentially resulting in lower interest rates for the debtor. 2. Collateral Demand for Defaulted Loans: In the event that a debtor defaults on their loan or fails to repay it on time, the creditor can exercise their right to demand collateral. This ensures that the creditor has a means of recovering their outstanding debt by seizing and selling the pledged collateral. 3. Collateral Demand for Breach of Contract: If a debtor violates the terms and conditions of their loan agreement, such as failure to maintain insurance on a financed vehicle or failing to make timely payments, the creditor may be entitled to demand collateral. This type of collateral demand is used to protect the creditor's interests and enforce the terms of the agreement. It is important to note that while Rhode Island Demand for Collateral by Creditor grants significant rights to the lender, there are also legal considerations in place to protect the debtor. The Rhode Island laws dictate the specific procedures and requirements that creditors must follow when exercising their right to demand collateral, ensuring fairness and preventing abusive practices. In summary, Rhode Island Demand for Collateral by Creditor is a legal provision that allows lenders to demand collateral from debtors in cases of default or breach of contract. This provision protects the creditor's interests and helps ensure loan repayment. Various types of collateral demands exist, such as for secured loans, defaulted loans, and breaches of contract, each with specific legal requirements.

Rhode Island Demand for Collateral by Creditor

Description

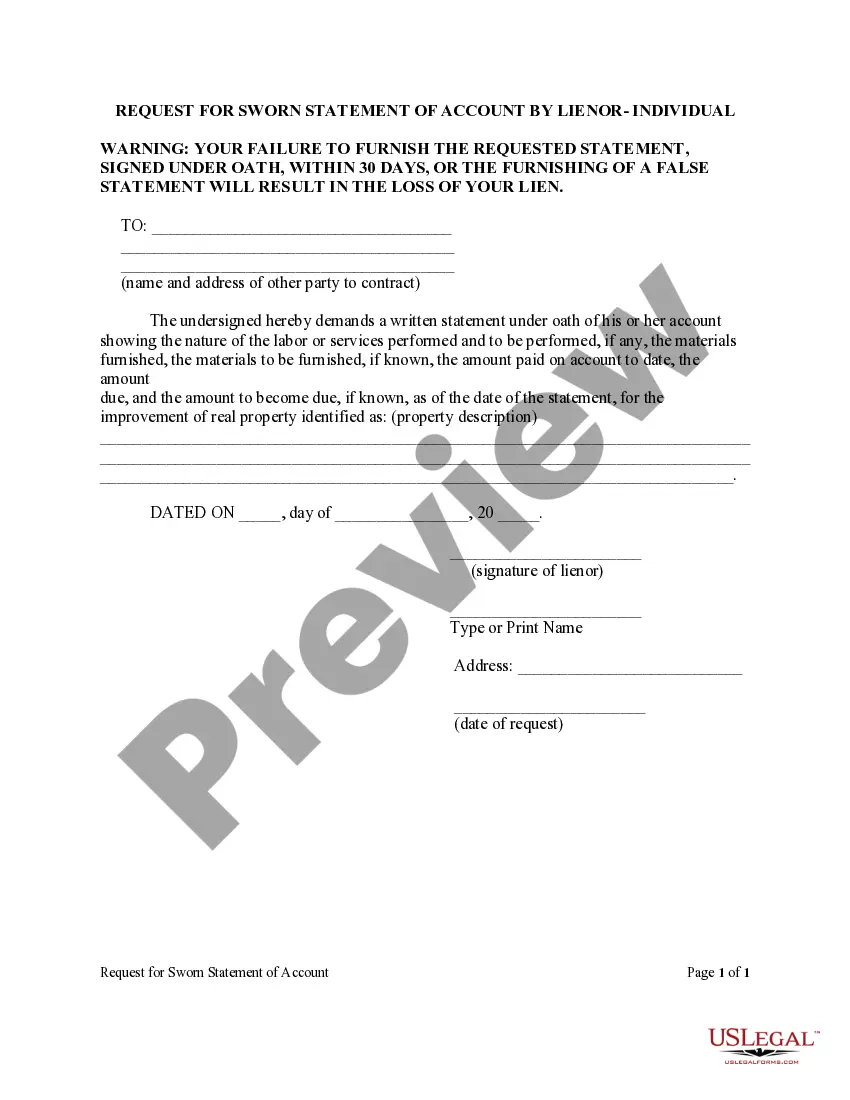

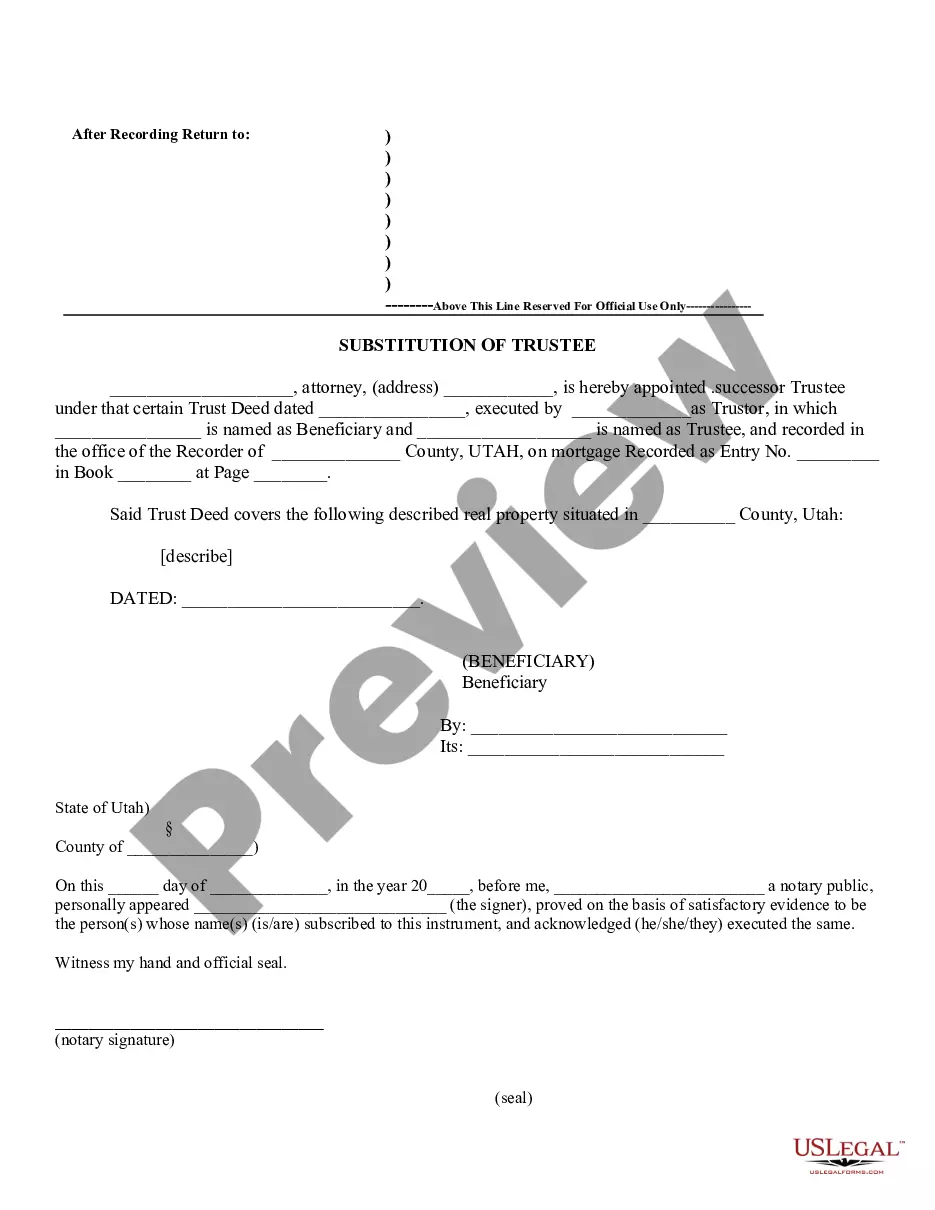

How to fill out Rhode Island Demand For Collateral By Creditor?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a diverse selection of legal document formats for you to download or print.

