A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

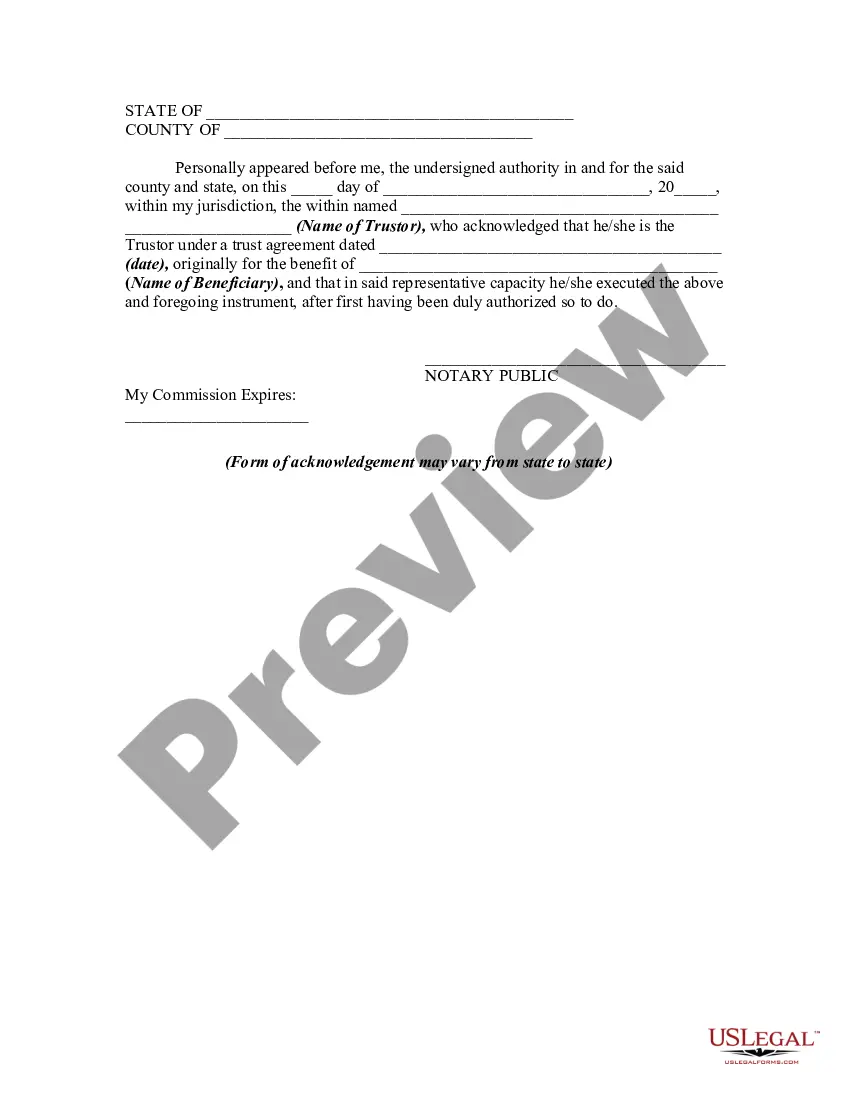

Rhode Island Amendment to Trust Agreement in Order to Change Beneficiaries: A Comprehensive Guide Introduction: The Rhode Island Amendment to Trust Agreement in Order to Change Beneficiaries allows individuals or granters to modify their trust agreement, specifically its beneficiaries. This legal document offers flexibility and ensures that the trust caters to changing circumstances, enabling granters to update beneficiary designations as needed. This detailed description provides an overview of the Rhode Island Amendment to Trust Agreement, its importance, and any potential variations of this amendment. 1. Overview of Rhode Island Amendment to Trust Agreement: The Rhode Island Amendment to Trust Agreement is a legal instrument that grants individuals or granters the ability to make changes to their trust agreement, specifically concerning the beneficiaries. This amendment is essential in cases where the existing trust provisions no longer align with the granter's intentions, resulting in the need for modifications to ensure their wishes are accurately reflected. 2. Importance of Changing Beneficiaries: By utilizing the Rhode Island Amendment to Trust Agreement, granters can ensure that their assets are distributed to the intended beneficiaries. Life events such as births, deaths, divorces, or changes in personal circumstances may necessitate modifications to the trust's beneficiary designations. This amendment ensures that the trust remains up-to-date and reflective of the granter's current desires. 3. Different Types of Rhode Island Amendment to Trust Agreement: While the Rhode Island Amendment to Trust Agreement primarily focuses on changing beneficiaries, there can be a few specific variations to consider, including: a. General Amendment to Trust Agreement: This type of amendment allows granters to make various changes to the trust agreement, such as adjusting distribution percentages, revising trustee powers, or altering trust instructions, in addition to modifying beneficiaries. b. Specific Beneficiary Change Amendment: This amendment specifically targets the beneficiary designations. It allows granters to replace, add, or remove beneficiaries from the trust, ensuring that the trust represents their current wishes accurately. c. Contingent Beneficiary Amendment: Granters can utilize this subtype of amendment to designate contingent beneficiaries who would receive the trust assets if the primary beneficiaries predecease them or become ineligible to inherit for any reason. 4. Procedure for Executing the Amendment: To execute a Rhode Island Amendment to Trust Agreement, granters must follow these steps: a. Draft the Amendment: Prepare a clear and concise document stating the desired changes to the beneficiary designations, ensuring it complies with Rhode Island state laws and the original trust agreement. b. Obtain Professional Assistance: Seek advice from an experienced estate planning attorney or trust professional who can review and verify the legality and enforceability of the proposed amendment. c. Execute the Amendment: Sign the amendment in the presence of a notary public with all necessary witnesses. It is crucial to follow the proper formalities, as per Rhode Island law, to ensure its validity. d. Distribute the Amendment: Provide copies of the executed amendment to all relevant parties, including trustees, beneficiaries, and other involved individuals, outlining the updated beneficiary designations. Conclusion: The Rhode Island Amendment to Trust Agreement in Order to Change Beneficiaries allows granters to modify their trust and adapt to changing circumstances. Whether through a general amendment, specific beneficiary change amendment, or contingent beneficiary amendment, this legal tool ensures that the trust remains relevant and aligned with the granter's intentions. By following the proper procedures and seeking professional assistance, granters can navigate this process effectively, ensuring their trust accurately represents their updated wishes and safeguards