Rhode Island Trust Agreement - Family Special Needs

Description

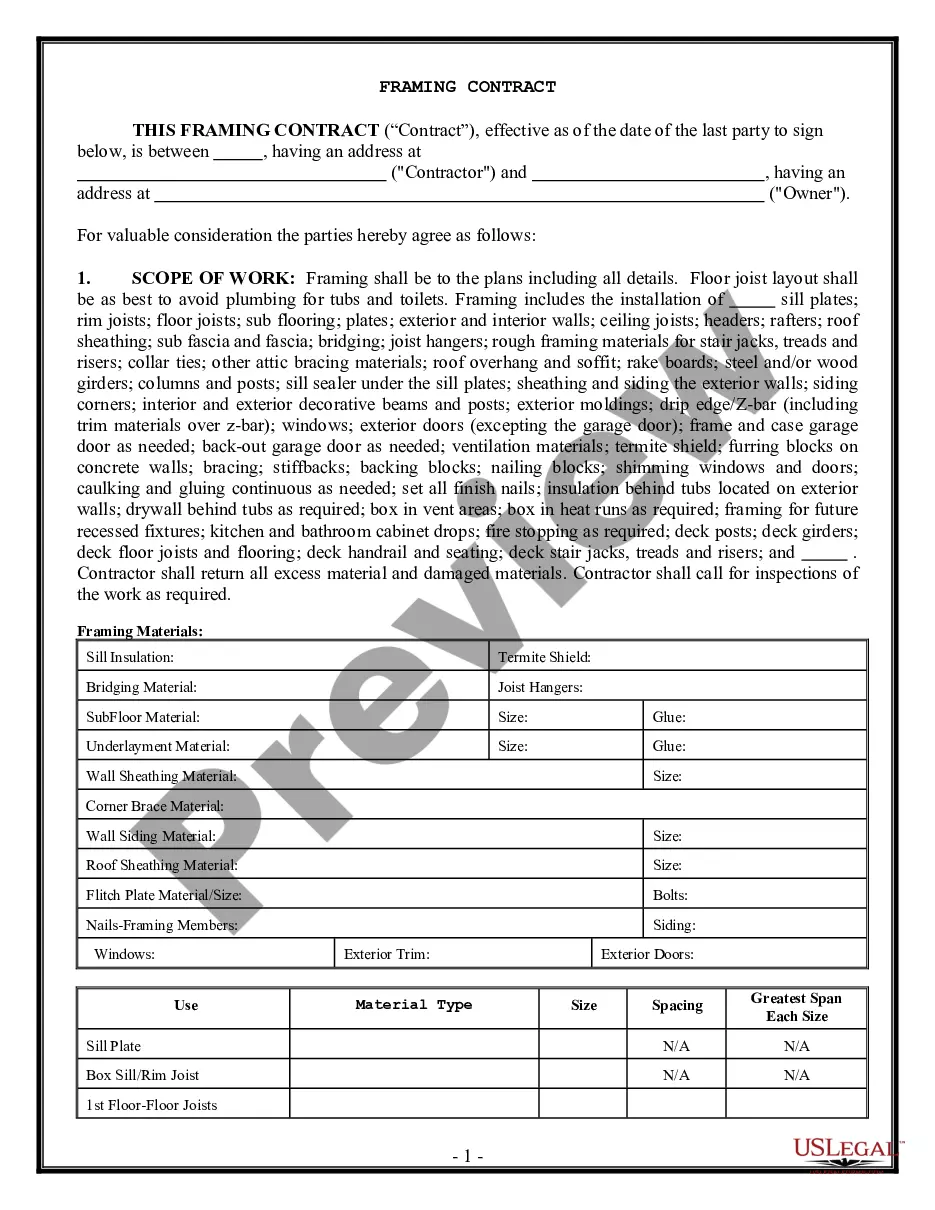

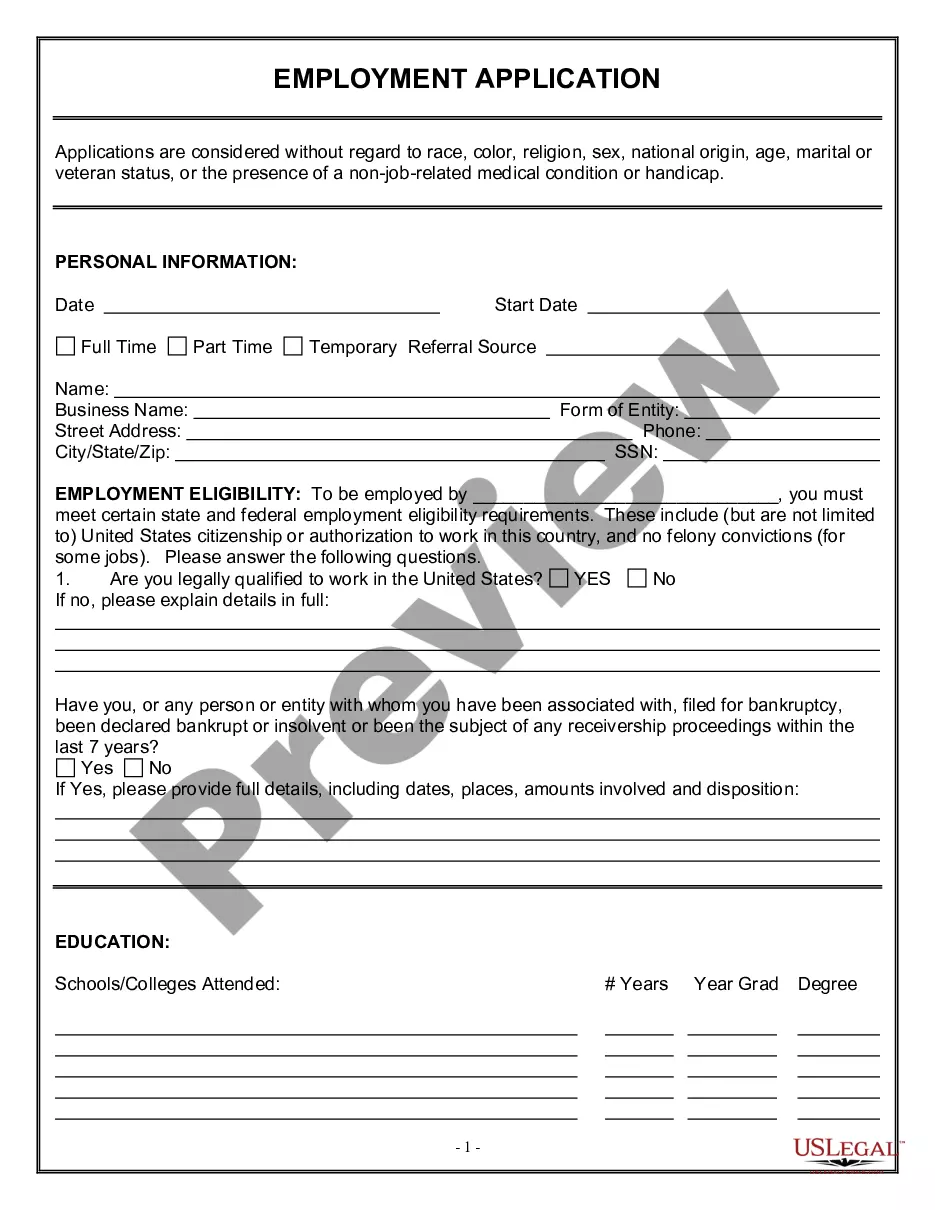

How to fill out Trust Agreement - Family Special Needs?

Are you presently in a situation where you require documents for potential organizational or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of template options, including the Rhode Island Trust Agreement - Family Special Needs, which can be downloaded to comply with state and federal requirements.

Access all the document templates you have ordered in the My documents menu.

