Rhode Island Sale of Partnership to Corporation refers to the process of transforming a partnership business structure into a corporation in the state of Rhode Island. This conversion allows the partnership to transfer its assets, liabilities, and operations to a newly formed corporation. It is essential to understand the intricacies of this procedure to ensure a smooth transition. Below, we will discuss the steps involved in the Rhode Island Sale of Partnership to Corporation, along with its different types and relevant keywords. 1. Overview of Rhode Island Sale of Partnership to Corporation: The Rhode Island Sale of Partnership to Corporation enables a partnership to convert into a corporation, offering various benefits such as increased liability protection, flexibility in ownership structure, and potential tax advantages. This process requires following legal guidelines and completing required documentation. 2. Steps involved in the Rhode Island Sale of Partnership to Corporation: The conversion involves certain key steps, including: a. Drafting a Conversion Plan: The partnership must prepare a conversion plan outlining the terms and conditions of the conversion. b. Obtaining Partnership Approval: The partnership's partners must approve the conversion plan and sign the necessary documents. c. Filing Conversion Documents: The partnership must file the conversion documents, including a Certificate of Conversion, with the Rhode Island Secretary of State, along with the required fees. d. Drafting Articles of Incorporation: Along with the Certificate of Conversion, the partnership must draft Articles of Incorporation for the new corporation. e. Filing Articles of Incorporation: The Articles of Incorporation, along with the required fees, must be filed with the Rhode Island Secretary of State. f. Post-conversion Tasks: After the conversion, tasks like obtaining new federal and state tax identification numbers, updating licenses and permits, and transferring assets and contracts to the new corporation need to be completed. 3. Types of Rhode Island Sale of Partnership to Corporation: a. Statutory Conversion: This process involves the conversion based on the guidelines and procedures laid out in the Rhode Island General Laws, specifically Title 7, Chapter 16 — "Conversion of Domestic Entity." b. Non-Statutory Conversion: In cases where the specific statutory requirements are not met, the partnership may opt for a non-statutory conversion. This type of conversion usually requires the drafting of a customized conversion plan and the approval of the partners. 4. Relevant Keywords: — Partnership conversion to corporation Rhode Island — Rhode Island Sale of Partnership to Corporation process — Conversion plan for partnership to corporation — Rhode Island Certificate of Conversion — Articles of Incorporation Rhode Island — Rhode Island Secretary of Stat— - Rhode Island partnership conversion legal requirements — Benefits of converting partnership to corporation in Rhode Island — Rhode Island General Laws Title 7 Chapter 16 — Non-statutory conversion partnership to corporation in Rhode Island Remember, it is crucial to consult with legal and tax professionals before proceeding with the Rhode Island Sale of Partnership to Corporation to ensure compliance with all regulations and maximize the potential benefits.

