Rhode Island Receipt Template for Small Business: A Comprehensive Overview In today's digitized business landscape, it is crucial for small businesses in Rhode Island to maintain accurate and well-documented financial records. One essential document that aids in this process is the Rhode Island Receipt Template for Small Business. This template serves as a standardized form that allows businesses to create professional and legally compliant receipts for their customers or clients. The Rhode Island Receipt Template for Small Business includes various key components that contribute to its effectiveness. Firstly, it contains fields for the business name, address, and contact information, ensuring that the receipt is branded and reflects the small business's identity. This element helps build trust and credibility with customers. Moreover, the template facilitates the inclusion of crucial customer details, including their name, contact information, and payment method. This enables businesses to maintain accurate customer records and simplifies communication, especially in cases where refunds or returns are involved. Additionally, the Rhode Island Receipt Template for Small Business provides fields to enter the product or service details, quantity, unit price, and subtotal. This comprehensive breakdown ensures transparency and clarity for both the small business and the customer. Accurate information regarding the items purchased helps resolve any disputes, supports inventory management, and assists in analyzing sales trends. To meet the legal requirements specific to Rhode Island, the template also allows for the inclusion of the state's sales tax rate and calculates the tax amount automatically. This feature ensures compliance with state regulations and saves businesses time and effort in manual calculations. Different Types of Rhode Island Receipt Template for Small Business: 1. Basic Receipt Template: This template provides a simple and straightforward format for documenting transactions. It includes essential fields such as business information, customer details, payment information, and itemized information. 2. Detailed Receipt Template: This type of receipt template offers a more comprehensive breakdown of each item or service purchased. It allows businesses to provide a detailed description for each item, along with additional fields for discounts, shipping charges, or any other applicable fees. 3. Service Receipt Template: Tailored for service-oriented businesses, this template focuses on capturing details specific to services provided rather than physical products sold. It accommodates fields for service descriptions, hourly rates, duration, and any additional charges. 4. Rent Receipt Template: This template caters specifically to businesses involved in rental services. It highlights rental periods, property addresses, payment terms, and any extra charges incurred, ensuring all relevant details are documented. In conclusion, the Rhode Island Receipt Template for Small Business is a valuable tool that streamlines financial record-keeping processes. Offering different types of templates, businesses can choose the format that best suits their needs, whether they sell products or provide services. By utilizing these templates, businesses in Rhode Island can efficiently generate professional and compliant receipts, fostering trust and enhancing financial transparency with their customers.

