Rhode Island Revocable Trust for Real Estate

Description

How to fill out Revocable Trust For Real Estate?

If you need to obtain, download, or print legal document templates, utilize US Legal Forms, the most significant collection of legal forms available online.

Take advantage of the site’s straightforward and efficient search feature to locate the documents you require.

Various templates for business and personal purposes are categorized by types and jurisdictions, or by keywords.

Every legal document template you obtain is yours permanently. You will have access to every form you have acquired in your account. Select the My documents section and choose a form to print or download again.

Complete and download, and print the Rhode Island Revocable Trust for Real Estate with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the Rhode Island Revocable Trust for Real Estate with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to obtain the Rhode Island Revocable Trust for Real Estate.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

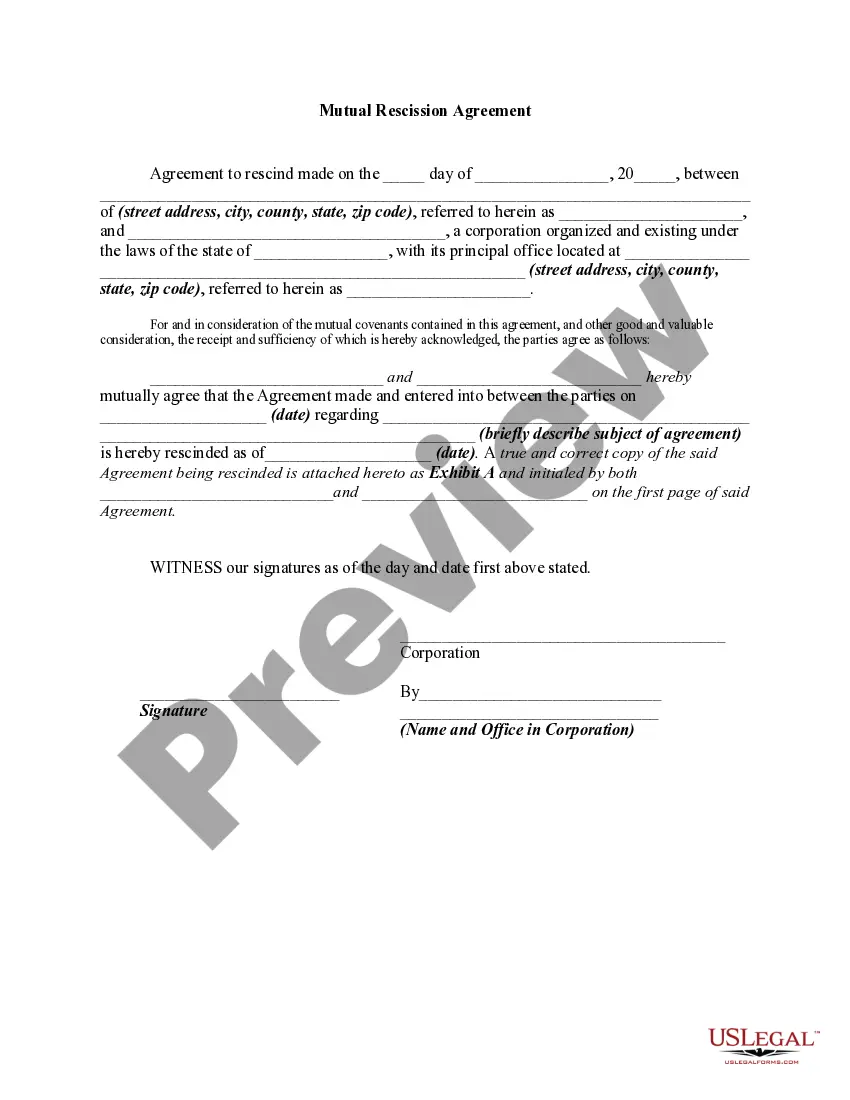

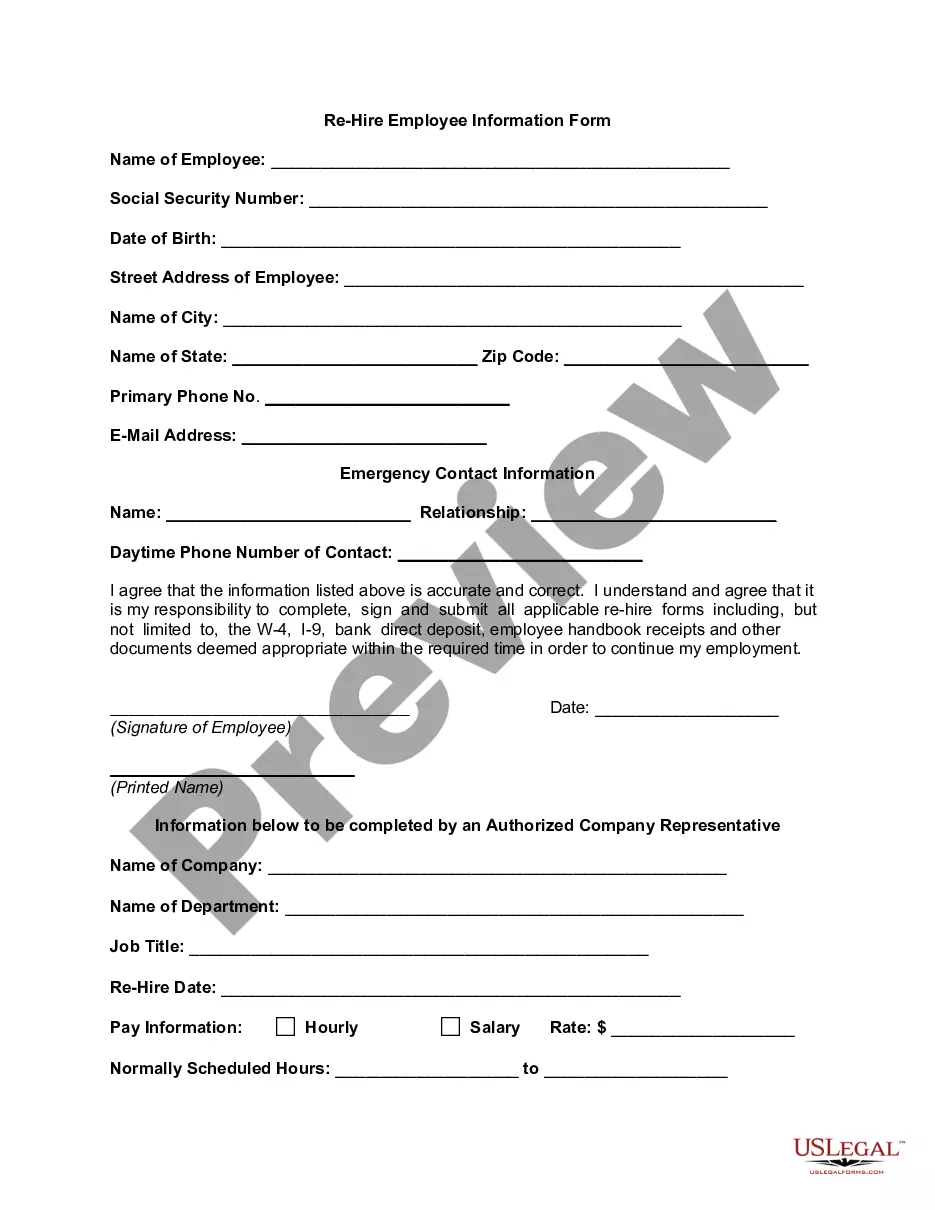

- Step 2. Use the Review feature to examine the form’s details. Always remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to look for other versions of the legal form type.

- Step 4. Once you have found the form you need, click the Buy now button. Select your preferred pricing plan and enter your credentials to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, print, or sign the Rhode Island Revocable Trust for Real Estate.

Form popularity

FAQ

The greatest advantage of a Rhode Island Revocable Trust for Real Estate is the flexibility it offers. You can modify or revoke the trust at any point during your lifetime, allowing you to adapt to changing circumstances. Furthermore, this type of trust enables a smooth transfer of assets upon your passing, avoiding lengthy probate, and providing peace of mind to you and your loved ones.

One of the most significant mistakes parents make when setting up a trust fund, including a Rhode Island Revocable Trust for Real Estate, is failing to fund the trust properly. It's essential to ensure that all assets intended for the trust are transferred into it; otherwise, those assets may become part of the probate process. Additionally, not communicating the process and purpose to beneficiaries can lead to misunderstandings.

Yes, a Rhode Island Revocable Trust for Real Estate becomes irrevocable upon your death. At that point, the trust is no longer under your control and cannot be changed. This transition ensures that your assets are distributed according to your wishes, as outlined in the trust document.

