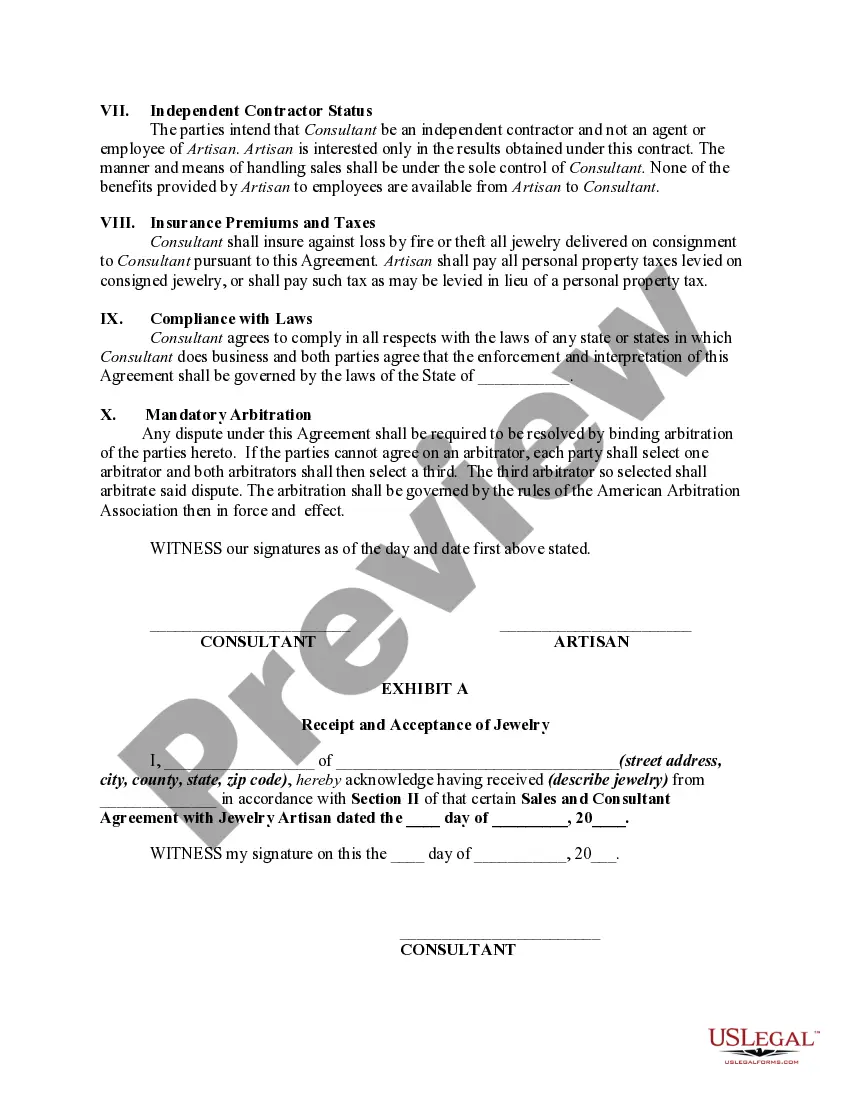

This form is a sample of an agreement to promote and sell jewelry between an artisan, who designs and creates fine jewelry, and an image consultant for various clients who have requested consultant's assessment of their wardrobe with regard to jewelry.

Rhode Island Sales and Marketing Consultant Agreement with Jewelry Artisan A Rhode Island Sales and Marketing Consultant Agreement with Jewelry Artisan is a legally binding contract between a consultant and a jewelry artisan. This agreement outlines the terms and conditions under which the sales and marketing consultant will provide their expertise to help promote and sell the artisan's jewelry products. This agreement is important as it helps establish a clear understanding of the responsibilities, compensation, and expectations between both parties involved. In Rhode Island, there might be different types of Sales and Marketing Consultant Agreements with Jewelry Artisans based on the specific needs and goals of each partnership. Some possible types include: 1. Commission-based Agreement: This type of agreement specifies that the consultant's compensation will be based on a percentage of the sales generated by their marketing efforts. The commission percentage can be predetermined and agreed upon by both parties. 2. Retainer-based Agreement: In this type of agreement, the consultant receives a fixed monthly or periodic fee for their services. This arrangement ensures a consistent level of support from the consultant in promoting the jewelry artisan's products. 3. Project-based Agreement: This agreement is tailored for specific projects or campaigns the consultant will undertake to market and sell the jewelry artisan's products. The agreement clearly outlines the scope of work, deliverables, timelines, and compensation for the completion of the project. Key elements included in a Rhode Island Sales and Marketing Consultant Agreement with Jewelry Artisan may consist of: 1. Parties Involved: This section identifies the names and contact information of both the consultant and the jewelry artisan. 2. Scope of Work: This section describes in detail the specific activities, strategies, and services the consultant will provide to promote and sell the jewelry artisan's products. 3. Compensation: This section outlines the agreed-upon payment structure, whether it's commission-based, retainer-based, project-based, or a combination thereof. It also specifies the mode and frequency of payment and whether any additional expenses will be reimbursed. 4. Term and Termination: This part details the duration of the agreement and the conditions under which either party can terminate the contract. It may also cover any notice periods required for termination. 5. Confidentiality and Non-Disclosure: This section ensures that both parties will maintain the confidentiality of any proprietary information, trade secrets, and customer data shared during the partnership. 6. Intellectual Property Rights: This part clarifies the ownership of any intellectual property created during the collaboration, such as marketing materials or branding assets. 7. Governing Law and Jurisdiction: This section specifies that the agreement will be governed by Rhode Island laws and any disputes will be resolved in the courts of Rhode Island. Consulting with a legal professional or business attorney experienced in Rhode Island laws is highly recommended when drafting or reviewing a Rhode Island Sales and Marketing Consultant Agreement with Jewelry Artisan to ensure compliance with state regulations and protection of both parties' rights and interests.