A Rhode Island Triple Net Commercial Lease Agreement is a legally binding contract that outlines the terms and conditions between a landlord and a tenant for the rental of commercial real estate. This specific type of lease is commonly used for commercial properties, such as retail stores, offices, or industrial spaces. The term "Triple Net" refers to the responsibility of the tenant to pay for the property's operating expenses, including taxes, insurance, and maintenance. In the state of Rhode Island, there are various types of Triple Net Commercial Lease Agreements available, each catering to specific needs and requirements. Some notable variations include: 1. Gross Lease: This type of lease usually applies to smaller commercial spaces and places the responsibility of operating expenses on the landlord. The tenant pays a fixed rent without being responsible for additional expenses, such as insurance or property taxes. 2. Single Net Lease: Although less common, this lease type requires the tenant to pay only a specific net expense, typically property taxes, with the landlord taking care of other operating expenses. It is important to note that the terms of the net expense can be negotiated between the parties. 3. Double Net Lease: In this agreement, the tenant is responsible for paying property taxes and insurance premiums, while the landlord remains responsible for the maintenance and repair costs of the property. 4. Triple Net Lease: This is the most common type of commercial lease agreement, particularly in Rhode Island. With a Triple Net Lease, the tenant assumes the financial responsibility for property taxes, insurance premiums, and maintenance, in addition to paying the base rent. Rhode Island Triple Net Commercial Lease Agreements typically include several key components. These include details about the parties involved, property description and address, lease term, rental payment terms, operating expense responsibility, repair and maintenance obligations, default and termination clauses, insurance requirements, and any additional provisions negotiated between the landlord and tenant. When entering into a Triple Net Commercial Lease Agreement in Rhode Island, it is crucial for both parties to carefully review and understand all terms and conditions. Consulting with a knowledgeable real estate attorney can help ensure that the agreement aligns with the desired objectives of the tenant and landlord, providing a fair and mutually beneficial arrangement.

Rhode Island Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Rhode Island Triple Net Commercial Lease Agreement - Real Estate Rental?

Have you been inside a position in which you will need paperwork for sometimes enterprise or specific reasons nearly every time? There are a lot of lawful file layouts available on the Internet, but discovering types you can trust isn`t simple. US Legal Forms delivers a large number of type layouts, like the Rhode Island Triple Net Commercial Lease Agreement - Real Estate Rental, which can be created to meet state and federal specifications.

In case you are presently acquainted with US Legal Forms site and get an account, basically log in. Next, you can download the Rhode Island Triple Net Commercial Lease Agreement - Real Estate Rental design.

Unless you come with an bank account and want to start using US Legal Forms, abide by these steps:

- Discover the type you need and make sure it is for that appropriate metropolis/area.

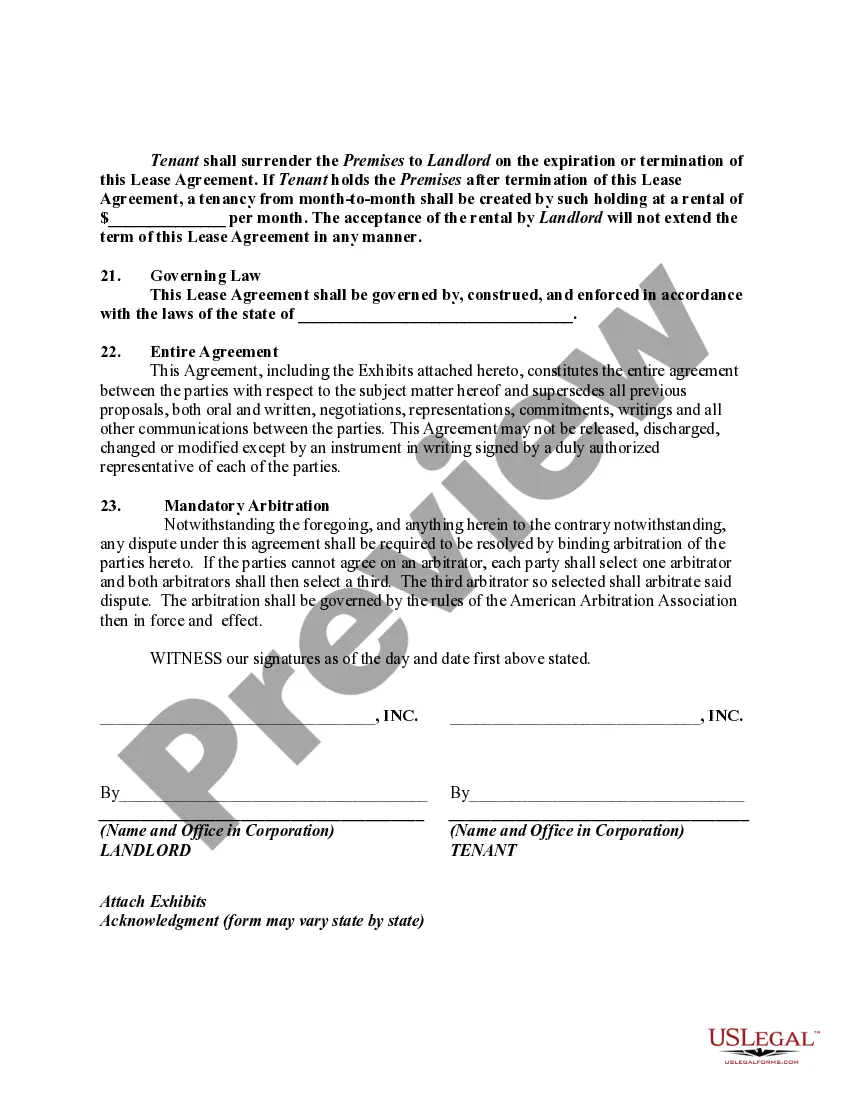

- Use the Preview switch to examine the form.

- See the explanation to actually have chosen the correct type.

- If the type isn`t what you`re searching for, make use of the Look for industry to discover the type that fits your needs and specifications.

- Whenever you get the appropriate type, click Get now.

- Pick the pricing prepare you want, complete the required information to generate your money, and pay money for an order utilizing your PayPal or charge card.

- Decide on a convenient paper format and download your backup.

Get all the file layouts you might have bought in the My Forms food selection. You can obtain a extra backup of Rhode Island Triple Net Commercial Lease Agreement - Real Estate Rental any time, if needed. Just select the essential type to download or produce the file design.

Use US Legal Forms, probably the most extensive variety of lawful varieties, to save efforts and steer clear of errors. The support delivers expertly produced lawful file layouts that can be used for a selection of reasons. Make an account on US Legal Forms and begin producing your life a little easier.