their assets for the intended beneficiaries.Rhode Island Amendment to Trust Agreement in Order to Change Beneficiaries: A Comprehensive Guide Introduction: The Rhode Island Amendment to Trust Agreement in Order to Change Beneficiaries allows individuals or granters to modify their trust agreement, specifically its beneficiaries. This legal document offers flexibility and ensures that the trust caters to changing circumstances, enabling granters to update beneficiary designations as needed. This detailed description provides an overview of the Rhode Island Amendment to Trust Agreement, its importance, and any potential variations of this amendment. 1. Overview of Rhode Island Amendment to Trust Agreement: The Rhode Island Amendment to Trust Agreement is a legal instrument that grants individuals or granters the ability to make changes to their trust agreement, specifically concerning the beneficiaries. This amendment is essential in cases where the existing trust provisions no longer align with the granter's intentions, resulting in the need for modifications to ensure their wishes are accurately reflected. 2. Importance of Changing Beneficiaries: By utilizing the Rhode Island Amendment to Trust Agreement, granters can ensure that their assets are distributed to the intended beneficiaries. Life events such as births, deaths, divorces, or changes in personal circumstances may necessitate modifications to the trust's beneficiary designations. This amendment ensures that the trust remains up-to-date and reflective of the granter's current desires. 3. Different Types of Rhode Island Amendment to Trust Agreement: While the Rhode Island Amendment to Trust Agreement primarily focuses on changing beneficiaries, there can be a few specific variations to consider, including: a. General Amendment to Trust Agreement: This type of amendment allows granters to make various changes to the trust agreement, such as adjusting distribution percentages, revising trustee powers, or altering trust instructions, in addition to modifying beneficiaries. b. Specific Beneficiary Change Amendment: This amendment specifically targets the beneficiary designations. It allows granters to replace, add, or remove beneficiaries from the trust, ensuring that the trust represents their current wishes accurately. c. Contingent Beneficiary Amendment: Granters can utilize this subtype of amendment to designate contingent beneficiaries who would receive the trust assets if the primary beneficiaries predecease them or become ineligible to inherit for any reason. 4. Procedure for Executing the Amendment: To execute a Rhode Island Amendment to Trust Agreement, granters must follow these steps: a. Draft the Amendment: Prepare a clear and concise document stating the desired changes to the beneficiary designations, ensuring it complies with Rhode Island state laws and the original trust agreement. b. Obtain Professional Assistance: Seek advice from an experienced estate planning attorney or trust professional who can review and verify the legality and enforceability of the proposed amendment. c. Execute the Amendment: Sign the amendment in the presence of a notary public with all necessary witnesses. It is crucial to follow the proper formalities, as per Rhode Island law, to ensure its validity. d. Distribute the Amendment: Provide copies of the executed amendment to all relevant parties, including trustees, beneficiaries, and other involved individuals, outlining the updated beneficiary designations. Conclusion: The Rhode Island Amendment to Trust Agreement in Order to Change Beneficiaries allows granters to modify their trust and adapt to changing circumstances. Whether through a general amendment, specific beneficiary change amendment, or contingent beneficiary amendment, this legal tool ensures that the trust remains relevant and aligned with the granter's intentions. By following the proper procedures and seeking professional assistance, granters can navigate this process effectively, ensuring their trust accurately represents their updated wishes and safeguards their assets for the intended beneficiaries.