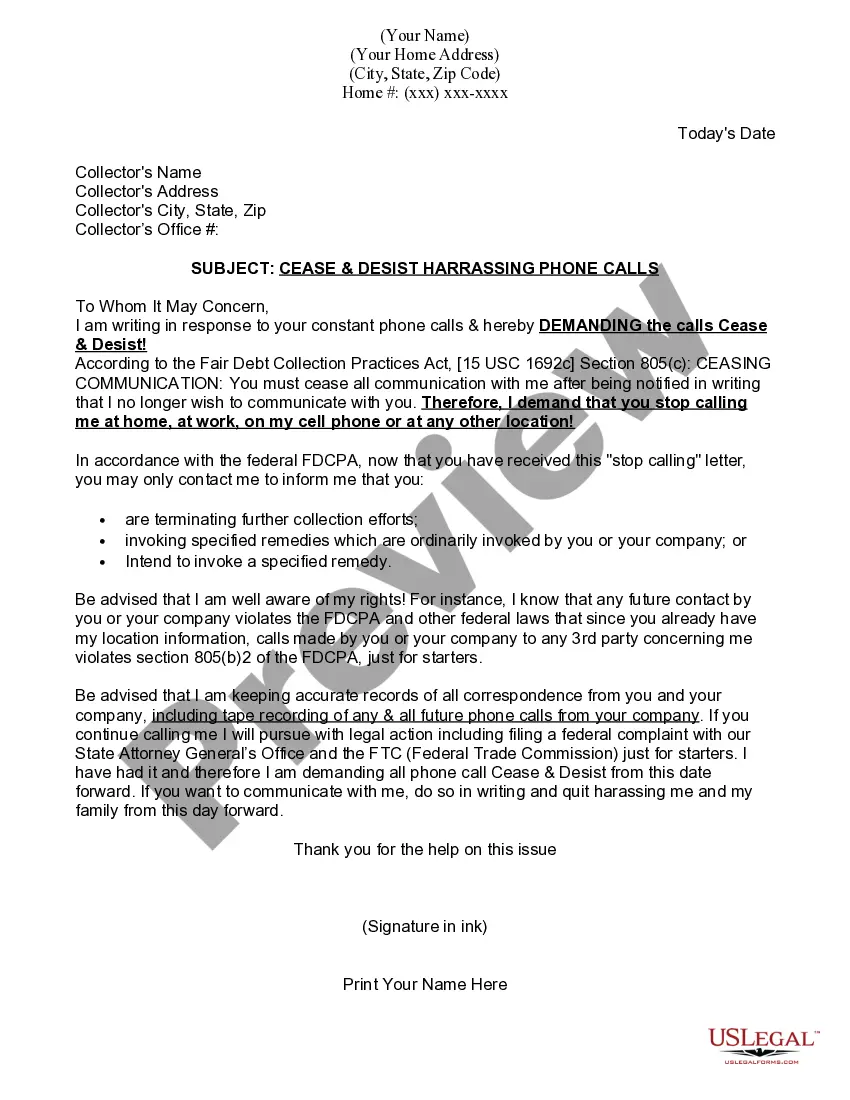

[Your Name] [Your Address] [City, State, ZIP Code] [Date] [Insurance Company Name] [Insurance Company Address] [City, State, ZIP Code] Subject: Explanation of Insurance Rate Increase — Policy [Policy Number] Dear [Insurance Company Name], I hope this letter finds you well. I am writing to express my concern and seek clarification regarding the recent insurance rate increase on my policy [Policy Number] with [Insurance Company Name]. As a long-standing and loyal customer, I understand that insurance rates can fluctuate based on various factors such as inflation, market conditions, and changes in risk assessment criteria. However, the purpose of this letter is to request a detailed explanation for the recent rate increase of [X] on my policy and to highlight my desire to understand the justification behind this adjustment. It is my understanding that transparency and fairness are integral to the business practices of [Insurance Company Name]. Therefore, I would appreciate if you could provide me with a detailed breakdown outlining the specific reasons for the rate increase. Some areas that I would like addressed and clarified include: 1. Factors Affecting Rates: Identify the specific factors, such as changes in weather patterns, increasing claim frequency, or regulatory changes, that have influenced the recent rate increase. Explain how these factors pertain to my policy and geographical location in Rhode Island. 2. Comparative Analysis: Provide a comparative analysis highlighting how my current premium aligns with the average rates across Rhode Island. This information would help me determine how significant the increase is compared to the local market. 3. Claim History: Evaluate my claim history and its impact on the rate increase. Indicate if any recent claims, whether related or unrelated, have contributed to the adjustment in my premium. Please clarify the claim amount and provide details regarding the specific incidents triggering the increase. 4. Product Improvement: Explain if the insurance rate increase is associated with enhancements to the coverage, additional benefits, or services provided by [Insurance Company Name]. This information will help me understand the added value associated with the higher premium. 5. Available Discounts: Inform me if I currently qualify for any discounts that could potentially mitigate the effect of the rate increase. Provide a comprehensive list of available discounts for my policy, which may include loyalty discounts, multi-line discounts, or any other applicable promotions. I kindly request a prompt response to this letter, preferably within [30 days], to ensure that I have a clear understanding of the rate adjustment and the factors contributing to it. Moreover, any relevant documents or supporting evidence you can provide to facilitate my understanding would be greatly appreciated. In conclusion, I value my relationship with [Insurance Company Name] and trust in your commitment to customer satisfaction. With your explanation regarding the insurance rate increase on my policy, I can make an informed decision about the course of action to take, including potentially seeking alternative insurance options. Thank you for your attention to this matter. I look forward to your prompt response and resolution of my concerns. Sincerely, [Your Name]