You can obtain another copy of the Rhode Island Trust Agreement - Family Special Needs at any time, if needed. Just select the desired template to download or print the document design.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Rhode Island Trust Agreement - Family Special Needs template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you require and ensure it is for your specific city/region.

- Utilize the Preview button to review the document.

- Check the description to confirm that you have selected the correct form.

- If the document is not what you are looking for, use the Lookup field to find the template that meets your needs and requirements.

- Once you locate the appropriate template, click Get now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

A special needs trust in Massachusetts operates by holding assets for the benefit of a disabled individual while allowing them to maintain eligibility for government benefits. The trust can provide funds for additional needs not covered by these benefits, enhancing the individual's quality of life. When implementing a Rhode Island Trust Agreement - Family Special Needs, it is crucial to follow legal guidelines to ensure that the trust functions effectively and meets the needs of your family member.

Many families benefit from having a trust, especially those with a member who has special needs. A trust helps manage and protect assets while ensuring that your loved ones are financially supported. If you are considering the advantages of a Rhode Island Trust Agreement - Family Special Needs, it's wise to consult with legal professionals who can guide you through the process.

Individuals with disabilities, including those who receive SSI, SSDI, or other benefits, often qualify for a special needs trust in Massachusetts. These trusts are designed to preserve assets while providing for additional needs that government benefits do not cover. By creating a Rhode Island Trust Agreement - Family Special Needs, families can secure funds for medical care, education, or personal services without jeopardizing eligibility for necessary benefits.

The minimum amount required to establish a special needs trust often depends on individual circumstances and goals. While there isn't a fixed minimum, it is generally beneficial to set up a trust with enough funding to provide for the needs of your loved one. A comprehensive Rhode Island Trust Agreement - Family Special Needs can help you determine the appropriate funding amount to ensure quality care.

In Massachusetts, individuals with disabilities can qualify for benefits under various programs. Typically, this includes those who have physical or mental impairments that significantly limit their daily activities. To explore options related to a Rhode Island Trust Agreement - Family Special Needs, consult with a legal expert or use resources like US Legal Forms to ensure you meet the necessary criteria.

The primary downside of a discretionary trust is the uncertainty it can create for beneficiaries regarding the distribution of assets. Since distributions depend on the trustee's judgment, beneficiaries may experience fluctuations in their financial support. When structuring a Rhode Island Trust Agreement - Family Special Needs, it is important to consider balancing discretion with the need for reliable benefits. Engaging with a qualified advisor can help navigate these concerns effectively.

The best place for a person on disability often depends on individual preferences, community support, and accessibility features. Look for areas with resources tailored for disabled individuals, such as healthcare and recreational facilities. If you’re establishing a Rhode Island Trust Agreement - Family Special Needs, consider how the chosen living environment supports the beneficiary's well-being and independence. Local support networks can also enhance living conditions.

Setting up a trust in Rhode Island involves several key steps, including deciding on the type of trust you need, like a special needs trust. You will need to draft the trust document, detailing specific terms and beneficiaries. Utilizing resources like the US Legal Forms platform can guide you through creating a Rhode Island Trust Agreement - Family Special Needs, ensuring it adheres to local laws. Consulting with an attorney can further streamline the process.

For a disabled beneficiary, a special needs trust is typically the most appropriate type of trust. This trust designates funds to support the individual without impacting their eligibility for needed public benefits. When creating a Rhode Island Trust Agreement - Family Special Needs, it is essential to ensure that the trust meets all legal requirements and properly safeguards the beneficiary's assets. Engaging with experts in estate planning can provide valuable insight.

A special needs trust in Massachusetts is a legal arrangement that allows funds to be set aside for a disabled person while maintaining eligibility for public benefits. This trust type ensures that the individual can receive support without the risk of losing essential government assistance. If you’re interested in drafting a Rhode Island Trust Agreement - Family Special Needs, remember that similar principles apply across state lines, enabling financial security and peace of mind.