Rhode Island Miller Trust Forms for Assisted Living

Description

How to fill out Miller Trust Forms For Assisted Living?

Selecting the optimal legal document format can be challenging. Indeed, there are numerous templates accessible online, but how do you locate the appropriate legal form you require? Utilize the US Legal Forms website.

The platform offers thousands of templates, including the Rhode Island Miller Trust Forms for Assisted Living, suitable for both business and personal needs. All the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Rhode Island Miller Trust Forms for Assisted Living. Use your account to browse through the legal forms you have purchased in the past. Navigate to the My documents tab in your account and download another copy of the document you need.

Complete, modify, print, and sign the acquired Rhode Island Miller Trust Forms for Assisted Living. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to obtain properly-crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

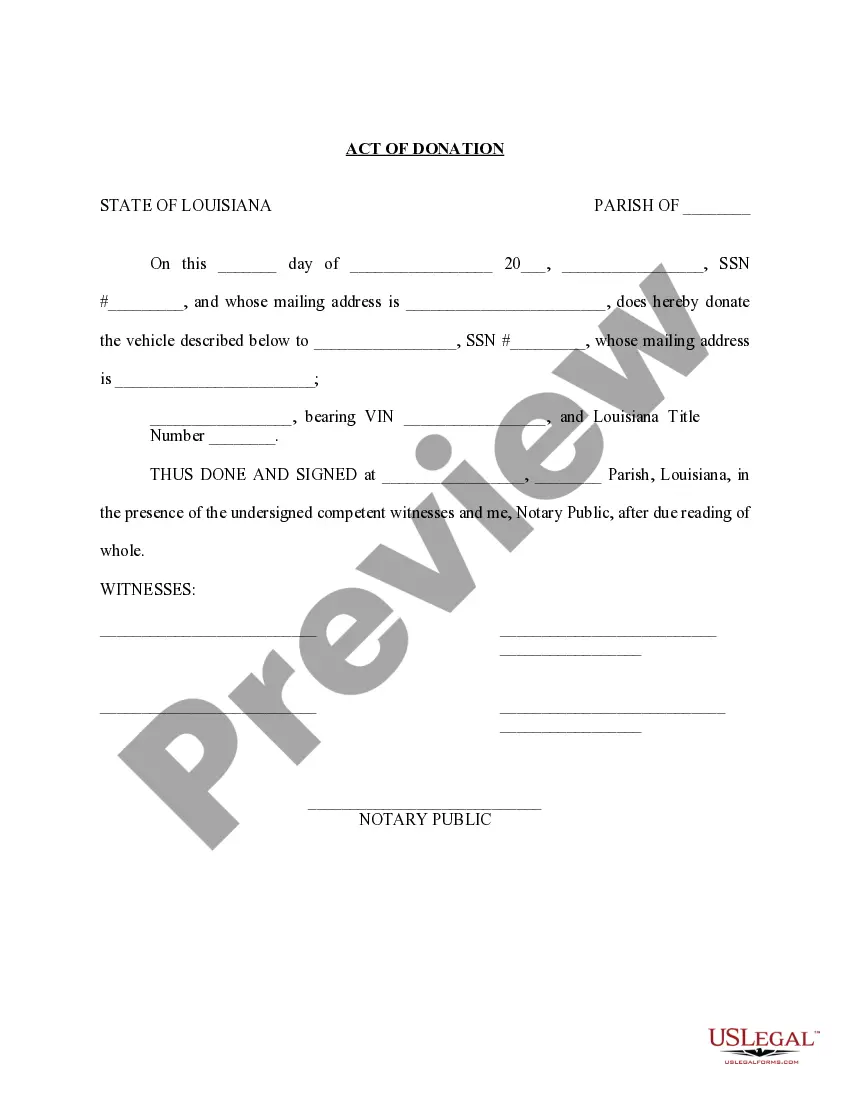

- First, ensure you have selected the correct form for the city/county. You can review the form using the Preview option and examine the form description to confirm this is indeed the right one for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click on the Acquire now button to obtain the form.

