Rhode Island Construction Contract with Subcontractor

Description

How to fill out Construction Contract With Subcontractor?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a variety of legal form templates that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Rhode Island Construction Contract with Subcontractor in mere seconds.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you desire and provide your information to register for an account.

- If you already have an account, Log In and download the Rhode Island Construction Contract with Subcontractor from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously saved forms in the My documents section of your profile.

- To utilize US Legal Forms for the first time, follow these simple instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

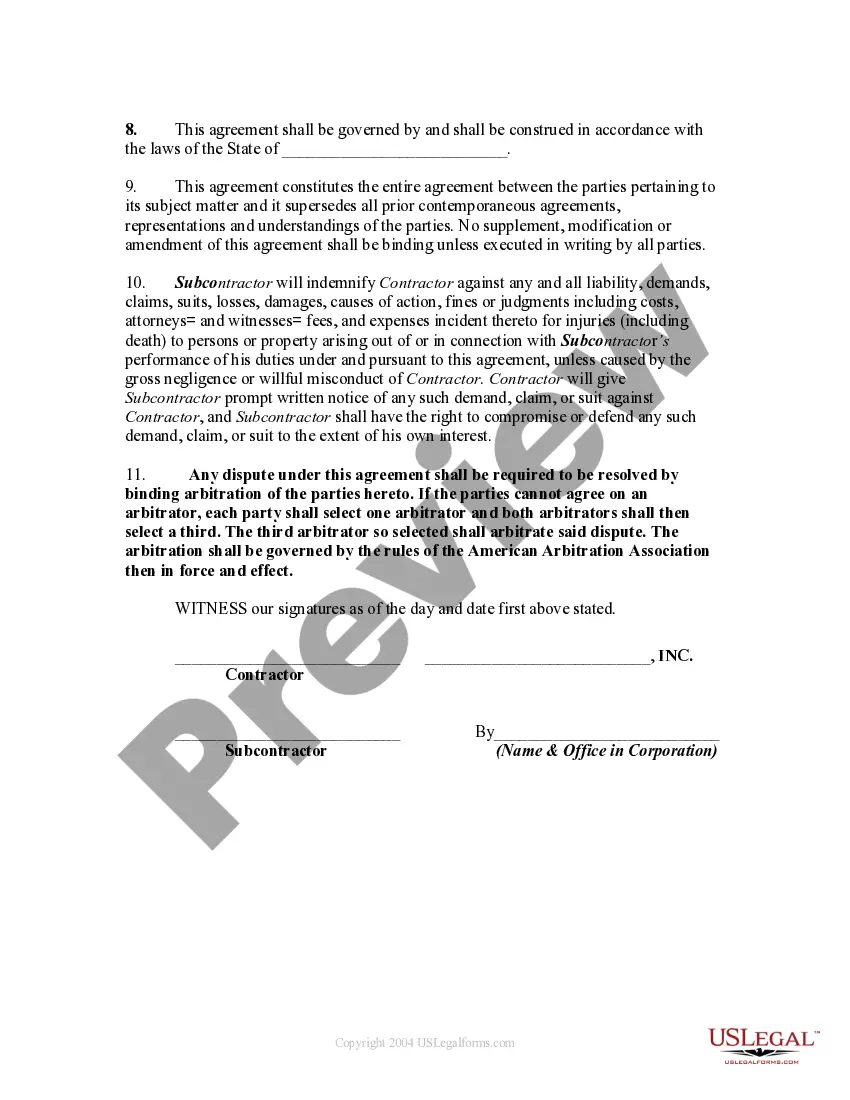

- Check the Preview button to see the form’s content. Browse the form overview to confirm you have chosen the right form.

Form popularity

FAQ

Avoiding estate tax in Rhode Island can be approached in several ways, including gifting assets before your death or establishing trusts. Proper estate planning plays a significant role, particularly for those with substantial assets or properties acquired through a Rhode Island Construction Contract with Subcontractor. Consulting with a legal professional can provide personalized strategies designed for your financial situation and ensure adherence to current laws.

Yes, Rhode Island sales tax exemption certificates do have an expiration date. Typically, these certificates remain valid as long as the buyer's legitimate tax-exempt status is confirmed. If you’re entering into a Rhode Island Construction Contract with Subcontractor, ensure that your exemption certificates are up to date to avoid complications. Regularly checking the status of your certificates can save you from unexpected tax liabilities.

In Rhode Island, certain items are non-taxable, including food for home consumption and prescription medications. Additionally, services like medical care and some educational services fall under this non-taxable category. Understanding these exemptions is especially important when negotiating a Rhode Island Construction Contract with Subcontractor, ensuring you are aware of what costs might incur tax burdens. Always consult applicable tax laws for the most current information.

In Rhode Island, homeowners may qualify for property tax relief at age 65. While there's no official age to stop paying entirely, seniors can benefit from programs that provide tax exemptions or credits. These programs support the financial needs of senior citizens on fixed incomes, especially when engaging in a Rhode Island Construction Contract with Subcontractor. It is wise to check with your local assessor for specific options and eligibility.

A certificate of no tax due in Rhode Island is a document that shows you do not owe any state taxes. This certificate is often required when obtaining a Rhode Island Construction Contract with Subcontractor, as it verifies your tax status. Essentially, it provides proof to contractors and subcontractors that you are compliant with tax obligations. You can easily request this certificate through the Rhode Island Division of Taxation.

Writing a subcontractor agreement involves outlining the scope of work, payment terms, and timelines clearly. In a Rhode Island Construction Contract with Subcontractor, ensure to include clauses related to compliance, liability, and dispute resolution. For assistance, platforms like uslegalforms provide templates and resources to help create effective and legally binding contracts tailored to your needs.

A contractor is primarily responsible for the overall management of a construction project, while a subcontractor is hired to complete specific tasks within that project. In a Rhode Island Construction Contract with Subcontractor, the contractor delegates portions of the project to subcontractors based on their expertise. Understanding these differences helps clarify roles and responsibilities in construction projects.

If there is no contract, issues may arise regarding expectations, payments, and responsibilities. This can lead to misunderstandings and potential legal disputes between the contractor and subcontractor. A Rhode Island Construction Contract with Subcontractor helps avoid such problems by clearly outlining the terms and conditions of the working relationship.

Yes, Rhode Island requires contractors to obtain a license prior to performing work, including subcontractor services. This ensures that all work complies with state regulations and standards. A Rhode Island Construction Contract with Subcontractor must reflect compliance with local laws, marking it as essential for legal operations.

The contract clause for a subcontractor typically includes specifications regarding the work to be performed, payment terms, and timelines. In a Rhode Island Construction Contract with Subcontractor, this clause will also address issues like liability, insurance, and dispute resolution. Including well-defined clauses helps in minimizing misunderstandings and legal disputes.