Rhode Island Sample Letter for Explanation of Insurance Rate Increase

Description

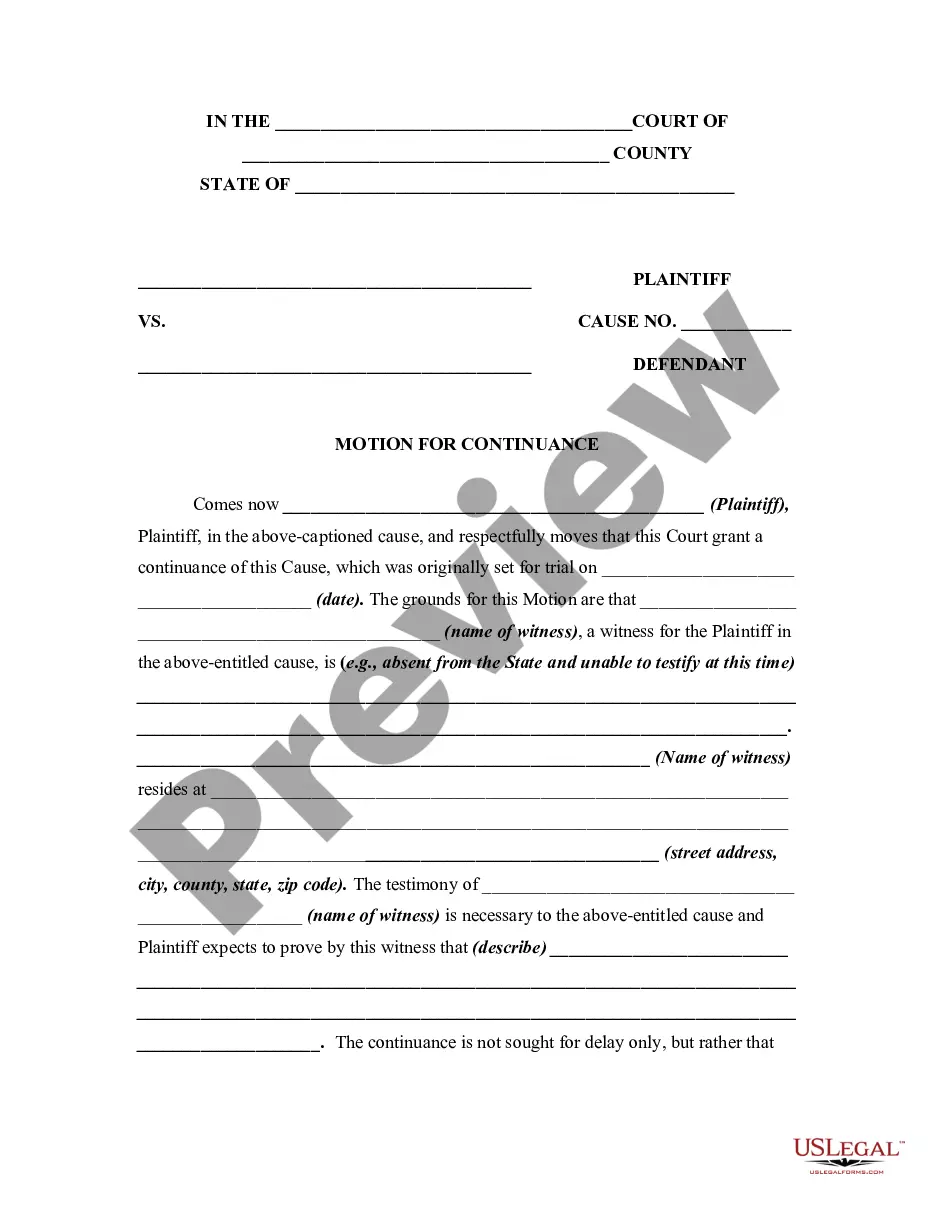

How to fill out Rhode Island Sample Letter For Explanation Of Insurance Rate Increase?

