Rhode Island Owner Financing Contract for Car

Description

How to fill out Owner Financing Contract For Car?

Are you in a situation where you require documents for both business and personal purposes virtually every day? There are many legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, including the Rhode Island Owner Financing Contract for Car, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can download the Rhode Island Owner Financing Contract for Car template.

You can review all the document templates you have purchased in the My documents section. You can obtain another copy of the Rhode Island Owner Financing Contract for Car at any time if needed. Simply access the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and reduce errors. The service provides properly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Obtain the desired form and ensure it is for the correct municipality/county.

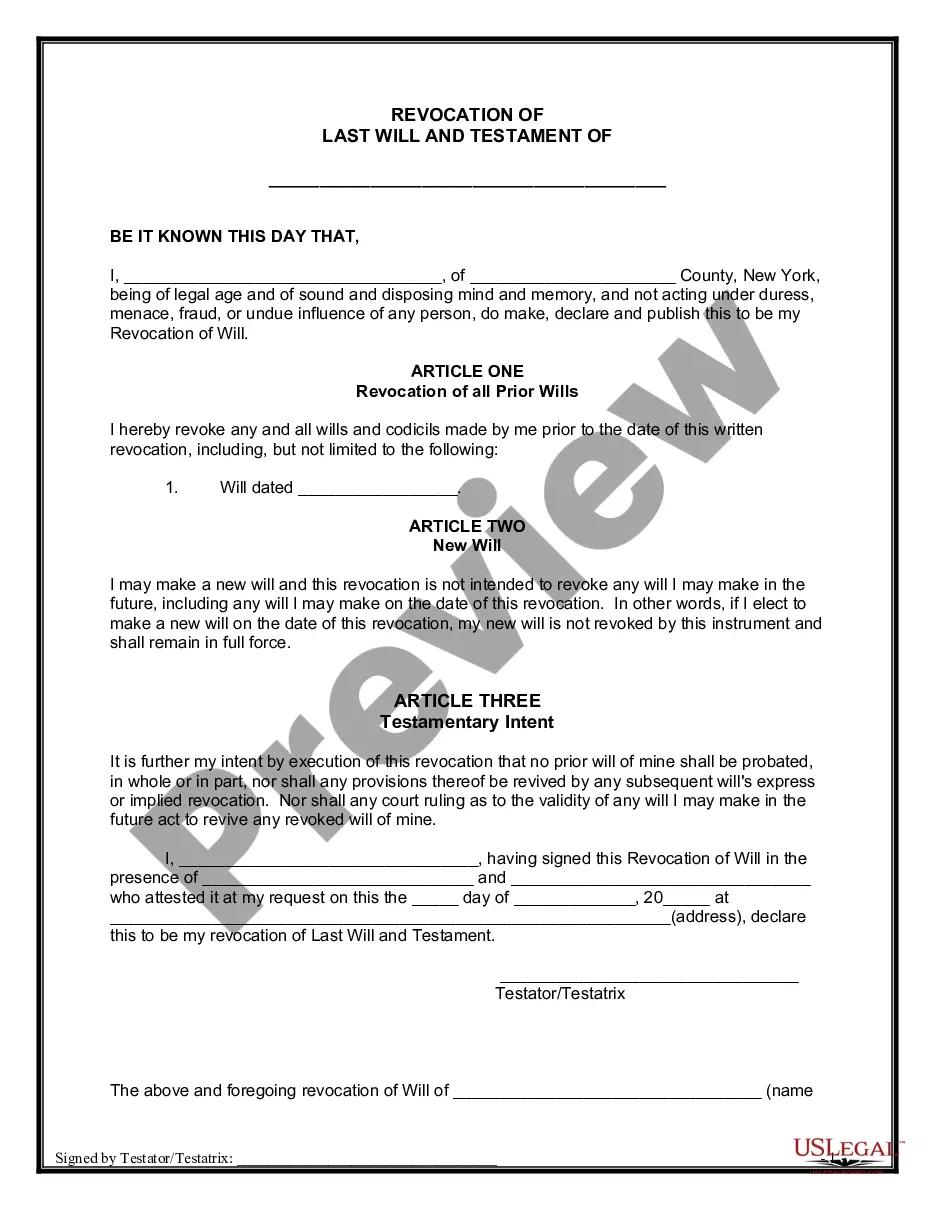

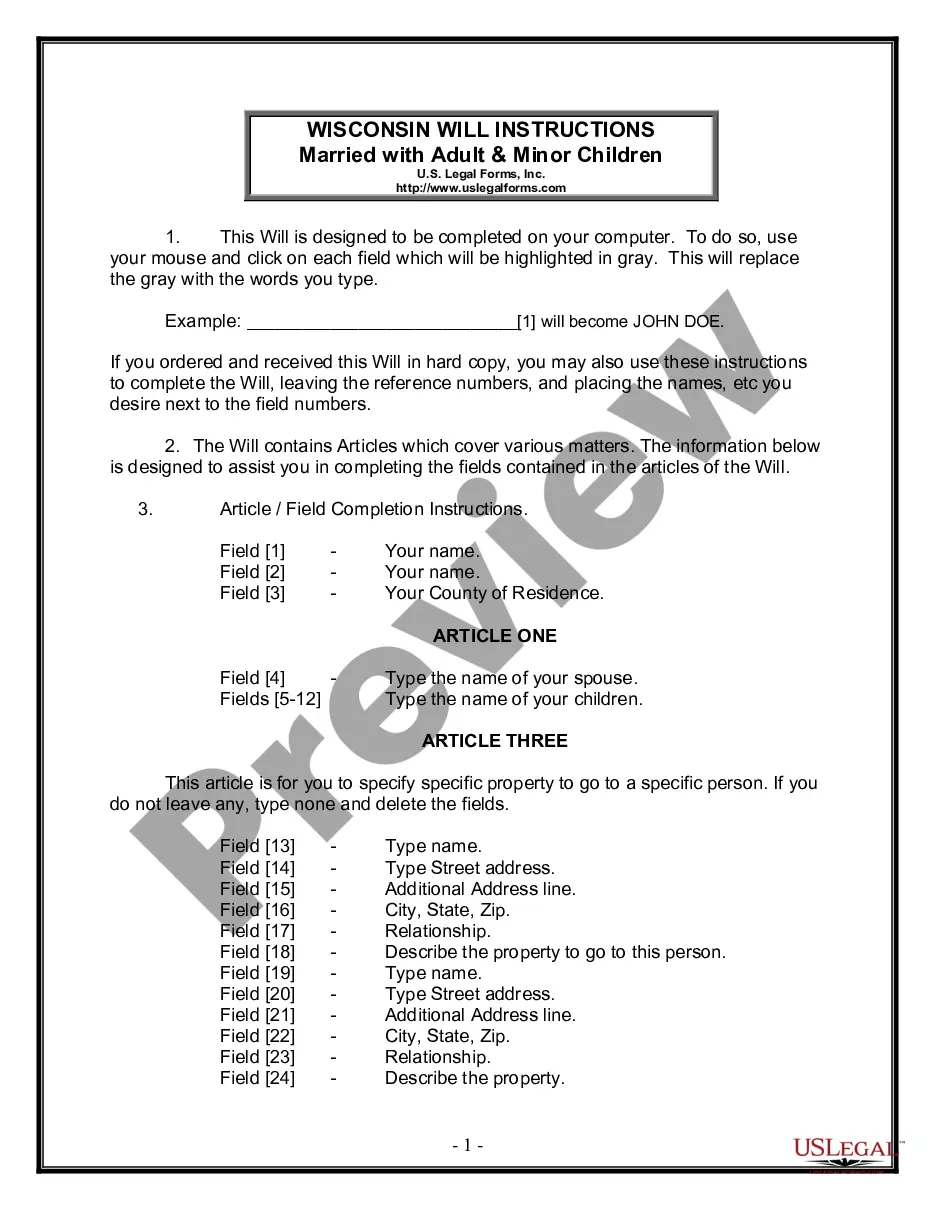

- Utilize the Review button to check the form.

- Examine the description to confirm you have selected the proper form.

- If the form does not meet your needs, use the Search field to locate a form that suits your requirements.

- Once you find the appropriate form, click Purchase now.

- Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for your purchase using PayPal or a credit card.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

An example of owner financing is when a seller allows the buyer to make monthly payments directly to them instead of a bank. This arrangement can include an agreed-upon interest rate and payment schedule, making it beneficial for both parties. If you're considering this method, a Rhode Island Owner Financing Contract for Car can help create a structured agreement that protects everyone's interests.

When transferring a title in Texas, both parties are not always required to be present. The seller can complete the title transfer by signing the title and providing it to the buyer. It's crucial to ensure all the necessary documents are properly filled out and submitted. Consider utilizing a Rhode Island Owner Financing Contract for Car to ensure a smooth transaction.

Owner financing can be a good idea for both buyers and sellers depending on their unique circumstances. Buyers may benefit from more flexible payment options and reduced reliance on banks, while sellers can receive regular payments and potentially earn interest. By using a Rhode Island Owner Financing Contract for Car, individuals can create a tailored agreement that meets their needs.

