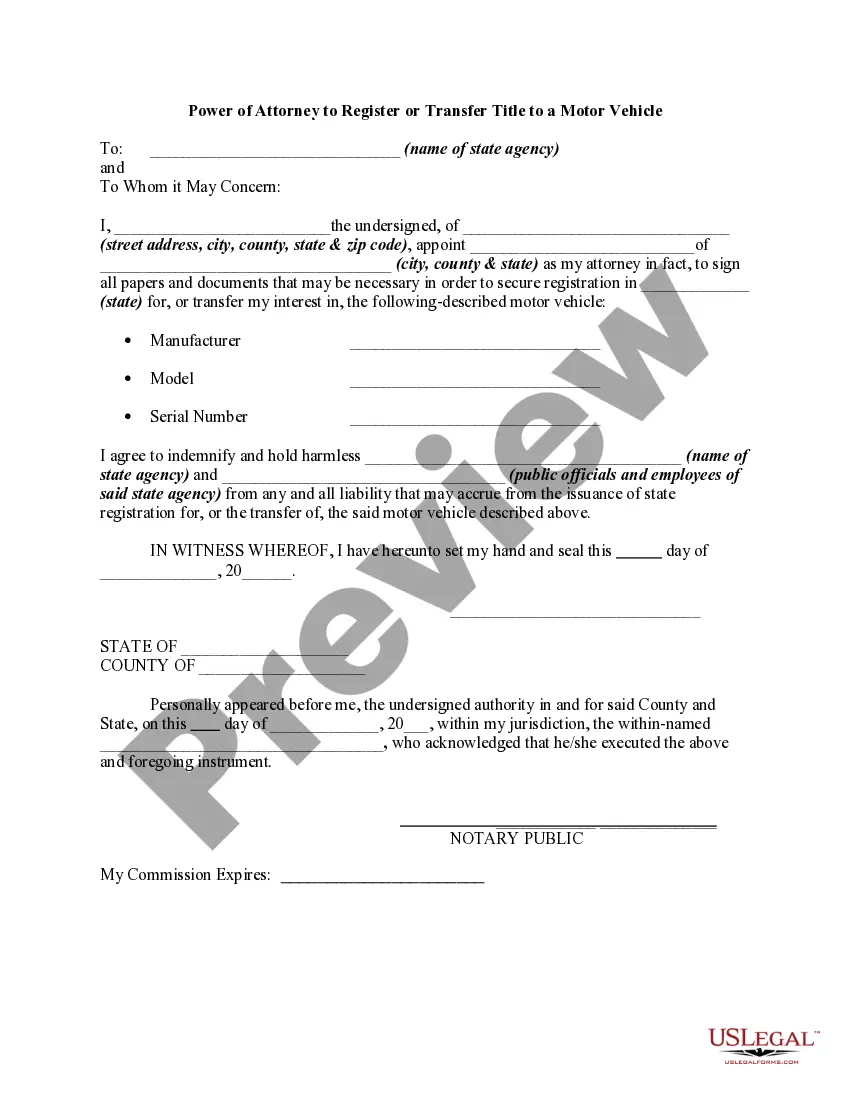

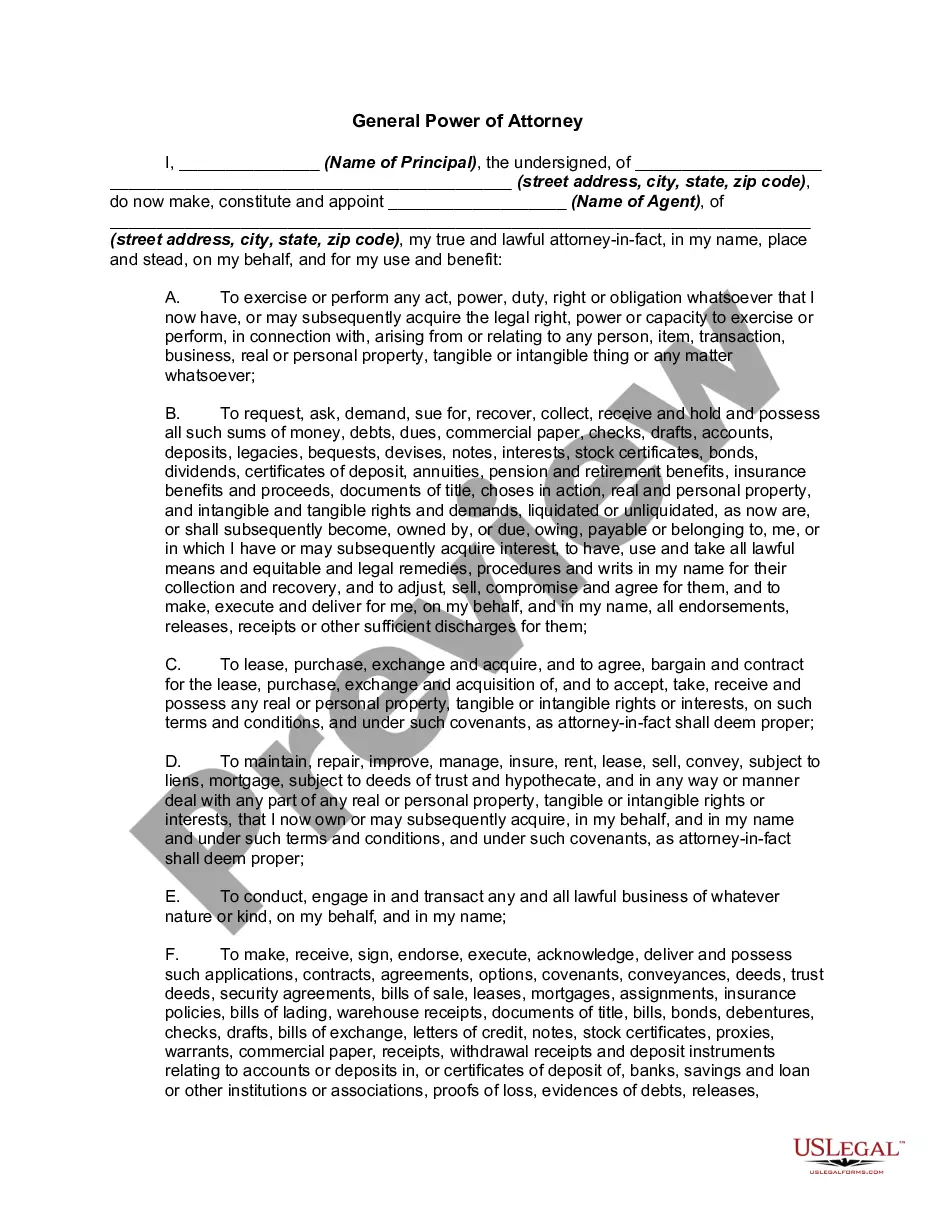

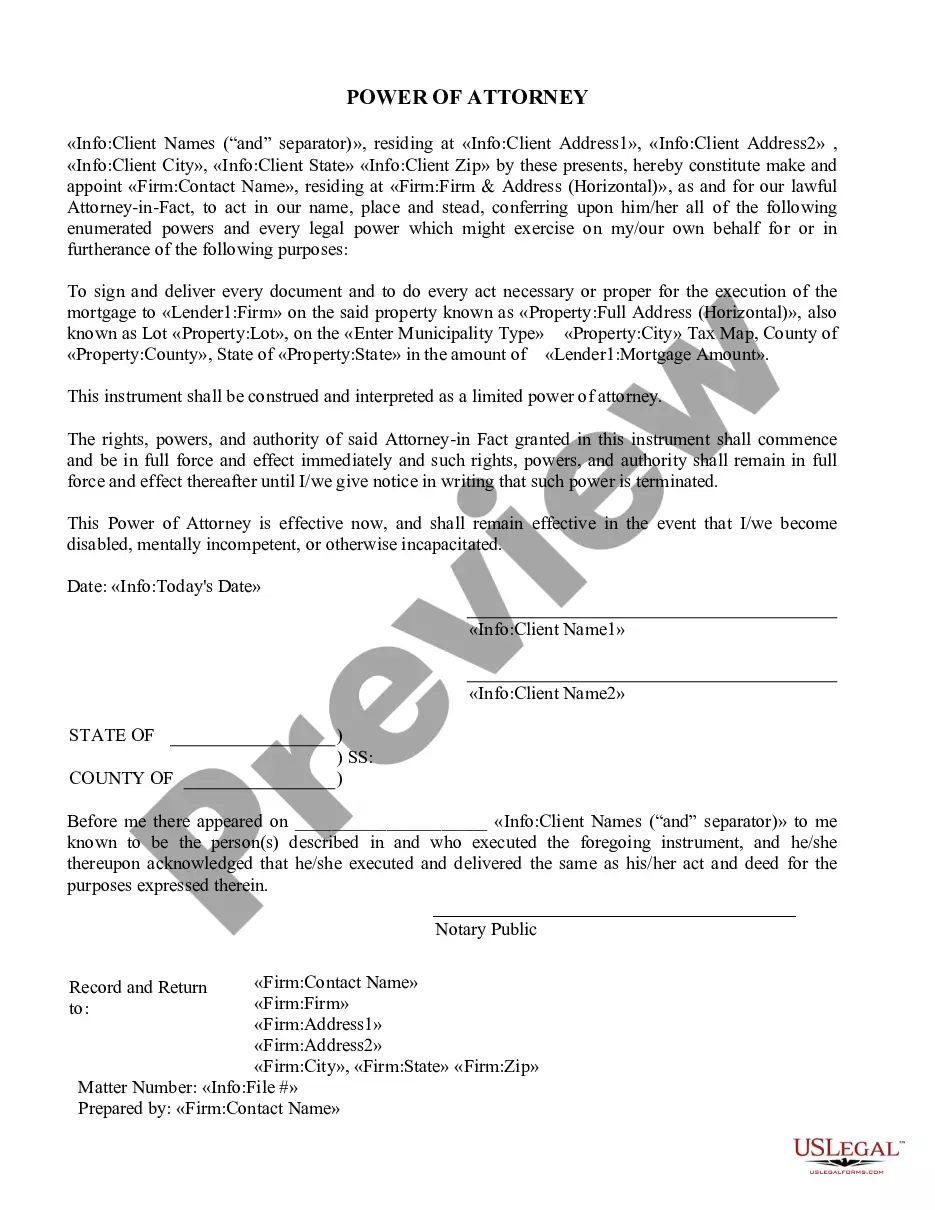

A power of attorney is an instrument containing an authorization for one to act as the agent of the principal. The person appointed is usually called an Attorney-in-Fact. A power of attorney can be either general or limited. This power of attorney is obviously limited.