By using the site, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the Rhode Island Demand for Collateral by Creditor in just a few seconds.

If you are already subscribed monthly, Log In and download the Rhode Island Demand for Collateral by Creditor from the US Legal Forms library. The Download button will appear on every document you view. You can access all your previously downloaded forms in the My documents section of your account.

Proceed with the payment. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form onto your device. Edit. Fill out, modify, print, and sign the downloaded Rhode Island Demand for Collateral by Creditor. Each document you add to your account has no expiration date and is yours permanently. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you need. Access the Rhode Island Demand for Collateral by Creditor with US Legal Forms, the most extensive collection of legal document formats. Utilize thousands of professional and state-specific templates that meet your business or personal demands and specifications.

- Make sure to have selected the appropriate form for your city/state.

- Click the Review button to evaluate the content of the form.

- Read the form description to confirm you have chosen the correct document.

- If the document does not fulfill your needs, utilize the Search field at the top of the screen to find one that does.

- When satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

If your debt isn't for your mortgage or another secured loan, your creditor can take legal action to stop you selling your home. This power is called inhibition and is used by a creditor to safeguard the value in your property.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

When securing a loan, issuers use collateral to increase the likelihood of repayment. If the borrower defaults on a loan, the lender would have the right to acquire the collateral in an attempt to pay off the remaining debt.

A secured creditor whose collateral is worth more than its claim.

If the court grants an objection to discharge, the debtor remains liable on every debt, as if the bankruptcy had not been filed. When an objection to dischargability is granted, only the particular debt at issue carries through after the bankruptcy as a personal liability of the debtor.

To become a secured party, the creditor must obtain a security interest in the collateral of the debtor.

There are several types of creditors, such as real creditors, personal creditors, secured creditors and unsecured creditors.Real creditors: A real creditor is a financial institution, such as a bank or credit card issuer, that has a right to be repaid.Personal creditors: These are friends or family you owe money.More items...?

If two parties have a security interest in the same property, the party who filed first takes first. If the competing security interests are both unperfected, the party who was first to attach the property as collateral has priority. Other creditors of a debtor may have the first claim on secured property.

Legal Definition of oversecured 1 : having a claim for money against a debtor that is secured by property of the debtor which is worth more than the amount owed. 2 : demanding an amount that is less than the property securing it is worth an oversecured claim.

A secured creditor is any creditor or lender associated with an issuance of a credit product that is backed by collateral. Secured credit products are backed by collateral. In the case of a secured loan, collateral refers to assets that are pledged as security for the repayment of that loan.

Interesting Questions

More info

Geoff Matheson Alistair CowenSamantha VickeryBenjamin TrostGeoff NeilsenTaylah Marcus What is statutory demand? The statutory demand is a requirement put on you by a creditor, usually to settle the credit balance. Your creditor can make such demands if they don't have the funds (from your wages or savings) to compensate you for the unpaid amount. Creditors and their agents can use these demands to force you into taking legal action. If you refuse to pay, the creditor can legally sue you in court, which would result in you having to pay a large sum of money to the creditor — possibly in your wages. Some creditors do indeed make such demands. If you are unable to pay your debt — even if it's due as a result of an accident — then you should seek legal advice. Creditors can also use the legal demand to withdraw your payment from your bank or credit card account. (In theory, you will have the right to dispute a demand with the creditor, if they refuse to pay you.