Rhode Island Rental Lease Agreement for Business is a legally binding document that outlines the terms and conditions of a commercial lease agreement between a landlord and a tenant. When entering into a rental lease agreement for business purposes in Rhode Island, it is crucial to have a comprehensive understanding of the rights and responsibilities of both parties. The Rhode Island Rental Lease Agreement for Business covers various aspects such as the duration of the lease, rental payments, security deposits, maintenance responsibilities, and termination clauses. It serves as a blueprint for the landlord and tenant to establish a mutually beneficial rental agreement while ensuring legal compliance. There are different types of Rhode Island Rental Lease Agreements for Business depending on the specific needs and requirements of the business. Some common types include: 1. Gross Lease: This type of lease agreement typically involves a flat monthly rent, where the landlord assumes the responsibility for property taxes, insurance, and maintenance costs. 2. Net Lease: In a net lease agreement, the tenant pays for a portion of the property expenses such as property taxes, insurance, and maintenance costs, in addition to the base rent. 3. Percentage Lease: This type of lease is commonly used for retail businesses, where the tenant pays a base rent along with a percentage of their sales revenue. 4. Triple Net Lease: In a triple net lease agreement, the tenant is responsible for paying all property expenses, including property taxes, insurance, maintenance costs, and utilities, in addition to the base rent. 5. Modified Gross Lease: A modified gross lease is a combination of the gross and net lease, where the tenant pays a base rent, and the landlord covers some property expenses, while others are the responsibility of the tenant. Rhode Island Rental Lease Agreements for Businesses are crucial in protecting the rights and interests of both landlords and tenants. It is advisable to consult with an attorney or legal professional experienced in commercial leases to ensure the lease agreement is thorough, accurately reflects the intentions of both parties, and complies with Rhode Island's laws and regulations.

