Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions

Description

How to fill out Dividend Policy - Resolution Form - Corporate Resolutions?

Selecting the finest authorized document format can be a challenge.

Clearly, there are numerous templates accessible online, but how will you locate the legal form you need.

Utilize the US Legal Forms website.

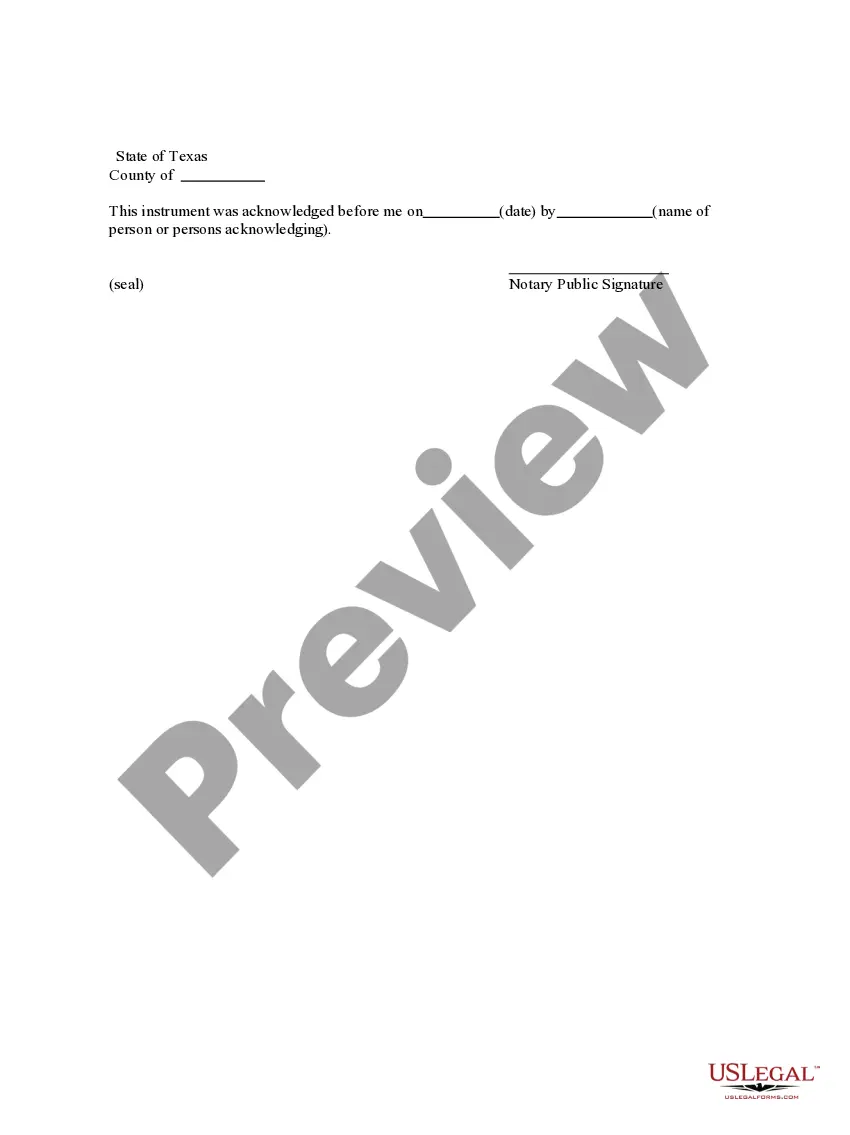

If you are a new user of US Legal Forms, here are straightforward steps for you to follow: First, make sure you have selected the correct form for your area/county. You can check the form using the Preview option and review the form description to ensure it is suitable for you.

- The platform offers thousands of templates, including the Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions, suitable for business and personal needs.

- All the forms are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Acquire button to access the Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions.

- Use your account to search through the legal forms you have previously purchased.

- Go to the My documents section of your account to download another copy of the documents you need.

Form popularity

FAQ

A corporate representative resolution appoints individuals who can represent the corporation in dealings with third parties. This ensures that only authorized persons engage in negotiations or enter contracts on behalf of the company. Utilizing the Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions helps businesses document this authority clearly, thus preventing any misunderstandings or legal issues that may arise.

A resolution of authorization is a directive from a company's board granting certain individuals or entities the power to act on behalf of the corporation. This typically involves approving contracts, financial transactions, or other significant business decisions. By employing the Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions, companies can clearly outline authorized actions, ensuring compliance and strategic execution.

A director's resolution for signing authority is a specific type of corporate resolution that designates which directors have the power to sign official documents. This resolution is vital for maintaining control over corporate actions and ensuring that only authorized personnel can enter into binding agreements. The Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions simplifies this process, making it easy for companies to establish and communicate signing powers.

The purpose of a corporate resolution is to formalize decisions made by a company's board of directors or shareholders. It serves to document significant actions, such as the approval of major transactions or changes in company structure. By using the Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions, organizations can ensure that these decisions are recorded properly, providing legal protection and fostering transparency.

A corporate signing authority resolution outlines the individuals authorized to sign documents on behalf of a company. This resolution is critical for ensuring that all contracts, agreements, and official documents are signed by designated personnel. By utilizing the Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions, businesses can effectively document and communicate these signing authorities, which enhances clarity and reduces potential legal disputes.

A board resolution in the United States is a formal document that records decisions made by a corporation's board of directors. It serves as an official account of actions taken, providing clarity and legal protection for the corporation. When using the Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions, you ensure that your board decisions are properly documented and compliant with state laws.

Incorporating in Rhode Island offers various advantages, including favorable tax conditions and a straightforward regulatory environment. The state provides resources for businesses to thrive, including support for corporate governance compliance. Utilizing the Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions can enhance your business's credibility and organizational structure.

The purpose of a board resolution is to document the decisions made by the board of directors. This formal documentation helps protect the corporation by providing evidence that specific actions were authorized. When you complete the Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions, you ensure your corporation has a reliable record of its governance activities.

To write a corporate resolution, start with a clear title indicating the nature of the resolution. Include the date, details of the decision, and ensure proper signatures are obtained from the board members present. Utilizing the Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions can provide structure and guidance throughout this process.

A board resolution typically refers to decisions made by the board of directors during a board meeting, often requiring a majority vote. In contrast, an ordinary resolution is a decision made by shareholders during a general meeting and usually requires a simple majority to pass. Understanding these distinctions is vital when completing the Rhode Island Dividend Policy - Resolution Form - Corporate Resolutions.