Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust is a legal document that allows individuals to make modifications to the terms and provisions of an existing trust agreement in Rhode Island. This amendment specifically focuses on the withdrawal of property from the trust, providing a framework for removing assets from the trust's ownership. When considering an amendment of an inter vivos trust agreement in Rhode Island for withdrawal of property from the trust, there are a few important aspects to understand. Firstly, it is crucial to consult with an experienced attorney who specializes in estate planning and trusts to ensure compliance with state laws and address any specific requirements. The amendment should clearly state the intention to withdraw certain property from the trust and describe the property in detail. This includes providing accurate descriptions, such as legal addresses, parcel numbers, or any other identifying information necessary to ensure the correct assets are removed from the trust. Rhode Island offers different types of amendments for inter vivos trusts to suit various circumstances. Some common types of amendments for withdrawal of property from a trust include: 1. Partial Withdrawal Amendment: This type of amendment allows the trust or to remove specific assets or a portion of assets from the trust while leaving the remainder intact. It ensures that only selected property is withdrawn, keeping the trust active with the remaining assets. 2. Complete Withdrawal Amendment: In certain situations, a trust or may choose to withdraw all of their property from the trust, effectively terminating it. This amendment cancels the trust and distributes the assets to the designated beneficiaries or according to the trust or's wishes. 3. Reformation Amendment: If there are ambiguities or errors within the initial trust agreement regarding property withdrawals, a reformation amendment can rectify these issues. This amendment aims to clarify the trust or's true intent and align the agreement with their wishes. Additionally, when drafting the amendment, specific keywords and phrases should be included to ensure clarity and legal effectiveness. These keywords may include "amendment," "inter vivos trust," "trust or," "property withdrawal," "beneficiaries," "trust agreement," and "Rhode Island law." Using these relevant keywords can help create a comprehensive and legally sound Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. It is essential to remember that trust law can be complex, and each situation is unique, so seeking professional legal advice is crucial before finalizing any amendments to a trust agreement.

Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust

Description

How to fill out Amendment Of Inter Vivos Trust Agreement For Withdrawal Of Property From Trust?

If you require to sum up, download, or generate legal document templates, utilize US Legal Forms, the premier collection of legal forms accessible online.

Take advantage of the site's straightforward and convenient search to find the documents you need.

Multiple templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. After you have located the form you require, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the payment. You can utilize your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to access the Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust.

