Title: Understanding the Rhode Island Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust, or Security Agreement Introduction: In Rhode Island, the Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust, or Security Agreement is a crucial legal document used in real estate transactions involving a balloon payment structure. This detailed description intends to shed light on the purpose, features, and different types of these addendums and riders while incorporating relevant keywords. 1. Purpose and Definition: The Rhode Island Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust, or Security Agreement serve as an additional agreement to the primary loan documents. Its purpose is to outline specific terms related to balloon payments, which are large one-time payments typically due at the end of a loan term. 2. Features: — Balloon Payment Details: The addendum and rider state the precise amount and due date of the balloon payment, typically at the maturity of the loan term. — Payment Amount and Schedule: It describes the regular payment structure until the balloon payment becomes due. — Interest Rate and Calculation: The document specifies the interest rate applicable to the loan and explains the method of calculation. — Security Interest: It includes provisions recognizing the security interest of the lender, making it enforceable in case of default. — Prepayment Option: Some addendums may provide borrowers with an optional prepayment clause, allowing them to pay off the loan early. — Late Payment Penalties: The document may outline penalties for late payments to incentivize timely payments. Types of Rhode Island Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust, or Security Agreement: 1. Residential Balloon Secured Note Addendum and Rider: This type applies specifically to residential properties, such as single-family homes, condominiums, or townhouses. It addresses the unique needs and considerations of residential borrowers. 2. Commercial Balloon Secured Note Addendum and Rider: Designed for commercial properties, this addendum applies to loans taken for commercial ventures. It accounts for the specific complexities and dynamics of commercial transactions. 3. Agricultural Balloon Secured Note Addendum and Rider: This variant caters to loans secured against agricultural properties, such as farms, ranches, or vineyards. It incorporates provisions specific to agricultural lending. Conclusion: The Rhode Island Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust, or Security Agreement play a crucial role in documenting loans with balloon payment terms. By providing a detailed description and outlining the different types of these agreements, borrowers and lenders can better understand the implications and tailor them to suit their specific needs.

Rhode Island Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement

Description

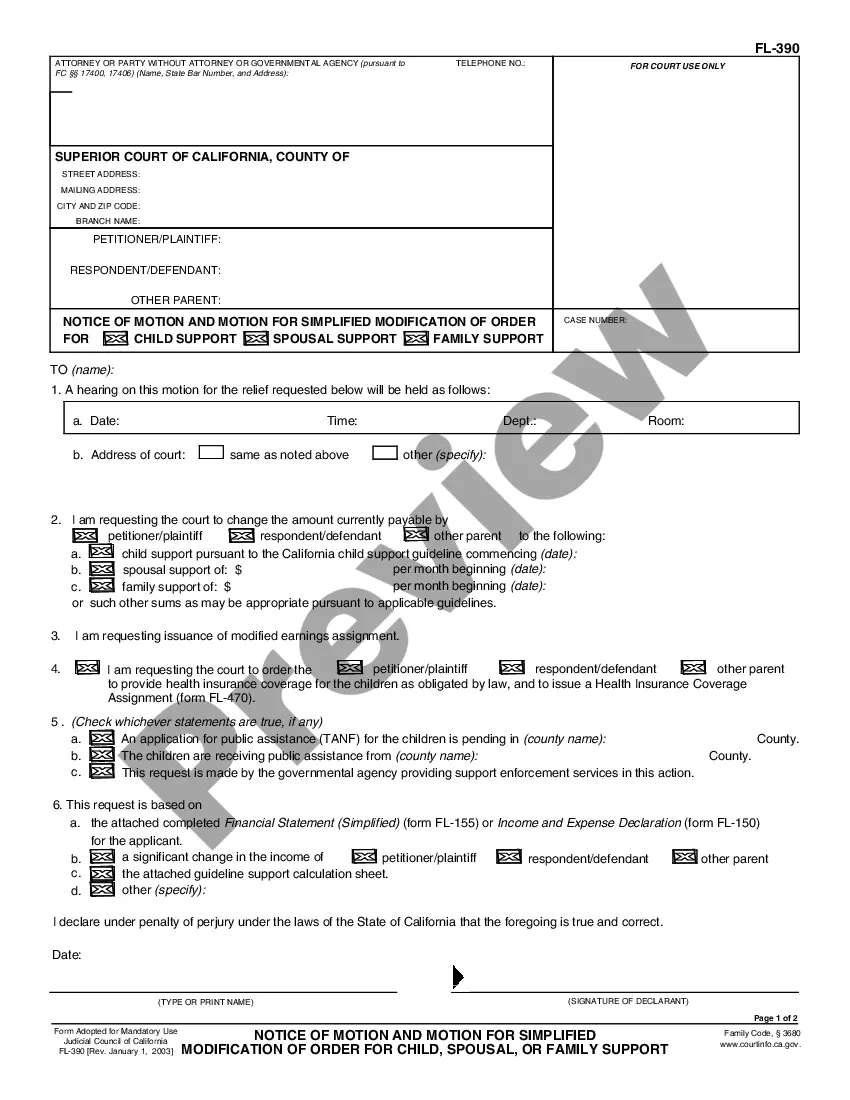

How to fill out Rhode Island Balloon Secured Note Addendum And Rider To Mortgage, Deed Of Trust Or Security Agreement?

US Legal Forms - among the largest libraries of authorized forms in the USA - provides a variety of authorized record themes it is possible to obtain or print. Utilizing the web site, you can get thousands of forms for organization and individual purposes, categorized by classes, suggests, or keywords and phrases.You will discover the most up-to-date versions of forms just like the Rhode Island Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement in seconds.

If you have a registration, log in and obtain Rhode Island Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement from your US Legal Forms local library. The Obtain button will show up on every single kind you look at. You gain access to all in the past delivered electronically forms from the My Forms tab of the account.

If you wish to use US Legal Forms initially, allow me to share easy instructions to help you started:

- Be sure to have selected the right kind to your area/area. Click the Review button to examine the form`s articles. Browse the kind outline to actually have selected the proper kind.

- In case the kind does not match your needs, make use of the Lookup discipline on top of the display to discover the the one that does.

- In case you are happy with the shape, affirm your decision by simply clicking the Purchase now button. Then, choose the rates plan you want and offer your credentials to register on an account.

- Process the purchase. Make use of Visa or Mastercard or PayPal account to finish the purchase.

- Pick the structure and obtain the shape on your product.

- Make changes. Load, modify and print and sign the delivered electronically Rhode Island Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement.

Each and every design you added to your bank account lacks an expiration date and it is your own property eternally. So, if you want to obtain or print another version, just proceed to the My Forms segment and click about the kind you want.

Obtain access to the Rhode Island Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement with US Legal Forms, probably the most comprehensive local library of authorized record themes. Use thousands of expert and state-certain themes that meet your company or individual demands and needs.

Form popularity

FAQ

A Promissory Note with Balloon Payments is a loan contract that enables a lender set loan terms with one or more larger payments at the end. This lending document helps you to clarify the terms of a loan, define the payment schedule, and provide an amortization table, if the loan includes interest.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

The type of foreclosure: If you have a deed of trust, you will usually have a nonjudicial foreclosure. On the other hand, the courts will typically be involved if you have a mortgage. Foreclosure details: When your lender forecloses with a deed of trust, the process will usually take less time and money to complete.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

Property title or deed, if applicable. Current mortgage statements, if applicable. Certificate of reverse mortgage counseling. Bank statements from the last two months.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.