One downside of a Rhode Island Revocable Trust for Real Estate is that it does not protect your assets from creditors or legal claims while you are alive. Additionally, managing a trust can involve ongoing administrative tasks, such as maintaining records and funding the trust adequately. While these factors may seem minor, they can evolve into larger issues if not handled properly.

When it comes to a Rhode Island Revocable Trust for Real Estate, you generally report income on your personal tax return. The Internal Revenue Service treats revocable trusts as disregarded entities during your lifetime. This means that any income generated from the trust assets, such as rental income, will be reported on your individual tax return, simplifying the filing process.

A Rhode Island Revocable Trust for Real Estate provides a solid foundation for your assets. It allows you to maintain control while offering a layer of protection from probate. However, it's important to note that since you can modify or dissolve the trust, it does not fully shield assets from creditors. Therefore, assessing your overall financial situation is crucial.

Assets such as your primary residence may not require placement in a Rhode Island Revocable Trust for Real Estate, but real estate that you rent could be beneficial to include. Additionally, you may want to keep certain business interests out of the trust, as the management might be complex. Consulting with an estate planning expert can clarify which assets should remain outside of your trust.

To set up a Rhode Island Revocable Trust for Real Estate, begin by drafting a trust document that outlines your wishes. You can create this document with the help of legal professionals, or utilize platforms like US Legal Forms, which provide templates and guidance. Once your document is ready, you need to fund the trust by transferring assets into it, ensuring it is properly established.

It is advisable not to place life insurance policies or certain retirement accounts in your Rhode Island Revocable Trust for Real Estate. These assets often have designated beneficiaries, which should be maintained for direct transfer. Moreover, personal items of sentimental value may not need to be included since they can be distributed without formal legal processes.

Typically, you should avoid placing certain bank accounts, like health savings accounts or retirement accounts, in your Rhode Island Revocable Trust for Real Estate. These types of accounts have specific beneficiary designations that can be more advantageous outside of a trust. Keeping them separate can also simplify your financial management while you are alive.