Rhode Island Receipt Template for Small Business

Description

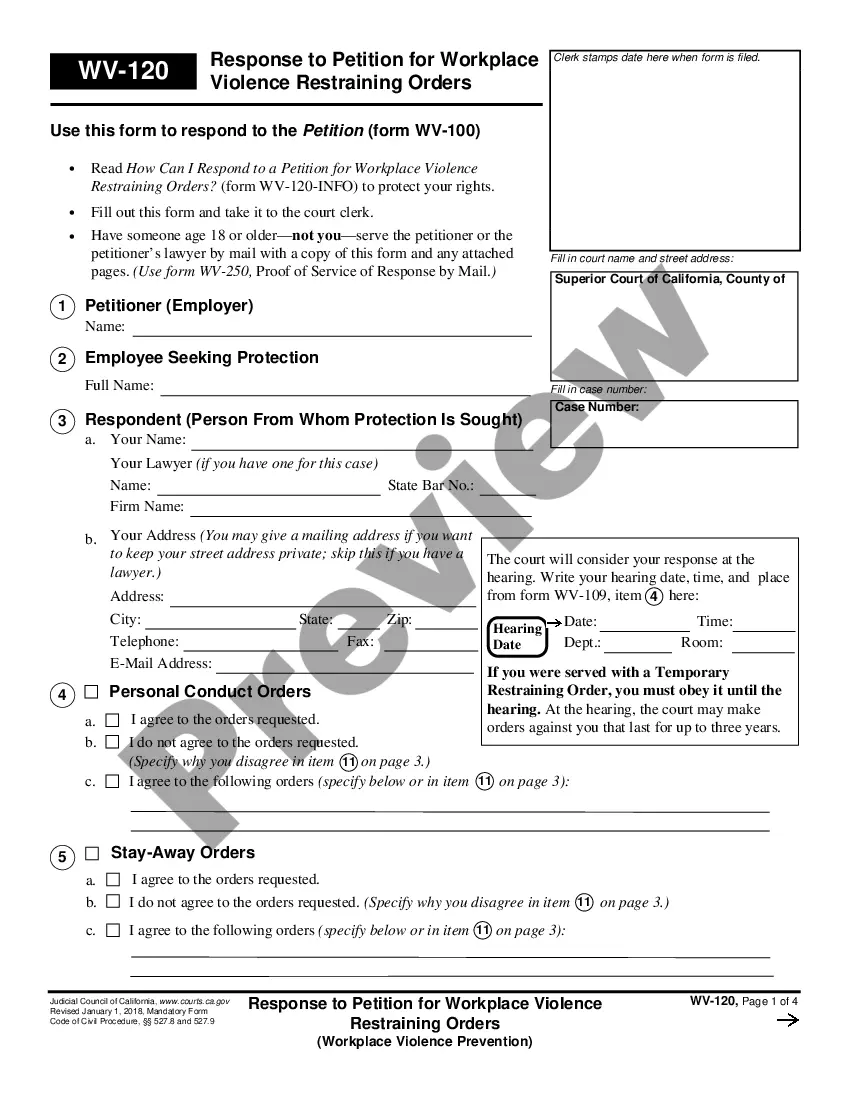

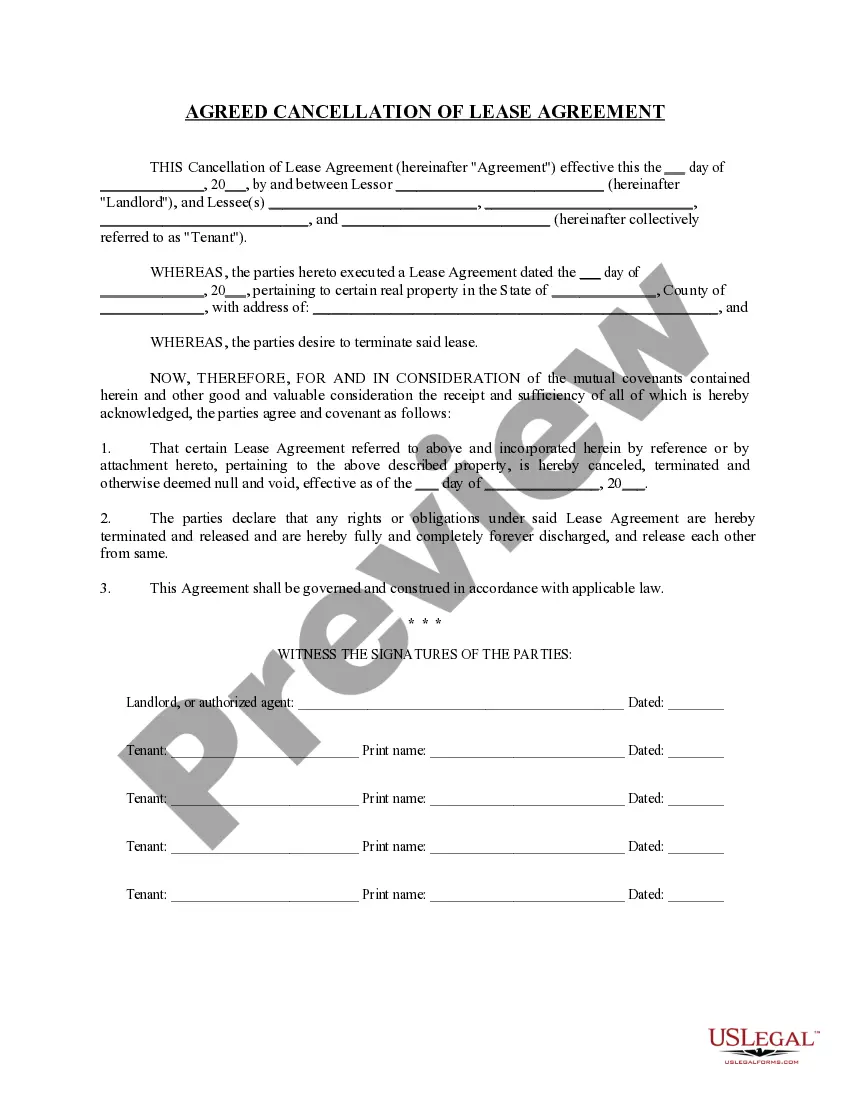

How to fill out Receipt Template For Small Business?