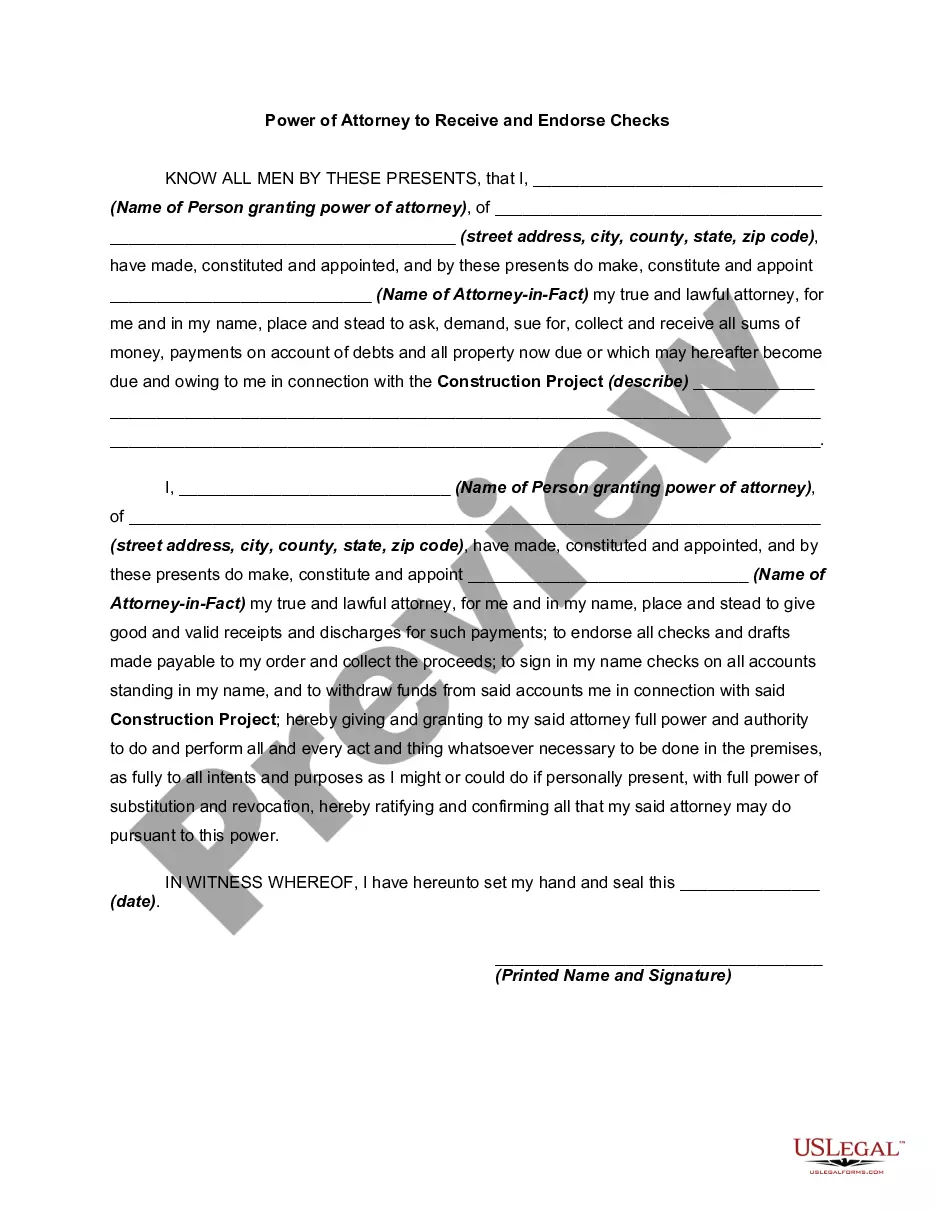

Rhode Island Power of Attorney to Receive and Endorse Checks

Description

How to fill out Power Of Attorney To Receive And Endorse Checks?

Are you presently in a scenario where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms provides an extensive range of form templates, including the Rhode Island Power of Attorney to Receive and Endorse Checks, which are designed to comply with federal and state regulations.

When you find the appropriate form, click on Buy now.

Select the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Rhode Island Power of Attorney to Receive and Endorse Checks template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to review the form.

- Check the description to confirm you have chosen the correct form.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

As there are no prescribed forms that exist in our law when drafting a Power of Attorney, this document should be drawn up with the utmost care and diligence to protect both principle and agent.

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

Registration of power of attorney is optional In India, where the 'Registration Act, 1908', is in force, the Power of Attorney should be authenticated by a Sub-Registrar only, otherwise it must be properly notarized by the notary especially where in case power to sell land is granted to the agent.