Rhode Island Sale of Partnership to Corporation

Description

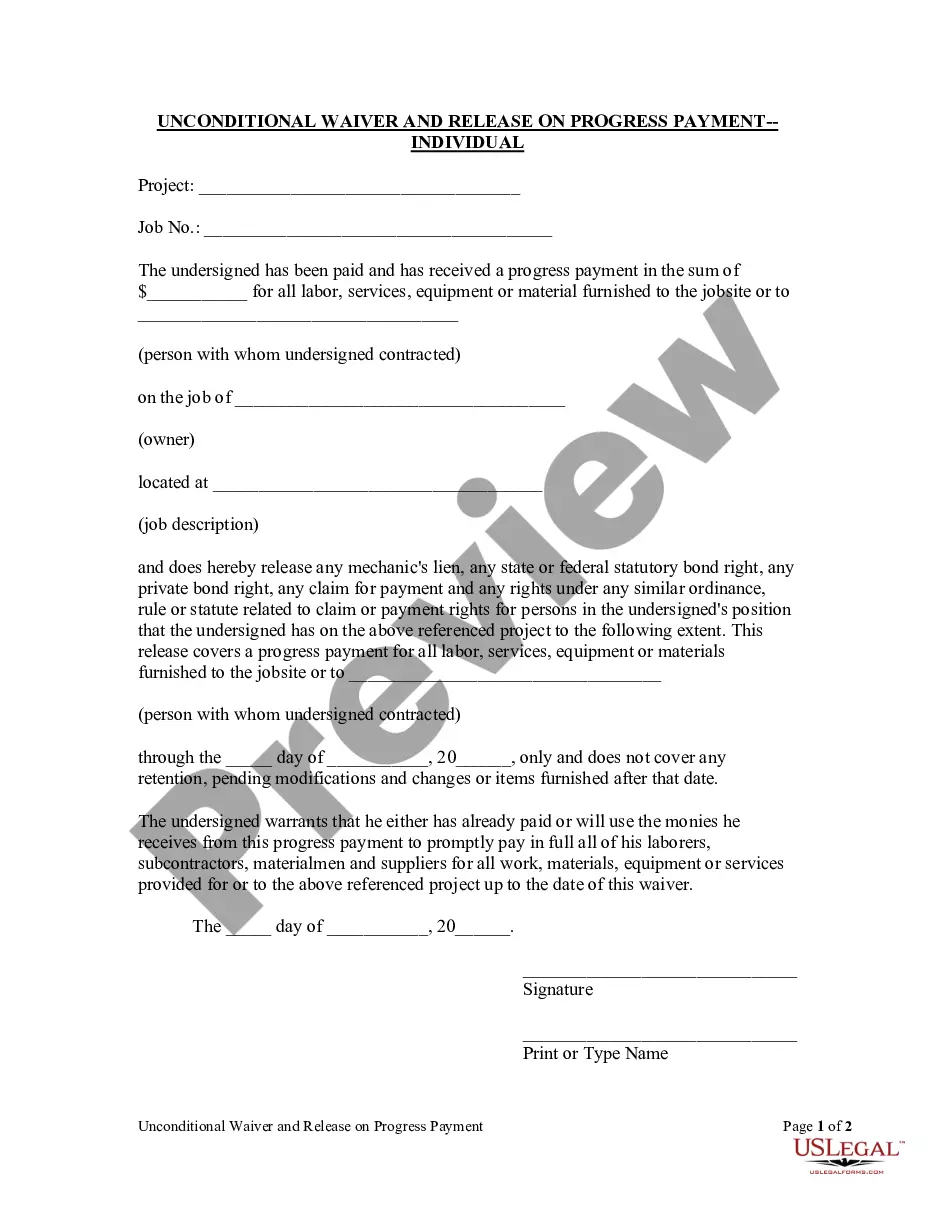

How to fill out Rhode Island Sale Of Partnership To Corporation?

You are capable of dedicating time online searching for the legal document template that meets the state and federal requirements you seek.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can effortlessly download or print the Rhode Island Sale of Partnership to Corporation from our services.

If available, make use of the Review button to preview the document template as well. If you wish to find another version of the form, use the Search section to locate the template that suits you and your needs.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, alter, print, or sign the Rhode Island Sale of Partnership to Corporation.

- Every legal document template you obtain is yours indefinitely.

- To acquire another version of the purchased form, visit the My documents section and click the relevant button.

- When you use the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/area of your choice.

- Review the form details to ensure you have chosen the right one.

Form popularity

FAQ

The taxation of the sale of a partnership typically depends on whether you have a gain or loss to report. Profits from the sale may be taxed as capital gains, subject to varying rates. Additionally, if your partnership income was classified as ordinary income, it may be taxed differently. To simplify this process during your Rhode Island Sale of Partnership to Corporation, consider using US Legal Forms for resources that can guide you through the tax implications.

Reporting a limited partnership sale involves completing the appropriate tax forms, such as Schedule D and Form 8949 for federal reporting. In Rhode Island, you must also include details on your state tax return, reflecting any gains or losses incurred. Accurately documenting your transaction ensures compliance with tax regulations. If you find reporting complicated, consider using US Legal Forms for easy access to the necessary forms and guidance.

Indeed, the conversion of a partnership to a corporation can have tax implications. In many cases, this transition may trigger a taxable event under federal and Rhode Island tax laws. However, careful structuring of the Rhode Island Sale of Partnership to Corporation may help minimize tax liabilities. It's advisable to seek guidance from a tax expert to ensure compliance and explore potential benefits.

To minimize capital gains during the Rhode Island Sale of Partnership to Corporation, consider utilizing tax deductions and exemptions available to you. Holding your partnership interest for over one year may also qualify you for favorable long-term capital gains treatment. Engaging in tax-deferred exchanges, when applicable, is another effective strategy. Always consult with a tax professional to explore all possible avenues.

Passthrough withholding in Rhode Island applies to partnerships and S corporations when income is distributed to non-resident members or shareholders. Under the Rhode Island Sale of Partnership to Corporation provisions, these entities must withhold a portion of income taxes for non-residents. This ensures tax compliance and prevents tax liabilities from falling fully on non-resident entities. For individuals navigating these processes, US Legal Forms offers resources that simplify the filing and compliance steps associated with passthrough withholdings.

Rhode Island has a reputation for having a higher tax burden compared to some other states. However, it also offers various incentives and credits that can benefit businesses and individuals alike. When considering a Rhode Island Sale of Partnership to Corporation, exploring these options can reveal potential advantages that you may find valuable. Engaging with local tax professionals can help navigate Rhode Island's landscape effectively.

The Streamlined Sales Tax (SST) program includes multiple states across the country. States like Florida, Georgia, and Illinois are part of this initiative. This network benefits businesses operating in multiple states, including those involved in the Rhode Island Sale of Partnership to Corporation. Being aware of SST states can simplify your sales tax management when expanding your business.

Rhode Island imposes a minimum tax of $500 for partnerships. This amount applies regardless of the partnership's income. Understanding this requirement is important for those considering a Rhode Island Sale of Partnership to Corporation, as it can influence overall financial strategies. Proper planning can help ensure that all tax obligations are met efficiently.

To file a partnership return in Rhode Island, you must use Form 1065, U.S. Return of Partnership Income. This form reports the partnership's income, deductions, gains, and losses. Afterward, each partner reports their share of income on their individual tax returns. When managing a Rhode Island Sale of Partnership to Corporation, following these steps will help you stay compliant.

Yes, Rhode Island imposes a statewide sales tax. However, there are no additional local sales taxes, making the total sales tax uniform across the state. Understanding the sales tax implications is critical for businesses, especially when conducting a Rhode Island Sale of Partnership to Corporation. Staying informed about tax obligations helps ensure compliance and effective budgeting.

Interesting Questions

More info

Search for the document type you want and see how the definition can help you choose the right document type for your research.