Rhode Island Rental Lease Agreement for Business

Description

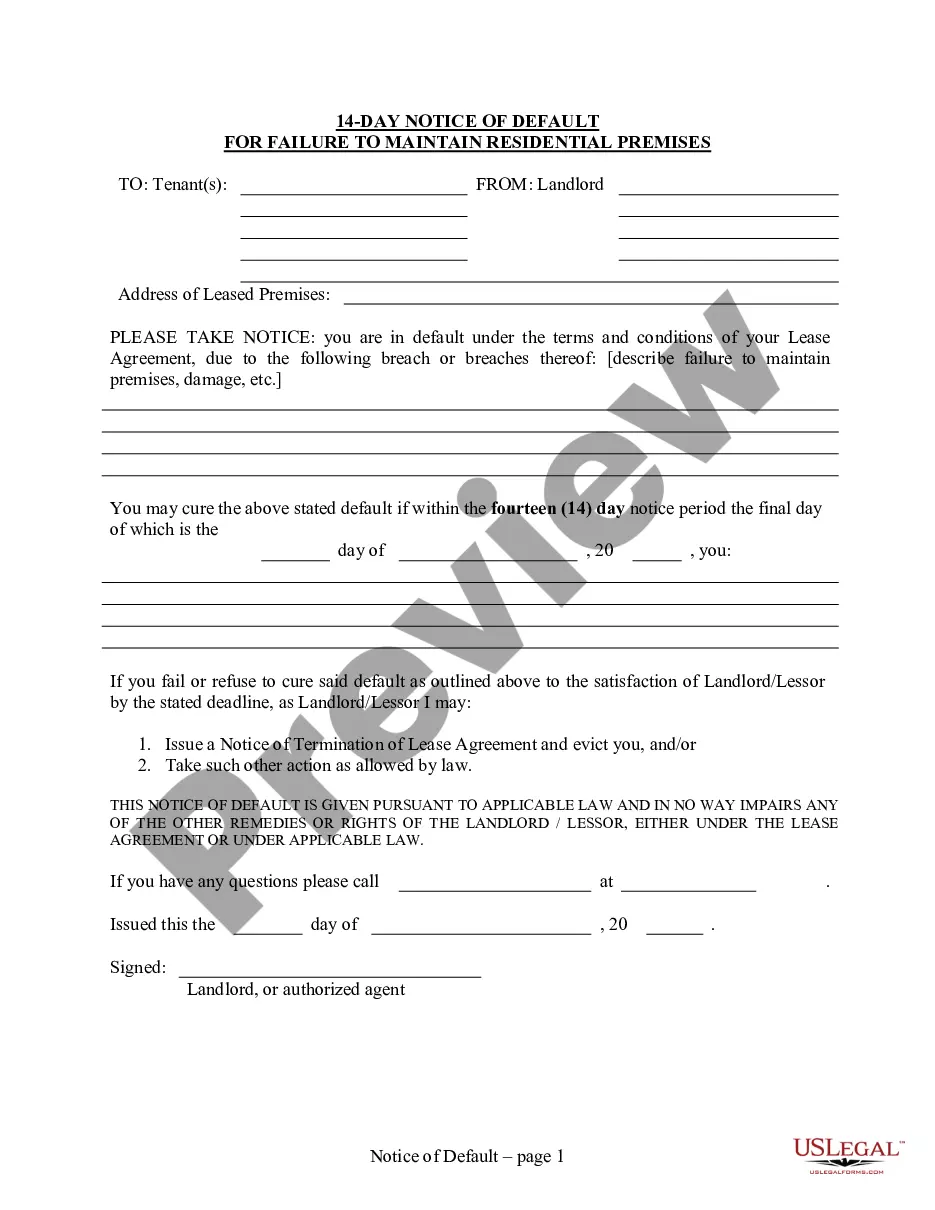

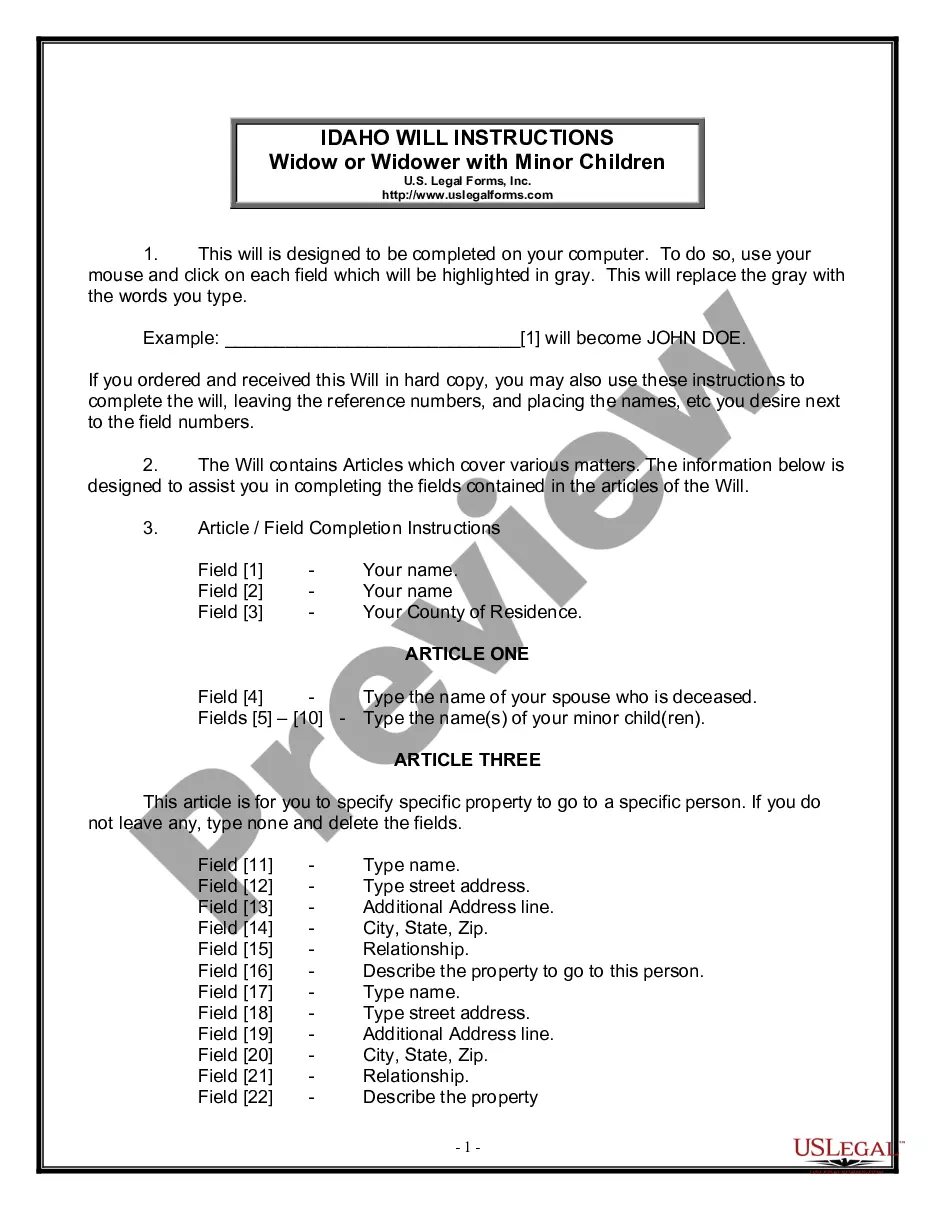

How to fill out Rhode Island Rental Lease Agreement For Business?

You can dedicate hours online searching for the authentic document template that fulfills the federal and state criteria you require.

US Legal Forms provides a vast selection of authentic forms that have been evaluated by professionals.

It is easy to acquire or print the Rhode Island Rental Lease Agreement for Business from their services.

If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- If you have a US Legal Forms account, you can.

- Log In.

- and click the.

- Acquire.

- button.

- Following that, you can complete, modify, print, or sign the Rhode Island Rental Lease Agreement for Business.

- Every authentic document template you obtain is yours permanently.

- To get another copy of any purchased form, go to the.

- My documents.

- tab and click the related button.

Form popularity

FAQ

Yes, having a rent agreement is mandatory in Uttar Pradesh for both legal protection and clarity between tenants and landlords. It serves as a formal record of the rental terms and can help avoid misunderstandings in the future. A suitable agreement, similar to a Rhode Island Rental Lease Agreement for Business, can streamline all aspects of the rental arrangement, providing peace of mind for both parties.

To write a successful business proposal for a lease, clearly outline your business's needs, proposed terms, and the benefits to the landlord. Make sure to include a detailed plan for how you intend to use the space, along with any financial commitments. Incorporating ideas from a Rhode Island Rental Lease Agreement for Business can enhance your proposal by demonstrating professionalism and commitment.

Making a rent agreement in Uttar Pradesh involves preparing a written document that outlines the terms and conditions between tenant and landlord. Both parties should include details like rent amount, duration, and responsibilities. Just like in a Rhode Island Rental Lease Agreement for Business, clarity in your UP agreement can prevent disputes and ensure a smooth rental process.

The most common residential lease is the standard month-to-month lease, which allows flexibility while providing a stable living arrangement. This type of lease typically remains in effect until either party decides to terminate it, often with a required notice period. However, for businesses, a Rhode Island Rental Lease Agreement for Business may offer greater customization options to align with usage and financial goals.