To transfer ownership of a car in Rhode Island, both the seller and buyer must complete the required forms and sign the title. The seller also needs to provide a bill of sale and any additional documentation requested by the Rhode Island Division of Motor Vehicles (DMV). Following these steps ensures a smooth transition, especially when using a Rhode Island Owner Financing Contract for Car.

In an owner financing agreement for a car, the seller retains the title until the buyer fulfills all payment obligations specified in the contract. Once the buyer pays off the total amount, the seller must transfer the title to the buyer, officially completing the sale. Understanding this aspect is crucial when drafting a Rhode Island Owner Financing Contract for Car.

An owner financing contract for a car is an agreement between the seller and buyer that allows the buyer to make payments directly to the seller instead of a bank or lender. This type of contract outlines the terms of the sale, including payment schedule, interest rate, and any conditions for default. In Rhode Island, this contract can provide a straightforward path to vehicle ownership without the need for traditional financing.

Typical terms for owner financing in Rhode Island vary but generally include a down payment, monthly payments, and an interest rate that both parties agree upon. Contracts often specify the total length of the financing period and any penalties for late payments. A well-drafted Rhode Island Owner Financing Contract for Car clearly outlines these terms, making it essential for protecting the interests of both the buyer and seller.

To transfer ownership of a car in Rhode Island, you need to complete the necessary paperwork, including the title transfer supported by a Rhode Island Owner Financing Contract for Car if applicable. Both the seller and buyer must sign the title, and the buyer should apply for a new registration with the Rhode Island Department of Motor Vehicles. It's crucial to ensure all documentation is processed properly to avoid issues in the future.

In Rhode Island, the buyer and seller jointly arrange the owner financing. Typically, the seller provides the financing directly to the buyer, creating an agreement that is documented in a Rhode Island Owner Financing Contract for Car. It is advisable to involve legal professionals to ensure all terms comply with state laws and protect both parties' interests.

In owner financing, the seller typically holds the title of the car until the buyer fulfills the payment terms as outlined in the contract. Once the payments are completed, the title transfers to the buyer, symbolizing full ownership. A Rhode Island Owner Financing Contract for Car will clearly define this process, ensuring that both parties understand their rights and responsibilities.