- You can also view forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

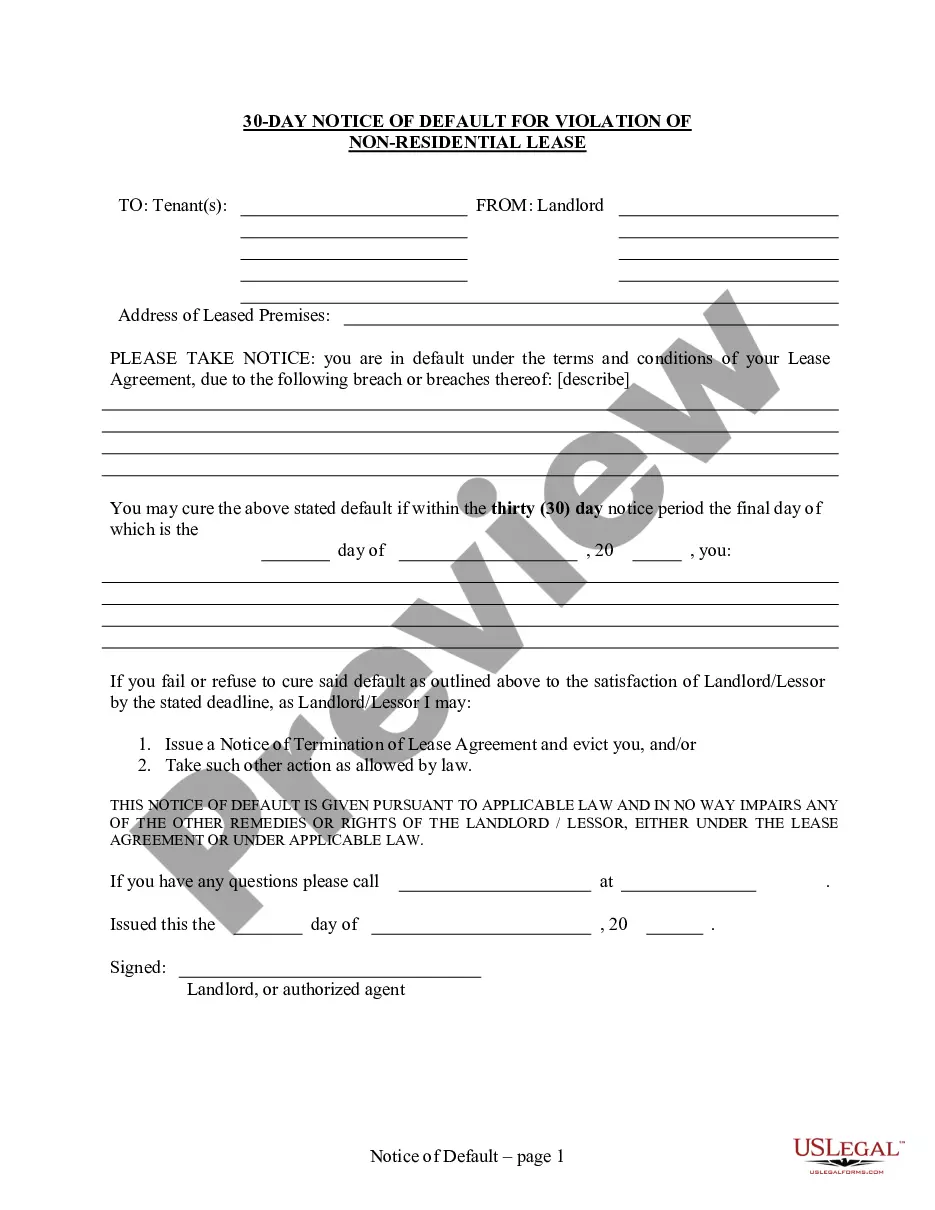

- Step 2. Utilize the Review feature to inspect the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other types of the legal form template.

Form popularity

FAQ

An amendment to a trust refers to a formal change made to the terms of the trust document. This process allows the trust creator to update or modify provisions without creating an entirely new trust. For example, the Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust enables the grantor to facilitate the removal of property from the trust. Ensuring that these amendments are properly documented is essential for maintaining the trust's integrity.

No, you cannot use a codicil to amend a trust. Codicils are specifically designed for making changes to wills, not trusts. To effectively amend a trust, you need to formally draft an amendment document, like the Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, that specifically addresses the trust's terms and any withdrawals. Using the correct legal instruments ensures clarity and compliance.

One disadvantage of a codicil is that it can create confusion if multiple codicils exist, as they may contradict one another. Additionally, a codicil must be executed with the same formalities as the original will, which may require additional legal attention. This could lead to complications when trying to execute changes to your estate plan, particularly regarding properties held in trust. Therefore, considering the Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust might be a more straightforward approach.

A codicil is not the same as an amendment. While both serve to change existing documents, a codicil specifically refers to modifications of a will. On the other hand, an amendment applies to trusts and can be used to make adjustments, such as the Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. Understanding these differences is crucial for proper legal documentation.

To write a trust amendment, you should start by clearly identifying the specific trust being amended, including its name and date. Next, outline the changes you wish to make, ensuring that it is clear and precise. Finally, sign the amendment in accordance with Rhode Island laws to ensure its validity. Consulting with a legal expert can also provide guidance on the Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust.

To amend your trust, start by drafting a new document that clearly outlines the changes you wish to make. Use a Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust to ensure that your amendment meets legal requirements. Once completed, sign the document in accordance with Rhode Island laws, and notify any trustees or beneficiaries of the changes.

Yes, you can amend your trust by yourself as long as you follow the correct legal procedures. It is essential to create a valid Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust to ensure that your changes are legally recognized. However, if you have questions or concerns, consulting a legal expert can provide clarity.

You can obtain a trust amendment form through various legal resources, including online platforms like US Legal Forms. These platforms provide access to reliable templates that comply with Rhode Island laws. By using a Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust form, you can simplify the amendment process and save time.

You cannot add a codicil to a trust, as a codicil is specific to wills. Instead, you will need to create an amendment to your trust. A Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust allows you to change specific terms of your trust effectively. By doing so, you can ensure your trust reflects your current wishes.

You can find a trust amendment form through various legal resources, but using an online platform like uslegalforms can simplify the process. They offer reliable templates specifically designed for a Rhode Island Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. This ensures that your form meets legal standards and saves you time.

More info

Inter vivos Crypto Wikipedia.