To create a valid rent agreement in Noida, you need several important documents. Typically, these include proof of identity like an Aadhar card or passport, proof of ownership of the property, and a recent utility bill. Additionally, it’s wise to have any necessary tax or business registration documents if you’re involved in a business arrangement. Understanding how a Rhode Island Rental Lease Agreement for Business works can help you tailor your agreement to meet specific needs.

The best lease type for commercial property often depends on your business needs and operational structure. Common options include gross leases, where the landlord covers expenses, and net leases, where the tenant pays for some operating costs. It is advisable to carefully evaluate the terms of your Rhode Island Rental Lease Agreement for Business to determine which lease type provides the best balance of responsibility and flexibility.

Yes, writing up a rental agreement is a straightforward process. You can create a detailed Rhode Island Rental Lease Agreement for Business using templates available on platforms like USLegalForms. These resources guide you through the essential elements to include, ensuring your agreement is both comprehensive and legally sound.

To lease a property for business, start by identifying the location that aligns with your operational needs. Next, outline the terms you want to include in your Rhode Island Rental Lease Agreement for Business, such as duration, rental amount, and maintenance responsibilities. Finally, consult with a legal expert or use a platform like USLegalForms to draft a lease that protects both parties.

Yes, you can lease your own property to your business by creating a formal Rhode Island Rental Lease Agreement for Business. This arrangement allows you to utilize your property for your business operations while providing your business with a clear legal framework. It is essential to ensure the terms are fair and compliant with local laws.

Renters in Rhode Island possess certain rights, including the right to habitable living conditions and protection against unlawful eviction. Understanding these rights is vital for both tenants and landlords. Utilizing a Rhode Island Rental Lease Agreement for Business can serve as a guideline to ensure that all parties are aware of their rights and responsibilities.