Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

How to fill out Reimbursement For Expenditures - Resolution Form - Corporate Resolutions?

Have you ever been in a situation where you need documents for either professional or personal purposes almost all the time.

There are numerous legal form templates accessible online, but finding ones you can trust is not easy.

US Legal Forms provides thousands of form templates, including the Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, which are created to comply with state and federal regulations.

Choose the payment plan you want, complete the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions whenever needed. Click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions template.

- If you do not have an account and need to start using US Legal Forms, follow these instructions.

- Obtain the form you require and make sure it is for the correct city/county.

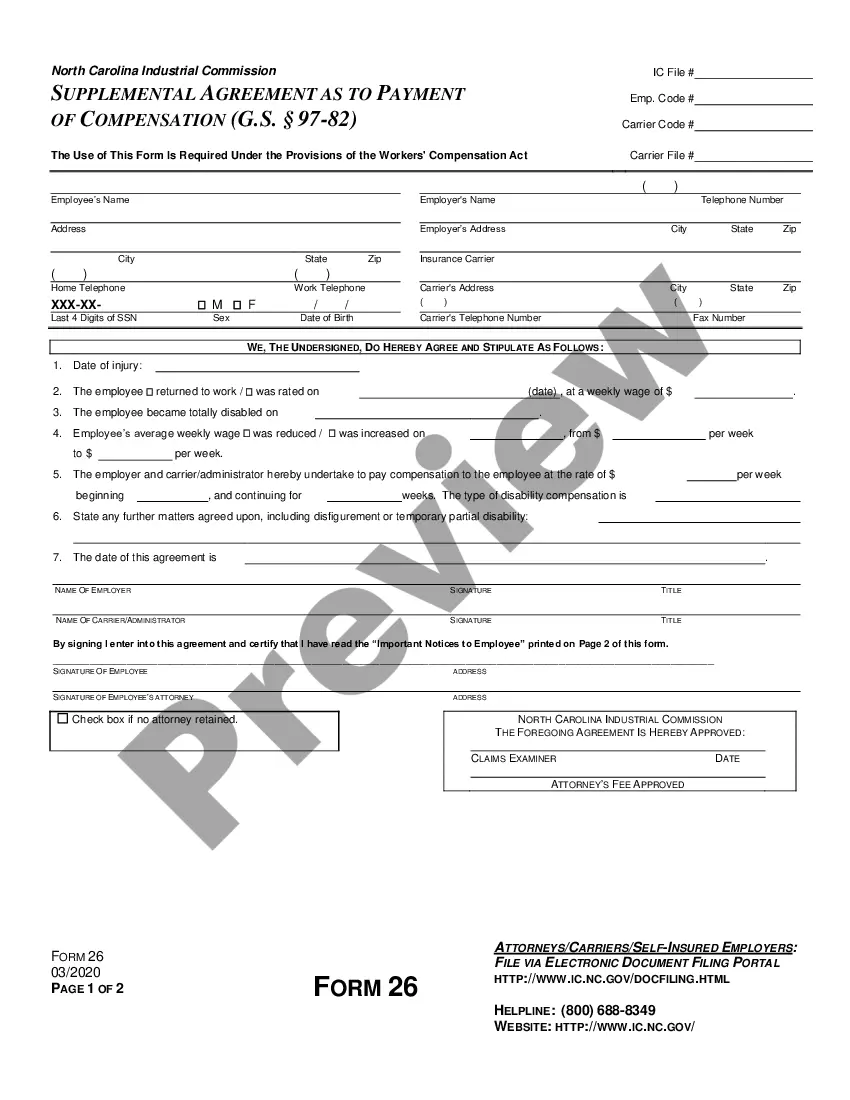

- Use the Preview button to review the form.

- Check the description to ensure that you have selected the right form.

- If the form isn’t what you need, use the Search field to locate the form that meets your needs and requirements.

- Once you find the correct form, click Purchase now.

Form popularity

FAQ

A form 1065 must be filed by partnerships and multi-member limited liability companies operating in Rhode Island. This form reports income, deductions, gains, and losses from the business. Filing accurately is essential for compliance, and the Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can help ease this process. For personalized assistance, you might consider using uslegalforms, which can provide essential templates and advice.

You are required to file a Rhode Island tax return if you are a resident or non-resident who earns income within the state. This applies regardless of your filing status, whether you are single, married, or head of household. Staying informed about your obligations is important, and resources like the Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can help. For assistance, uslegalforms can guide you through the filing complexities.

You can obtain Rhode Island tax forms directly from the Rhode Island Division of Taxation's website. They offer a comprehensive list of forms, including the latest versions of essential documents. To enhance your filing experience, the Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions serves as a vital resource. You may also find forms through uslegalforms for added convenience.

1065 must be filed if you operate a partnership in Rhode Island. This includes general partnerships, limited partnerships, and limited liability companies taxed as partnerships. Accurate filing is crucial, and with tools like the Rhode Island Reimbursement for Expenditures Resolution Form Corporate Resolutions, you can ensure compliance. Consider using uslegalforms for guidance on partnership filings.

You must file a Rhode Island estate tax return if the gross estate exceeds the exemption amount established by the state. This includes all property you owned at the time of death, including real estate and financial assets. If you're uncertain about your status, reviewing the Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can provide clarity. Consulting an expert or using uslegalforms can streamline your filing process.

To find out the mailing address the IRS has on file for you, you can check your most recent tax return or contact the IRS directly. It is important to keep this information updated to ensure you receive critical correspondence. For related corporate resolutions, the Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions may be a helpful resource.

In Rhode Island, any partnerships doing business or deriving income within the state must file Form RI 1065. It is essential for compliance and reporting purposes. If your partnership encounters expenditures needing reimbursement, consider utilizing the Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

To mail your IRS estate tax return, you need to send it to the address specified in the instructions for Form 706. It's crucial to follow these guidelines closely to avoid delays. Additionally, make use of the Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions if you need assistance with related financial matters.

year resident in Rhode Island is someone who lives in the state for only a portion of the year. This status affects how you file your taxes. If you are a partyear resident, you may benefit from the Rhode Island Reimbursement for Expenditures Resolution Form Corporate Resolutions to help manage expenses related to your time in the state.

The mailing address for your Form 1040 can vary depending on whether you are enclosing a payment. For returns without payment, send it to the Rhode Island Division of Taxation. To facilitate your filing experience, keep in mind the benefits of the Rhode Island Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.