Rhode Island Assignment of Debt refers to a legal transfer of debt ownership from one party, known as the assignor, to another party, known as the assignee, within the state of Rhode Island. This assignment is typically governed by specific laws and regulations set forth by the Rhode Island legal system, ensuring its validity and enforceability. In the realm of debt transactions, the Rhode Island Assignment of Debt plays a crucial role by allowing individuals, businesses, or financial institutions to transfer outstanding debts to another party. This process is often undertaken to streamline debt management, enhance collection efforts, or satisfy debt obligations through alternative means. One common type of Rhode Island Assignment of Debt is the assignment of credit card debt. When an individual or entity holds substantial credit card debt, they may choose to transfer this debt to another person or entity through an assignment agreement. This agreement outlines the terms and conditions of the assignment, ensuring legal compliance and protecting the interests of all involved parties. Another type is the assignment of student loan debt. In this scenario, a student loan lender or service may assign an outstanding debt owed by a borrower to another financial institution or debt buyer. The purpose of such assignment is often to transfer the debt to a specialized entity that specializes in debt collection or loan servicing, for more efficient management and administration. Additionally, Rhode Island Assignment of Debt can also involve other types of financial obligations such as personal loans, mortgage debts, medical debts, or business debts. Each debt type may have specific regulations and requirements governing its assignment process within Rhode Island. It is important to note that the Rhode Island Assignment of Debt must comply with applicable state laws, including the Rhode Island Uniform Commercial Code (UCC). This code provides a comprehensive framework for the assignment of debts, ensuring transparency, fairness, and protection for all parties involved. Furthermore, it often requires parties to provide written notice to the debtor regarding the assignment, outlining the new ownership and contact information, ensuring transparency in the debt collection process. In conclusion, the Rhode Island Assignment of Debt entails the transfer of debt ownership from one party to another within the legal boundaries of Rhode Island. This process ensures the orderly transfer and management of debts and can involve various types of debts, including credit card debts, student loan debts, personal loans, mortgage debts, medical debts, and business debts. Following the applicable laws and regulations, such as the Rhode Island Uniform Commercial Code, is crucial to ensure compliance and protect the rights of all involved parties.

Rhode Island Assignment of Debt

Description

How to fill out Rhode Island Assignment Of Debt?

Are you in a position the place you need to have documents for possibly business or specific reasons nearly every working day? There are plenty of legitimate document templates available on the Internet, but locating types you can rely on is not effortless. US Legal Forms provides thousands of type templates, much like the Rhode Island Assignment of Debt, which can be created to fulfill state and federal specifications.

Should you be presently familiar with US Legal Forms web site and possess a merchant account, just log in. After that, you may download the Rhode Island Assignment of Debt design.

Unless you have an account and want to begin using US Legal Forms, follow these steps:

- Discover the type you want and make sure it is for the proper area/region.

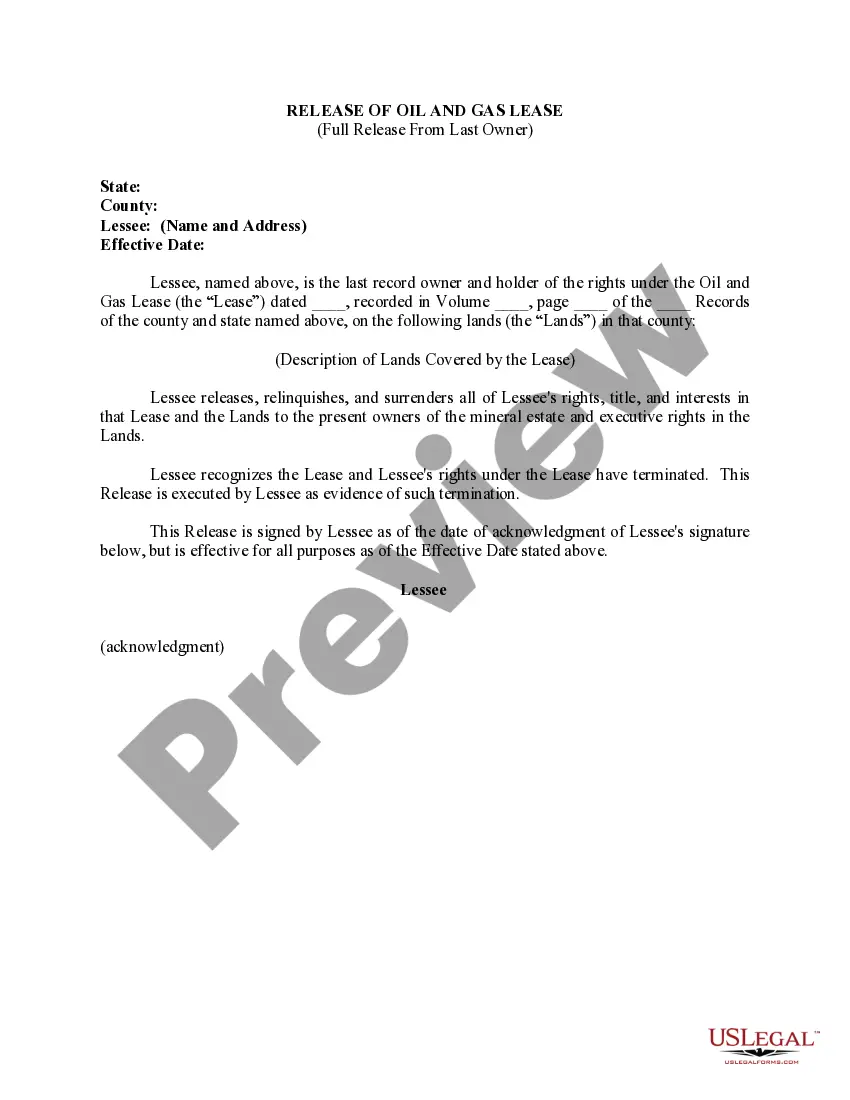

- Use the Review option to analyze the shape.

- Look at the explanation to ensure that you have chosen the appropriate type.

- In case the type is not what you`re looking for, utilize the Lookup area to find the type that meets your requirements and specifications.

- Whenever you find the proper type, just click Get now.

- Opt for the prices program you need, fill in the necessary info to create your bank account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a handy data file file format and download your duplicate.

Locate every one of the document templates you might have bought in the My Forms menus. You may get a additional duplicate of Rhode Island Assignment of Debt at any time, if required. Just select the essential type to download or printing the document design.

Use US Legal Forms, one of the most extensive collection of legitimate forms, to save lots of time as well as steer clear of errors. The assistance provides expertly manufactured legitimate document templates that can be used for a range of reasons. Generate a merchant account on US Legal Forms and start producing your lifestyle a little easier.