Rhode Island General Form of Revocable Trust Agreement

Description

How to fill out General Form Of Revocable Trust Agreement?

If you require comprehensive, acquire, or producing authentic document templates, utilize US Legal Forms, the foremost collection of authentic forms available on the web.

Employ the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of the legal document and download it onto your device. Step 7. Complete, modify, and print or sign the Rhode Island Revocable Trust for Married Couple.

- Use US Legal Forms to quickly locate the Rhode Island Revocable Trust for Married Couple in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Rhode Island Revocable Trust for Married Couple.

- You can also find forms you have previously purchased in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

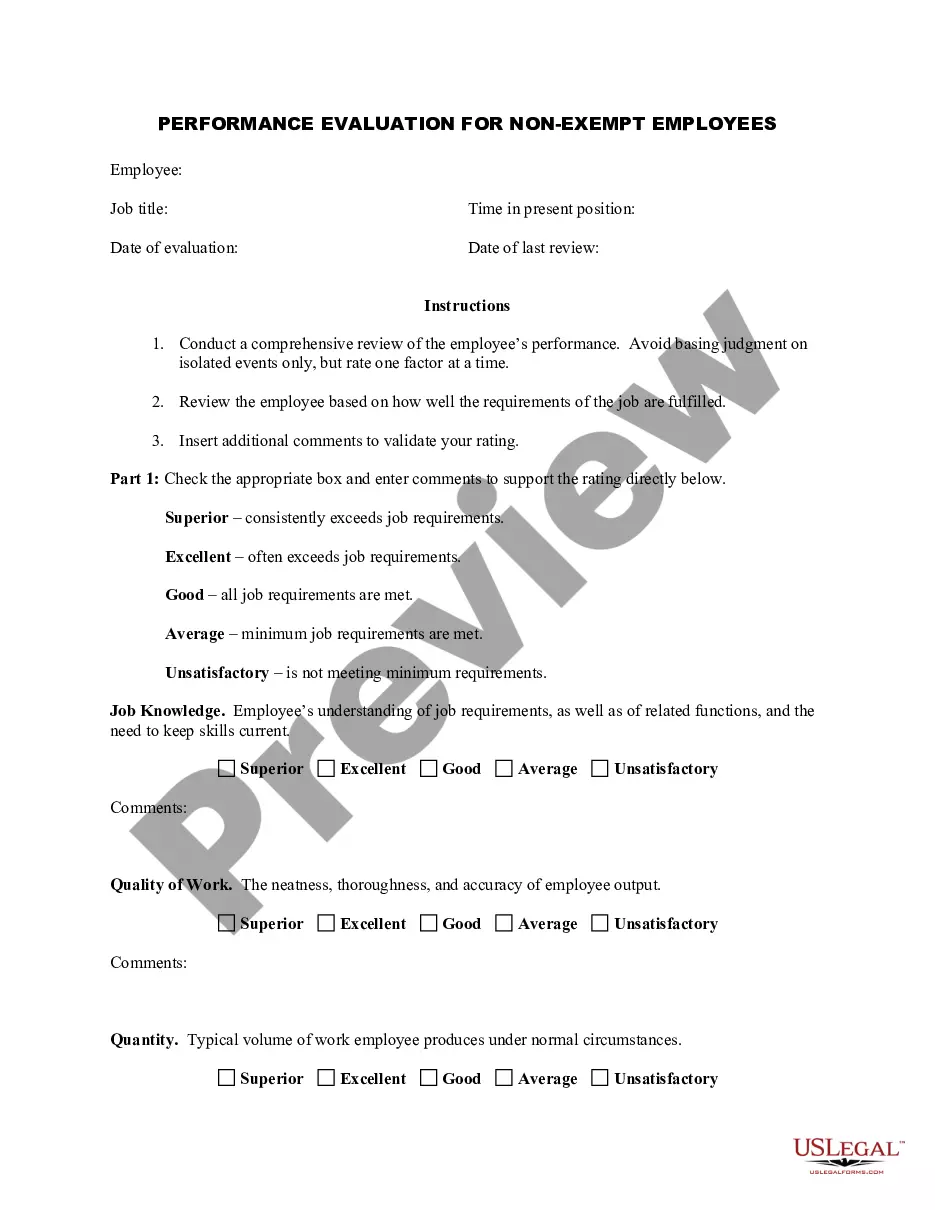

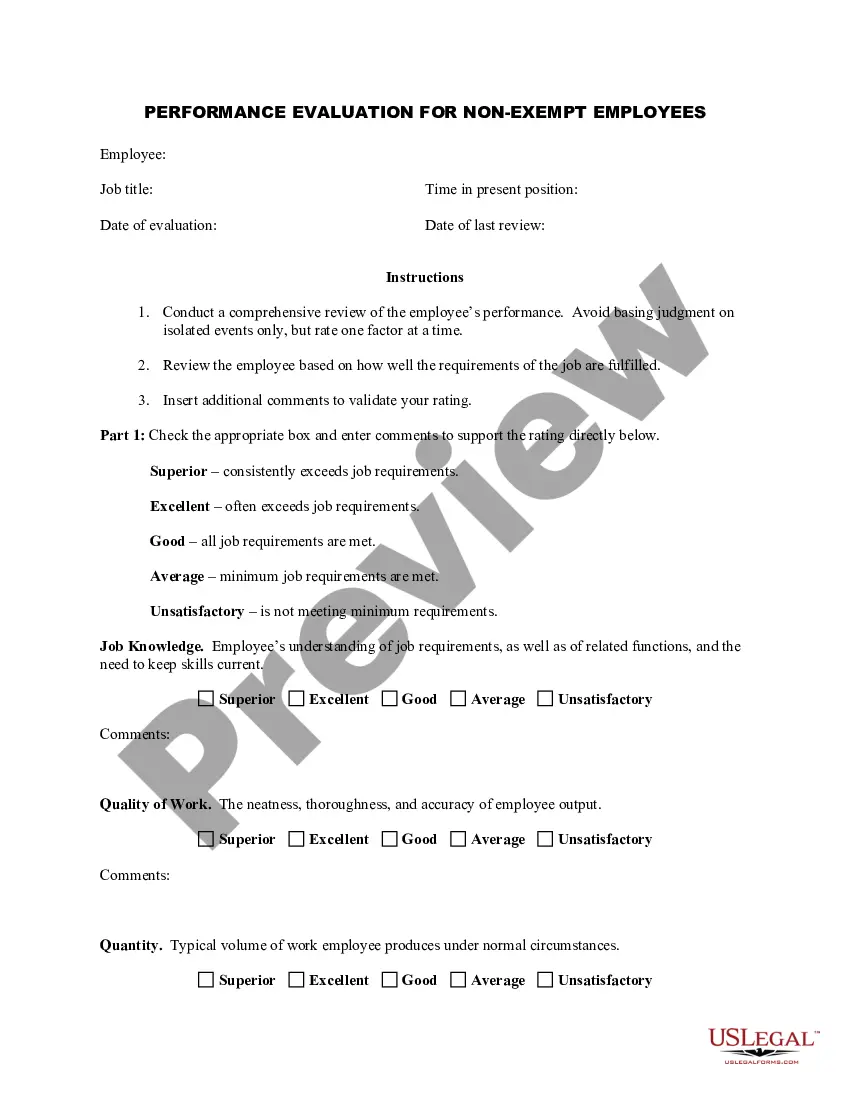

- Step 2. Utilize the Preview option to review the contents of the form. Don't forget to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative templates of the legal form design.

- Step 4. Once you've found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your information to create an account.

Form popularity

FAQ

The three primary types of trust are revocable trusts, irrevocable trusts, and testamentary trusts. A Rhode Island Revocable Trust for Married Couple falls under the revocable category, allowing for changes as your situation evolves. Irrevocable trusts typically offer more tax advantages but cannot be modified once established. Testamentary trusts are created through a will and take effect after the individual's death.

Setting up a Rhode Island Revocable Trust for Married Couple involves several steps. First, you need to gather your financial information and decide on the assets you want to include in the trust. Next, you will draft the trust document, specifying the terms and designating beneficiaries. Finally, you should fund the trust by transferring ownership of the selected assets into it, ensuring it is effective in managing your estate.

When one spouse passes away, a joint revocable trust typically continues to operate as an individual trust for the surviving spouse. The terms set forth in the Rhode Island Revocable Trust for Married Couple will dictate how assets are managed and distributed after the death. It’s important for both spouses to understand how the trust works and to keep it updated with changing circumstances.

