Rhode Island Tax Free Exchange Agreement Section 1031 is a tax provision that allows taxpayers in Rhode Island to defer capital gains taxes on the sale of investment properties or assets through a like-kind exchange. This provision is based on Section 1031 of the Internal Revenue Code, which allows for the exchange of one investment property for another of similar nature, commonly referred to as a tax-deferred exchange or a "1031 exchange." A Rhode Island tax-free exchange under Section 1031 offers individuals and businesses the opportunity to reinvest the proceeds from the sale of a property into a new investment property without recognizing the capital gains tax liability at the time of the exchange. This provision encourages investment, facilitates the growth of businesses, and stimulates the real estate market. By deferring taxes, taxpayers can potentially increase their purchasing power and leverage their investment gains to acquire larger or more profitable properties. It is important to note that the Rhode Island Tax Free Exchange Agreement Section 1031 applies only to properties held for investment or used in a trade or business. Personal residences or dealer properties meant for resale are not eligible for a tax-free exchange. There are two common types of exchanges under the Rhode Island Tax Free Exchange Agreement Section 1031: 1. Simultaneous Exchange: This is the most straightforward type of exchange where the relinquished property is sold, and the replacement property is acquired simultaneously. Both properties are transferred in a single transaction, ensuring a seamless exchange. 2. Delayed Exchange: In a delayed exchange, the taxpayer has a specific period known as the identification period, typically 45 days, to identify potential replacement properties after the sale of the relinquished property. Once identified, the taxpayer has 180 days to acquire the replacement property. During this period, the proceeds from the sale of the relinquished property are held by a qualified intermediary to ensure compliance with the exchange requirements. It is crucial for taxpayers to comply with the strict guidelines set forth by the Rhode Island Tax Free Exchange Agreement Section 1031 to receive the tax benefits. Qualified intermediaries and tax professionals specializing in 1031 exchanges can provide guidance and assist in navigating the intricacies of the process to ensure a successful exchange. By taking advantage of the Rhode Island Tax Free Exchange Agreement Section 1031, taxpayers can defer significant capital gains taxes, optimize their investment portfolios, and facilitate the growth of the real estate market in Rhode Island. Proper planning and professional assistance are key to maximizing the benefits of this tax provision.

Rhode Island Tax Free Exchange Agreement Section 1031

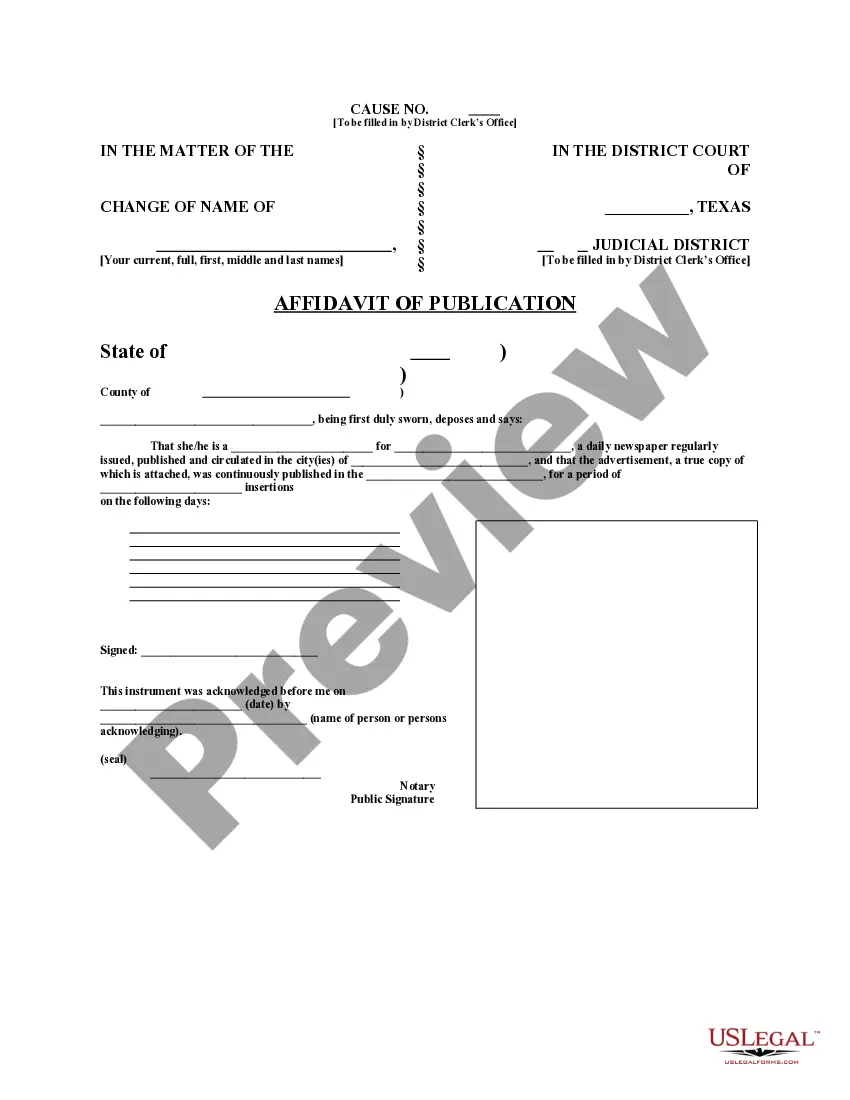

Description

How to fill out Rhode Island Tax Free Exchange Agreement Section 1031?

If you have to complete, obtain, or print lawful papers templates, use US Legal Forms, the biggest variety of lawful forms, which can be found on-line. Utilize the site`s easy and practical research to discover the paperwork you will need. Numerous templates for business and person functions are sorted by categories and claims, or search phrases. Use US Legal Forms to discover the Rhode Island Tax Free Exchange Agreement Section 1031 in just a few clicks.

When you are already a US Legal Forms buyer, log in to your bank account and click on the Acquire switch to find the Rhode Island Tax Free Exchange Agreement Section 1031. Also you can gain access to forms you previously saved in the My Forms tab of the bank account.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form to the appropriate town/nation.

- Step 2. Utilize the Preview choice to check out the form`s content material. Do not neglect to see the outline.

- Step 3. When you are not satisfied with the develop, utilize the Lookup area near the top of the monitor to get other versions from the lawful develop template.

- Step 4. Upon having located the form you will need, go through the Purchase now switch. Choose the costs strategy you like and include your credentials to sign up on an bank account.

- Step 5. Approach the deal. You can use your charge card or PayPal bank account to finish the deal.

- Step 6. Find the structure from the lawful develop and obtain it on your own product.

- Step 7. Full, change and print or signal the Rhode Island Tax Free Exchange Agreement Section 1031.

Each and every lawful papers template you get is the one you have eternally. You might have acces to every single develop you saved in your acccount. Click on the My Forms segment and select a develop to print or obtain once again.

Contend and obtain, and print the Rhode Island Tax Free Exchange Agreement Section 1031 with US Legal Forms. There are many skilled and express-distinct forms you can utilize for the business or person requires.