Durable Power of Attorney:A Power of Attorney which specifically says otherwise, agent's power ends if principal become mentally incapacitated. However, a power of attorney may say that it is to remain in effect in the event of future incapacity of the principal.

How To Get a Rhode Island Power of AttorneyUnderstand How a Financial POA Works in Rhode Island.Pick someone you trust to be your agent.Decide how much authority your agent will have.Sign your power of attorney document.Deliver your signed power of attorney to your agent.

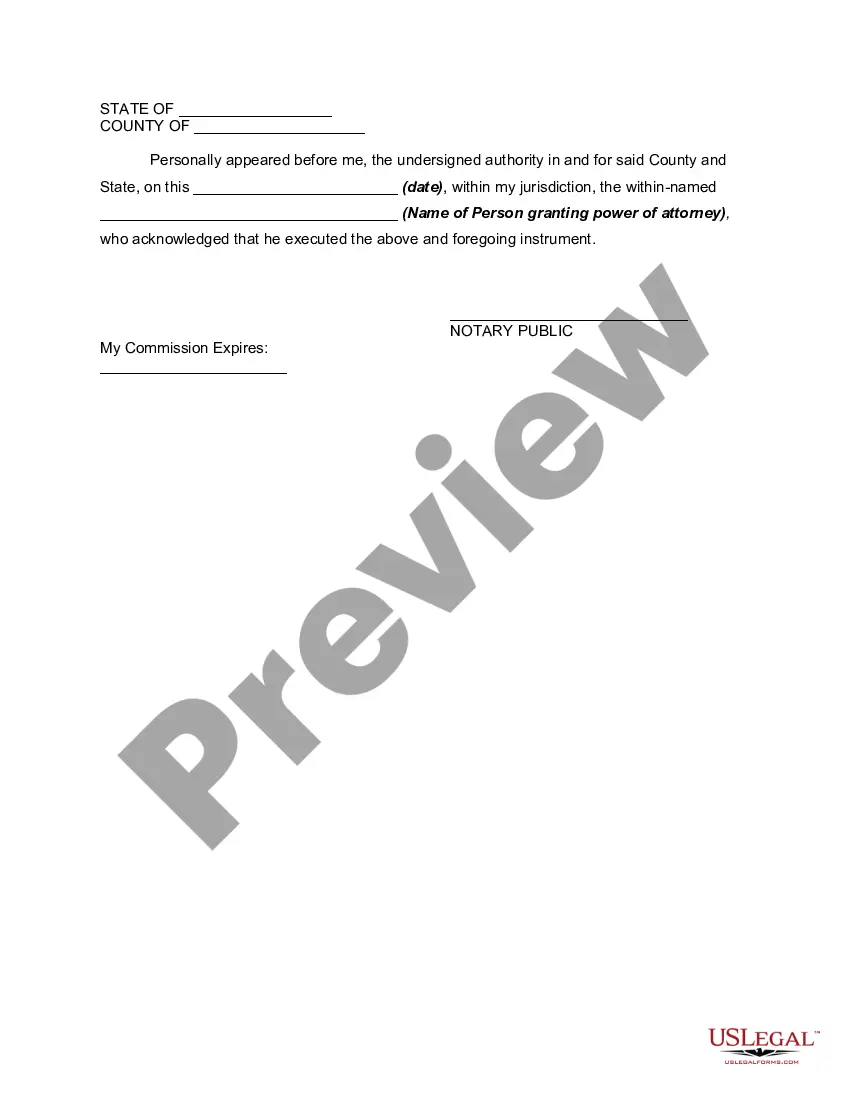

No, in Rhode Island, you do not need to notarize your will to make it legal. However, Rhode Island allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that.

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Under Rhode Island power of attorney law, all documents must be signed with at least two (2) witnesses or a notary public in order to become valid.