- Choose the pricing plan you prefer and input the required information. Create your account and complete the payment using your PayPal account or Visa/Mastercard.

- Select the file format and download the legal document format to your device.

Form popularity

FAQ

Yes, Rhode Island Medicaid can provide coverage for assisted living, depending on eligibility criteria and specific programs. The coverage often aims to assist those who need help with daily activities but prefer to live in a supportive community. Utilizing Rhode Island Miller Trust Forms for Assisted Living can be a strategic step to protect your resources while accessing these necessary benefits.

Medicare typically does not cover assisted living services in Rhode Island. Instead, Medicare usually focuses on short-term stays in skilled nursing facilities or rehabilitation centers. If you’re considering options for financial assistance, Rhode Island Miller Trust Forms for Assisted Living can help you manage assets while qualifying for Medicaid benefits.

You do not necessarily need a lawyer to set up a Miller trust, but having legal guidance can simplify the process. The Rhode Island Miller Trust Forms for Assisted Living are designed to be user-friendly, yet professional advice can help you avoid pitfalls and ensure everything is compliant with current laws. If you feel uncertain about any aspect, consulting with a legal expert can provide reassurance and clarity as you establish your trust.

In Rhode Island, certain assets are exempt from Medicaid consideration, including your primary residence, personal belongings, and some retirement accounts. It is vital to understand which assets you can keep while qualifying for Medicaid benefits, particularly if you are preparing for assisted living. Using Rhode Island Miller Trust Forms for Assisted Living can help you navigate these exemptions and optimize your financial situation when applying for Medicaid. Knowing what remains protected can significantly ease your planning.

If everyone who is designated to benefit from a trust passes away, the trust assets will typically be distributed according to the trust's terms. In some cases, assets may pass to the next of kin or be held until the terms are fulfilled. This can complicate matters, so utilizing Rhode Island Miller Trust Forms for Assisted Living can help clarify how your assets will be managed and distributed after your passing. Ensuring clarity in your trust structure is crucial for peace of mind.

A Medicaid income trust, often referred to as a Miller trust, helps individuals in Rhode Island meet the income limits for Medicaid eligibility. This trust allows you to deposit excess income, thereby lowering your countable income under Medicaid guidelines. By using Rhode Island Miller Trust Forms for Assisted Living, you can ensure that your income does not disqualify you from necessary medical care. It effectively allows you to still receive Medicaid benefits while maintaining your financial responsibilities.

Miller trust funds serve as vital financial resources for individuals seeking assisted living in Rhode Island. These funds can be used to cover various costs associated with living in a facility, such as room and board, personal care services, and medical expenses. By effectively utilizing Rhode Island Miller Trust Forms for Assisted Living, individuals can protect their assets while ensuring access to necessary care and services.

The criteria for assisted living in Rhode Island include age, health condition, and the type of care required. Potential residents should have a need for help with activities of daily living, such as bathing, dressing, and medication management. Additionally, utilizing Rhode Island Miller Trust Forms for Assisted Living can assist in managing financial assets, ensuring that you meet eligibility requirements while accessing needed services.

Getting into assisted living in Rhode Island requires careful planning and decision-making. First, evaluate the facilities available and their services; then, you should gather necessary documentation, including the Rhode Island Miller Trust Forms for Assisted Living, to streamline the financial process. Once you have chosen a suitable facility, complete their application process, which may include interviews and assessments to confirm your health needs.

Qualifying for assisted living in Rhode Island involves several factors, including your health status, financial situation, and personal preferences. Typically, you will need to demonstrate a certain level of care needs, which can be assessed through a medical examination. Additionally, understanding the Rhode Island Miller Trust Forms for Assisted Living can help improve your financial qualifications, ensuring you meet the necessary requirements for eligibility.