Rhode Island Option to Purchase - Residential

Description

How to fill out Option To Purchase - Residential?

Have you found yourself in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Rhode Island Option to Purchase - Residential, that are designed to comply with state and federal regulations.

You can obtain an additional copy of Rhode Island Option to Purchase - Residential at any time if necessary. Just select the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Rhode Island Option to Purchase - Residential template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

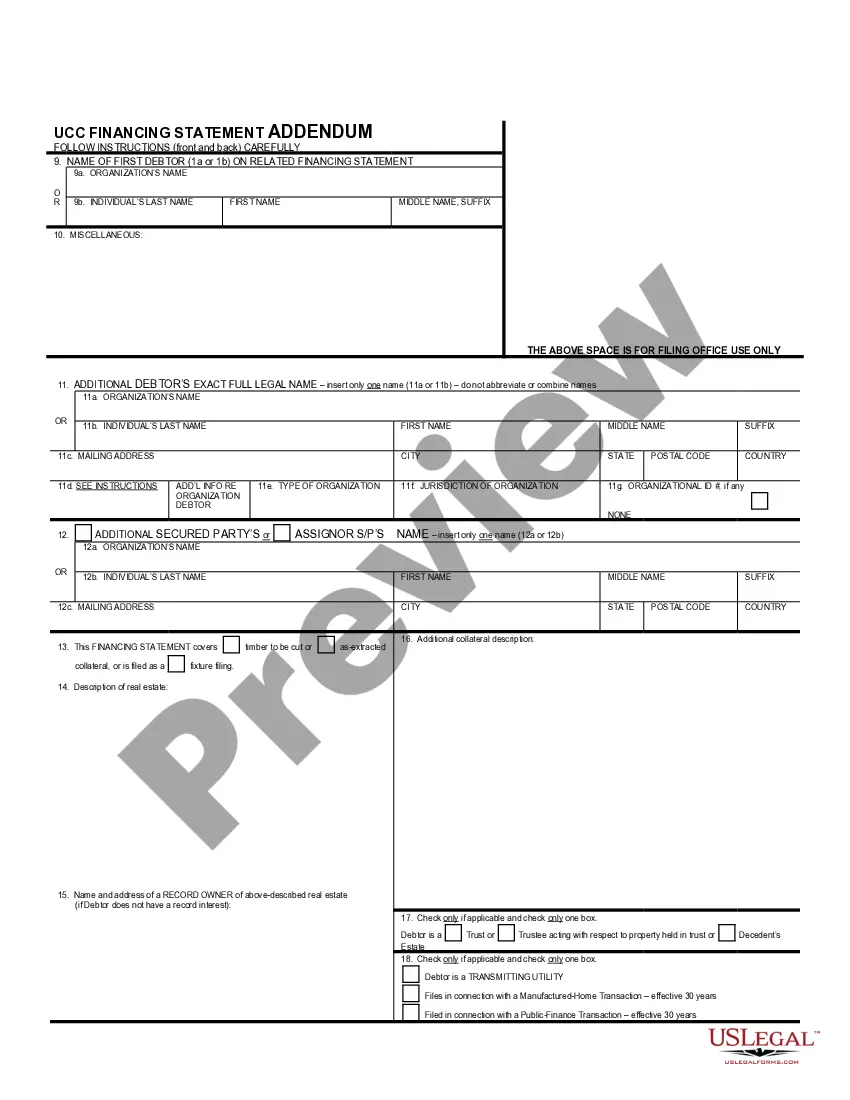

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs and specifications.

- Once you locate the correct form, click Get now.

- Choose the pricing plan you prefer, enter the required information for your payment, and complete the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section.

Form popularity

FAQ

There is no rent control in Rhode Island, so a landlord is free to set the rent at whatever s/he decides. You and the landlord can agree on the date that rent will be paid. If your rent is more than 15 days late, you can be evicted for non-payment and the landlord can use a quick court proceeding.

Rhode Island is a partially landlord-friendly state. There are no rent control policies and landlords are not limited in the kinds of fees they charge. However, tenants normally require a substantial amount of notice before eviction.

Requirements for buying a home include:A good credit record. As far as your bank is concerned, your credit score is a big number above your head that tells them how much of a risk you are.A deposit.Prequalification certificate (optional)A home loan.Money set aside for 'hidden costs'Estate agent (optional)

What are the steps to buying a house in Rhode Island?Save for down payment.Get pre-approved for a mortgage.Choose your preferred Rhode Island.Partner with the right real estate agent in Rhode Island.Go house hunting.Make a strong offer.Pass inspections and appraisal.Do a final walkthrough and close.

Landlord Friendly-States ClassificationGeorgia.Arizona.Texas.West Virginia.Florida.North Carolina.Kentucky.Louisiana. The large rental market of this state gives plenty of options for landlords trying to find good tenants that pay their rent on time and take care of the properties you provide for them.More items...

Pursuant to RI law, the real estate buyer has the right to choose the lawyers to search title to the RI real estate. A purchaser of real estate in Rhode Island should always insist on an experience property lawyer instead of a title company to perform a title search.

REASONS YOUR LANDLORD MAY USE TO ASK YOU TO MOVE Under Rhode Island law, if you do not have a lease, a landlord does not need to have any reason in order to ask you to move from your apartment. Even if you have never been late with your rent and are the best tenant in the state, your landlord can still ask you to move.

To that end, some of the most landlord-friendly states in 2021 are as follows:Alabama.Arizona.Florida.Illinois.Pennsylvania.Ohio.Georgia.Kentucky.More items...

Generally speaking, your credit score should be 620 or higher to qualify to buy a house in Rhode Island, especially if you plan to take out a conventional mortgage loan. If your credit score is below 620, consider these options.