A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Rhode Island Conditional Guaranty of Payment of Obligation

Description

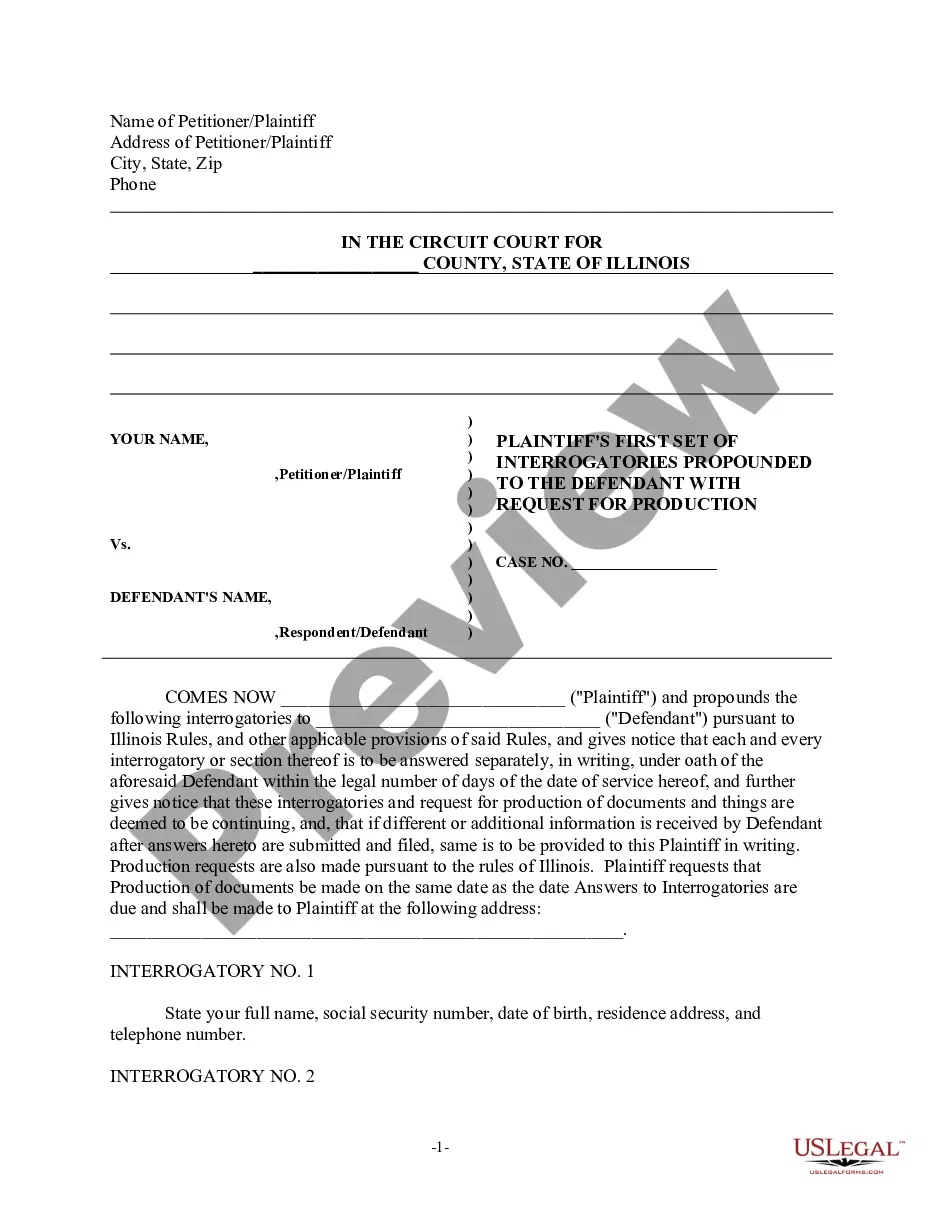

How to fill out Conditional Guaranty Of Payment Of Obligation?

It is feasible to spend hours online searching for the legitimate document template that meets the federal and state standards you desire.

US Legal Forms provides a vast selection of legal forms that are reviewed by professionals.

It is straightforward to obtain or print the Rhode Island Conditional Guaranty of Payment of Obligation from the platform.

If you wish to find another version of your document, use the Search field to identify the template that meets your needs.

- If you possess a US Legal Forms account, you may Log In and select the Download option.

- Subsequently, you can fill out, modify, print, or sign the Rhode Island Conditional Guaranty of Payment of Obligation.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of a purchased form, navigate to the My documents tab and select the relevant option.

- If you are using the US Legal Forms website for the first time, adhere to the simple instructions outlined below.

- First, ensure you have chosen the correct document template for the state/city of your preference.

- Review the form description to confirm you have picked the accurate template.

Form popularity

FAQ

A contract of suretyship is an agreement whereby a party, called the surety, guarantees the performance by another party, called the principal or obligor, of an obligation or undertaking in favor of another party, called the obligee.

The Guarantor undertakes to pay compensation up to a certain amount to the Beneficiary in case the Applicant/Instructing Party fails to deliver the goods or to carry out certain work. This type of Guarantee is often issued for 5-10% of the contract value, although the percentage varies case by case.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

A conditional guaranty is one which is not enforceable immediately upon the default of the principal debtor, but some contingency must happen, or the guarantee must take some steps, to fix the liability under the guaranty.

A contract of suretyship is one in terms of which one person (the surety) undertakes to the creditor of another person to perform the latter's obligation owed to the former when the debtor fails to perform. Typically, the performance by the surety is of a financial nature (eg. payment of a debt).

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

Guarantor unconditionally guarantees payment to Lender of all amounts owing under the Note. This Guarantee remains in effect until the Note is paid in full. Guarantor must pay all amounts due under the Note when Lender makes written demand upon Guarantor.

Suretyship is a very specialized line of insurance that is created whenever one party guarantees performance of an obligation by another party. There are three parties to the agreement: · The principal is the party that undertakes the obligation.

A conditional guaranty is one which is not enforceable immediately upon the default of the principal debtor, but some contingency must happen, or the guarantee must take some steps, to fix the liability under the guaranty.