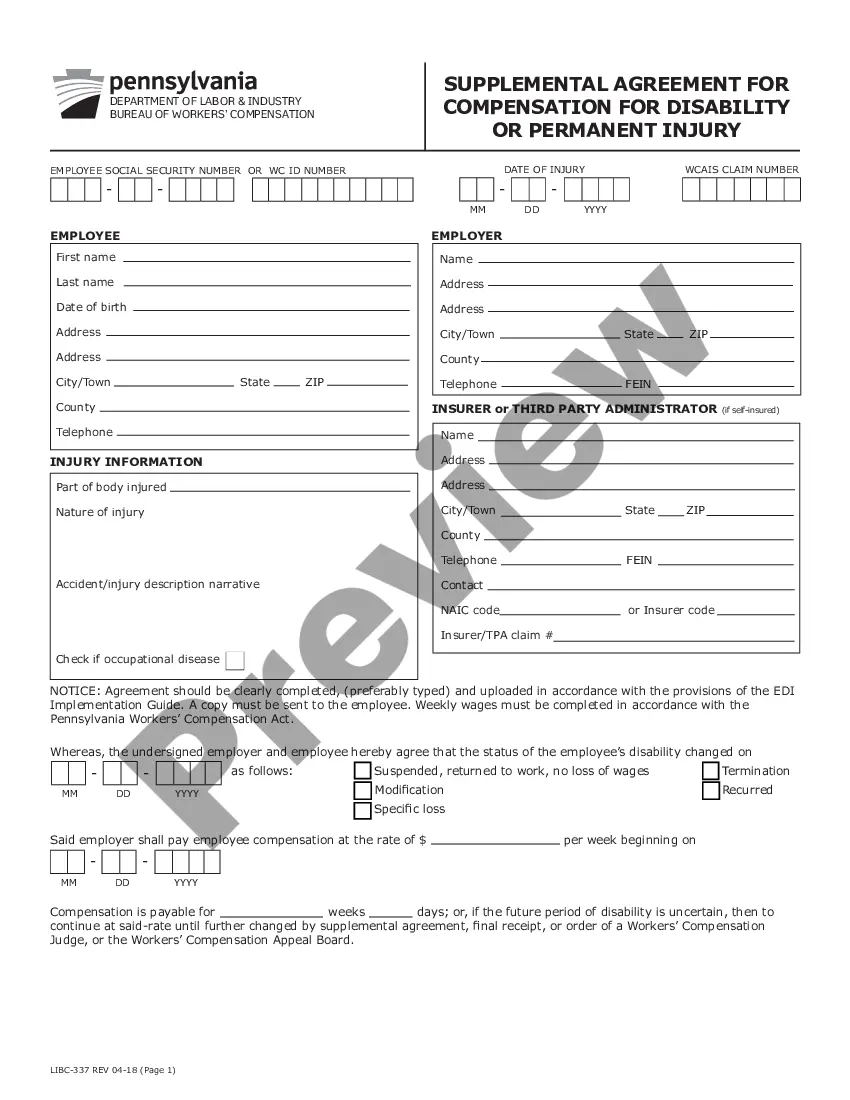

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Rhode Island Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness is a legal document used to transfer any expected interest in an estate to a creditor in order to satisfy a debt. This assignment is typically utilized when an individual owes money to a creditor and does not have sufficient liquid assets to repay the debt. The Rhode Island Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness is an important tool for both creditors and debtors. Creditors can ensure that they have a means of collecting the debt owed to them, while debtors can use this assignment to satisfy their obligations and avoid further legal consequences. There are different types of Rhode Island Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, each tailored to specific circumstances: 1. Voluntary Assignment: This type of assignment is initiated by the debtor willingly transferring their expected interest in the estate to the creditor to satisfy the indebtedness. It is a proactive measure taken by a debtor to settle their debts. 2. Involuntary Assignment: In some cases, when a debtor fails to repay their debt, a creditor may seek legal action to obtain an involuntary assignment. This type of assignment is ordered by the court and compels the debtor to transfer their expected interest in the estate to the creditor. 3. Partial Assignment: This assignment allows debtors to transfer only a portion of their expected interest in the estate to the creditor. It can be negotiated between the debtor and the creditor and is a popular option when the debtor possesses multiple assets or interests in different estates. 4. Full Assignment: When debtors transfer their entire expected interest in the estate to the creditor, it is known as a full assignment. This type of assignment leaves the debtor with no further claim or interest in the estate, ensuring that the creditor receives full satisfaction of the debt. It is crucial to consult with an attorney or legal professional to draft and execute a Rhode Island Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness accurately. This ensures compliance with Rhode Island state laws and safeguards the rights and interests of both parties involved in the assignment.