Are you presently in a scenario where you need documents for either business or personal activities nearly every workday.

There are numerous legitimate document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of document templates, such as the Rhode Island Receipt Template for Small Business, which are designed to comply with state and federal regulations.

Once you acquire the appropriate document, click on Acquire now.

Choose the pricing plan you prefer, complete the required information to create your account, and purchase the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can retrieve the Rhode Island Receipt Template for Small Business template.

- If you do not have an account and would like to use US Legal Forms, follow these steps.

- Obtain the document you need and make sure it is for the correct city/county.

- Use the Review button to examine the document.

- Check the description to ensure that you have selected the correct template.

- If the document is not what you seek, utilize the Research section to find the document that suits your needs.

Form popularity

FAQ

The best legal form for a small business often depends on your specific needs and goals. Common options include sole proprietorships, LLCs, and corporations. An LLC often provides both liability protection and administrative ease, making it a popular choice. Consider using a Rhode Island Receipt Template for Small Business to track relevant information and facilitate smart decision-making about your business structure.

To fill out Schedule C, start by reporting your business income at the top. Next, deduct your business expenses, which can include costs documented through a Rhode Island Receipt Template for Small Business. Proper documentation supports your claimed deductions, making a crucial part of your overall tax strategy. Take your time to ensure accuracy and completeness.

Typically, LLCs are pass-through entities, meaning you report business income on your personal tax return using Schedule C. However, if you choose to be taxed as a corporation, the process differs. Using a Rhode Island Receipt Template for Small Business can help you differentiate between personal and business expenses effectively. Organized records simplify filing and ensure accuracy.

Certain items are exempt from Rhode Island sales tax, including most groceries, prescription drugs, and specific services. Understanding these exemptions can significantly benefit your small business, as it can reduce overall costs. Using a Rhode Island Receipt Template for Small Business allows you to document exempt transactions effectively. This practice supports compliance while managing your expenses.

Yes, if your small business generates income, you need to file a Rhode Island tax return. This filing is crucial for fulfilling your tax obligations and avoiding penalties. Leveraging a Rhode Island Receipt Template for Small Business helps you keep documentation organized, making your tax preparation smoother. It's about preparing proactively for your financial responsibilities.

For a small business, the primary form to fill out is the IRS Form 1040 with Schedule C attached. This allows you to report income or loss from your business. Utilizing a Rhode Island Receipt Template for Small Business can streamline the data collection needed for this form, simplifying your reporting process. Keeping organized records supports your financial health.

The minimum LLC tax in Rhode Island is $400. This amount is due each year, and it is critical for maintaining good standing in the state. By using a Rhode Island Receipt Template for Small Business, you can keep track of these expenses, ensuring timely payments. Remember, regular compliance helps you focus on growing your business.

You can add receipts for all ordinary and necessary business expenses to your taxes. This includes operational costs, equipment purchases, and travel expenses related to your business. By using a Rhode Island Receipt Template for Small Business, you can efficiently collect and categorize these receipts for tax purposes.

You should keep receipts that verify expenses related to your business operations, such as utility bills, office supplies, and payroll receipts. These documents are crucial for accurate tax filings and can help in claiming necessary deductions. Utilizing a Rhode Island Receipt Template for Small Business makes organizing these receipts easier.

In Rhode Island, the minimum tax return for an LLC is typically based on the income generated from the business. However, even if you earn little, filing a return is a good practice. Keeping updated records with a Rhode Island Receipt Template for Small Business ensures you have the necessary documentation when you file.

Interesting Questions

More info

Free Receipt Templates Download Now.