Rhode Island Receipt for Payment of Rent

Description

How to fill out Receipt For Payment Of Rent?

It is feasible to spend several hours online trying to locate the legal document style that meets the state and federal standards you require.

US Legal Forms offers a vast array of legal forms that have been evaluated by experts.

You can indeed acquire or generate the Rhode Island Receipt for Payment of Rent through our service.

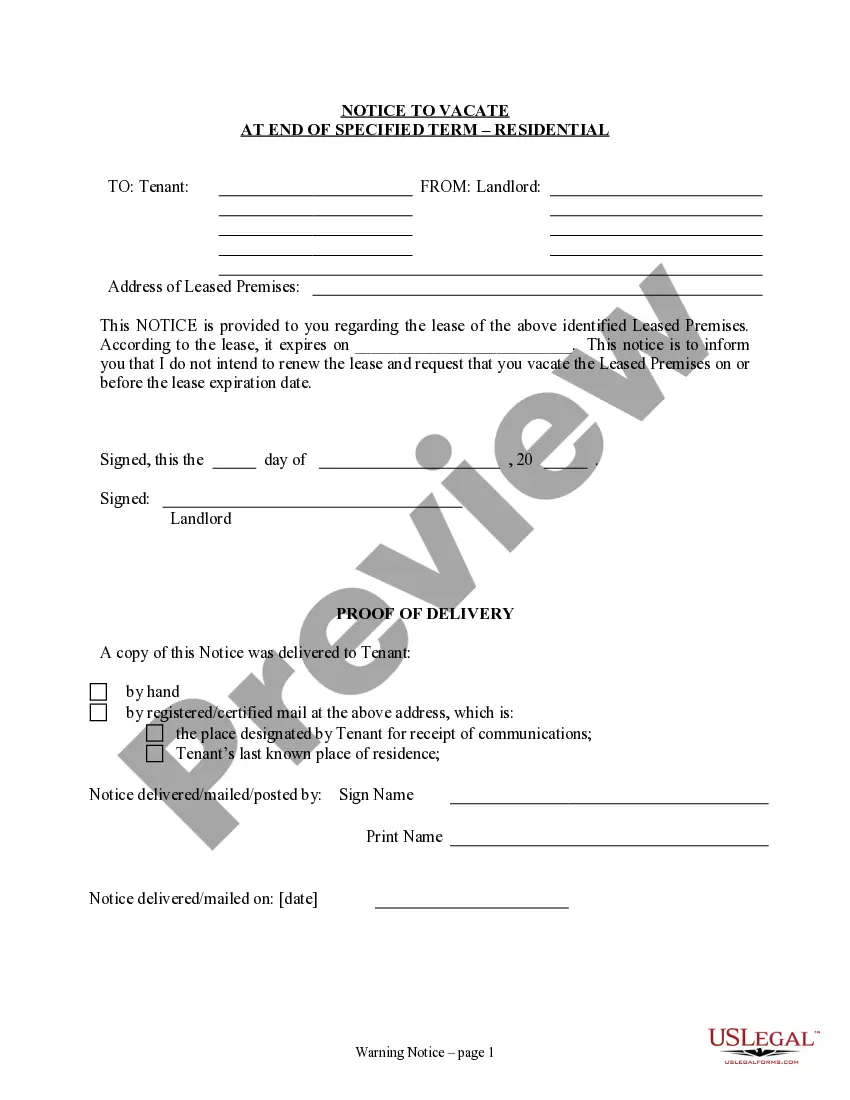

If available, utilize the Review button to peruse the document format as well. If you wish to locate another version of the form, use the Search field to find the format that suits your needs and preferences.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Rhode Island Receipt for Payment of Rent.

- Every legal document format you obtain is yours permanently.

- To retrieve an additional copy of any obtained form, go to the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your chosen county/city.

- Review the form description to confirm you have chosen the correct one.

Form popularity

FAQ

To prove that you are paying rent, it's essential to keep all your receipts organized and easily accessible. A Rhode Island Receipt for Payment of Rent serves as your official proof of payment. If you need assistance creating these receipts, consider using uslegalforms for reliable templates that help you document every transaction accurately.

Generating a Rhode Island Receipt for Payment of Rent can be done easily with the help of templates available online. Websites such as uslegalforms offer customizable options to fit your specific needs. Just fill in the required information such as the payment date, amount, and tenant details, and you will have an official receipt ready in no time.

Getting a receipt for your rent payment typically involves asking your landlord to provide one after you make your payment. If your landlord does not provide a receipt, you may consider creating one yourself using a template from uslegalforms. Just remember to include all relevant details to ensure it serves as valid proof of payment.

To obtain a Rhode Island Receipt for Payment of Rent, you should always request a written confirmation from your landlord upon making a payment. It’s a standard practice that benefits both tenants and landlords. Additionally, you can utilize online services like uslegalforms to generate a formal receipt that meets state requirements.

To create a Rhode Island Receipt for Payment of Rent, start by including essential details such as the date of payment, the amount received, and the tenant's name. Always mention the property address to avoid any confusion. You can use a receipt template available on platforms like uslegalforms to ensure you have all the necessary elements in your receipt.

Property tax in Rhode Island varies by municipality but generally averages around 1.6% of a property's assessed value. Local governments use property taxes to fund public services, schools, and infrastructure. When managing rental properties, keeping good records is essential, and a Rhode Island Receipt for Payment of Rent can help you maintain accurate financial documentation. It's helpful for both budgeting and tax preparation.

Yes, Rhode Island residents can file their taxes online using the state’s electronic filing system. Filing online simplifies the process and provides immediate confirmation of your submission. Additionally, if you are a landlord, having a Rhode Island Receipt for Payment of Rent will streamline your reporting. Make sure your records are up to date before you start.

Rhode Island charges an occupancy tax on short-term rentals, which typically ranges from 1% to 8%. This tax applies to properties rented for a period of less than 30 consecutive days. For landlords and tenants alike, understanding this tax is vital for legal compliance. A Rhode Island Receipt for Payment of Rent will help document these transactions accurately.

In Rhode Island, sales tax generally does not apply to residential rental properties. However, if the rental is for a short-term stay, you may be subject to accommodations tax instead. It is important to clarify these distinctions to ensure compliance. Utilize a Rhode Island Receipt for Payment of Rent to track any applicable taxes.

Rhode Island imposes an estate tax on the value of an estate exceeding $1.5 million. The tax rate varies based on the value exceeding this threshold. Understanding the estate tax is crucial for property owners and heirs, particularly if the estate involves rental properties. Remember, obtaining a Rhode Island Receipt for Payment of Rent can help keep your rental accounts organized.