Medicaid qualified individuals can receive care: in a traditional nursing home; in a hospice; in their home through a Home and Community Based Services (HCBS) Waiver; through a Program of All Inclusive Care for the Elderly (PACE); or through long term care insurance purchased through a state insurance partnership if you live in New York, Connecticut, Indiana, or California.

This is an excellent guide to help you understand Medicaid, the benefits it provides for long term care, and who may qualify. The guide also contains tips and strategies to help you with your long term care planning, a planner to help you estimate your eligibility, and a state resource guide with state .gov websites, addresses and telephone numbers.

Rhode Island Medicaid Long Term Care Handbook, Planner, and State Resource Guide

Description

How to fill out Medicaid Long Term Care Handbook, Planner, And State Resource Guide?

Are you currently in the position in which you need to have papers for either organization or individual functions nearly every working day? There are tons of lawful document layouts available on the net, but finding types you can depend on isn`t straightforward. US Legal Forms delivers a large number of kind layouts, such as the Rhode Island Medicaid Long Term Care Handbook, Planner, and State Resource Guide, which are composed in order to meet state and federal demands.

If you are presently knowledgeable about US Legal Forms web site and get a merchant account, basically log in. After that, you are able to acquire the Rhode Island Medicaid Long Term Care Handbook, Planner, and State Resource Guide format.

Should you not come with an bank account and need to start using US Legal Forms, abide by these steps:

- Discover the kind you want and make sure it is for that correct city/region.

- Use the Review option to review the shape.

- Look at the information to actually have chosen the correct kind.

- In case the kind isn`t what you are looking for, use the Research area to get the kind that meets your needs and demands.

- Once you find the correct kind, click Purchase now.

- Select the prices plan you desire, fill out the necessary information and facts to generate your bank account, and purchase an order making use of your PayPal or credit card.

- Select a hassle-free document file format and acquire your backup.

Find all the document layouts you may have purchased in the My Forms menus. You can get a extra backup of Rhode Island Medicaid Long Term Care Handbook, Planner, and State Resource Guide at any time, if required. Just click on the essential kind to acquire or print out the document format.

Use US Legal Forms, one of the most considerable assortment of lawful types, to save lots of time and avoid blunders. The support delivers appropriately made lawful document layouts which you can use for a range of functions. Produce a merchant account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

Rhode Island Medicaid will cover the cost of long term care in a nursing home for eligible Rhode Island residents who require a Nursing Facility Level of Care. Nursing home coverage includes payment for room and board, as well as all necessary medical and non-medical goods and services.

Income & Asset Limits for Eligibility 2023 Rhode Island Medicaid Long-Term Care Eligibility for SeniorsType of MedicaidSingleMarried (both spouses applying)Regular Medicaid / Elders and Adults with Disabilities (EAD)$1,215 / month$1,643 / month3 more rows ?

However, in Rhode Island (and most other states), the application process involves a 60 month (5 years) ?Lookback Rule,? which means that the state will review any transfers or gifts given within five years of your application and take those into account.

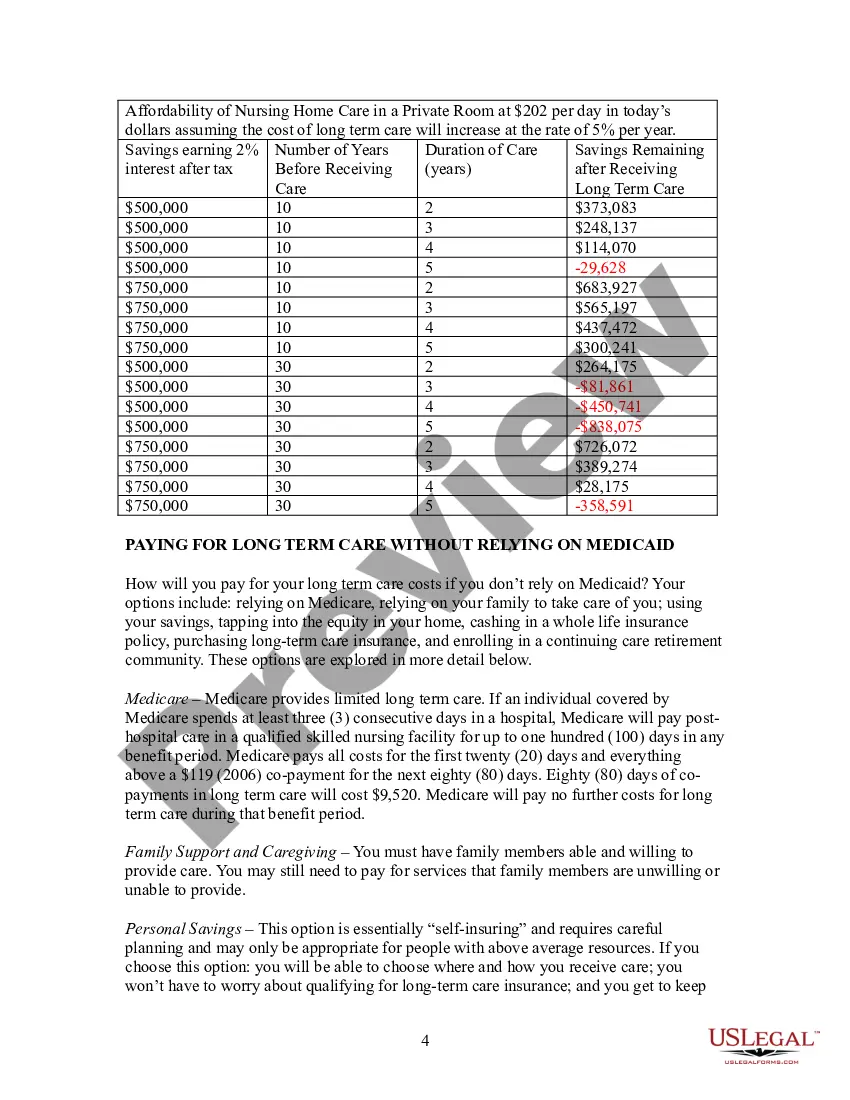

The cost of nursing homes in Rhode Island is nearly 40% greater than that of assisted living facilities. The average cost for a semi-private room is $9,429 per month, and a private room is $10,038 per month. These costs will vary across the state.

You can also get help by clicking on our MyOptionsRI website. Assisted Living: The Rhode Island Medicaid program covers assisted living services in State-licensed Assisted Living Residences (ALRs) that are certified to participate in the long-term services and support (LTSS) program.

Exempt Assets in 2023 for an applicant in Rhode Island include: i. $4,000 or less in cash/non-exempt assets if single. If married, the asset limit is raised to $6,000.

In 2023, the Medically Needy Income Limits (MNILs) are $1,092 / month for an individual and $1,133 / month for a couple. The ?spend down? amount, which can be thought of as a deductible, is the difference between one's monthly income and the MNIL. In RI, one's ?spend down? is calculated for a 6-month period.

You can preserve your assets for your spouse or future generations by transferring them into a Medicaid Qualifying Trust at least five (5) years prior to the need for long-term skilled nursing care.