In Rhode Island, a trust document does not require notarization, but it is strongly recommended to enhance its validity. Although your Rhode Island Revocable Trust for Married Couple can be established without a notary, having the document notarized can add an extra layer of credibility. It's always beneficial to follow best practices in estate planning, and consulting an expert can provide additional insights.

One of the biggest mistakes parents make when setting up a trust fund is not properly funding the trust. Failing to transfer assets into a Rhode Island Revocable Trust for Married Couple can render the trust ineffective and lead to unforeseen complications. It is essential to identify all assets and retitle them under the trust’s name to ensure it operates as intended.

To set up a trust in Rhode Island, start by choosing the type of trust that fits your needs, such as a Rhode Island Revocable Trust for Married Couple. Then, you will need to draft a trust document outlining the terms and appoint a trustee. Consulting with an estate planning attorney can streamline the process, or you can use resources like uslegalforms to access customizable templates.

The easiest way to set up a trust is to work with a knowledgeable attorney who specializes in estate planning. They can guide you through the process of creating a Rhode Island Revocable Trust for Married Couple, ensuring that your wishes and needs are met. Additionally, using online platforms like uslegalforms can simplify the paperwork involved and help you avoid common pitfalls.

Remarried couples often benefit from a Rhode Island Revocable Trust for Married Couple, which can be customized to respect the needs of each partner and their previous families. This trust helps manage shared assets while ensuring that the interests of children from previous marriages are protected. It allows for flexibility in administering family arrangements, making it a thoughtful choice for blended families.

While a joint trust can offer benefits, it also has disadvantages to consider. One potential drawback of a Rhode Island Revocable Trust for Married Couple is the lack of individual control, as both partners must agree on decisions. Additionally, if one spouse passes away, the remaining spouse may face complexities in managing the trust. It's crucial to weigh these factors when deciding on a joint trust.

The best type of trust for a married couple is often a Rhode Island Revocable Trust for Married Couple. This trust allows spouses to manage their assets together while retaining the ability to modify or revoke the trust as their needs change. By using this type of trust, couples can ensure a smooth transfer of assets upon their passing and provide for each other’s financial security.