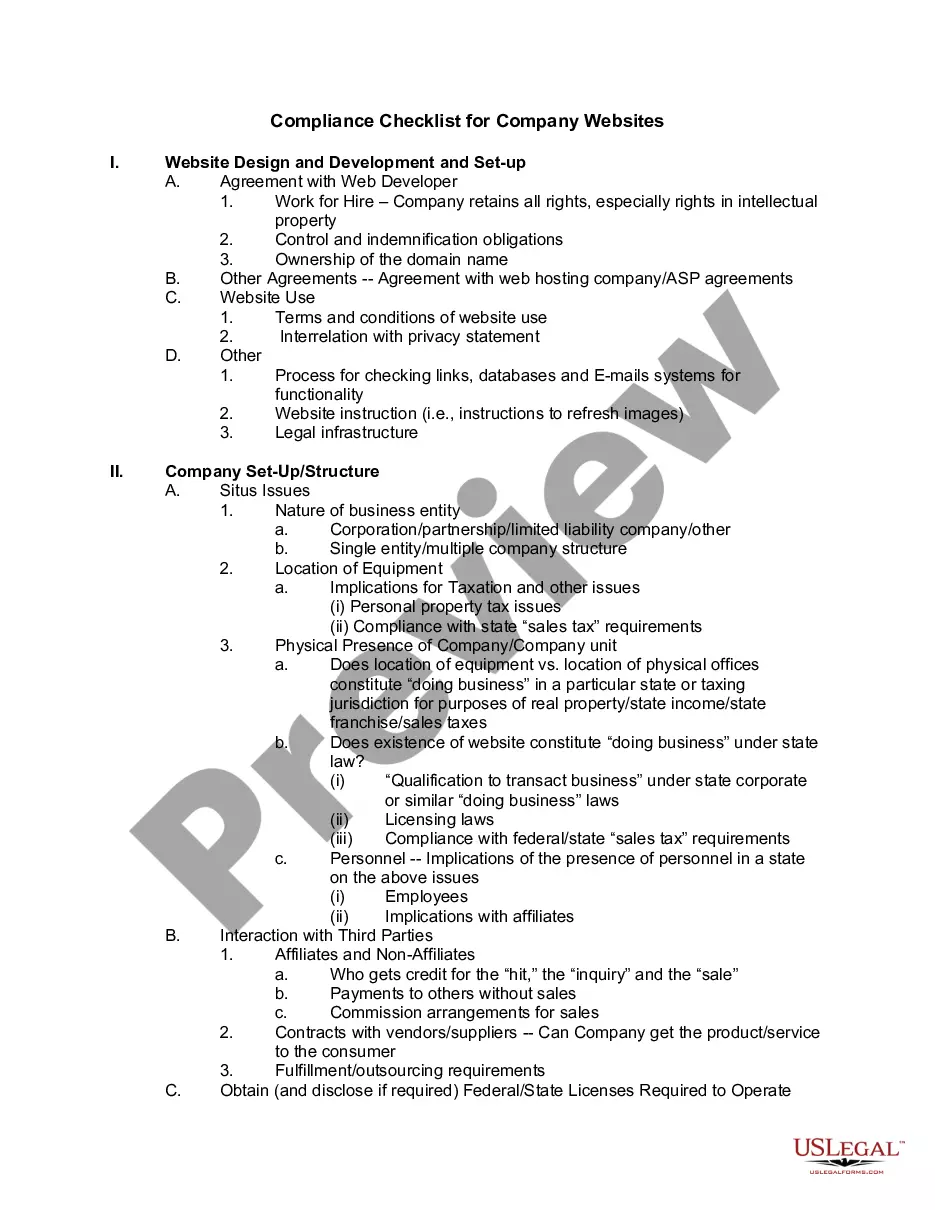

You are able to devote time on the Internet trying to find the lawful file design that suits the federal and state needs you will need. US Legal Forms provides a huge number of lawful forms that happen to be examined by professionals. You can easily obtain or printing the Rhode Island Sample Letter for Explanation of Insurance Rate Increase from your support.

If you have a US Legal Forms accounts, you are able to log in and click the Acquire option. Afterward, you are able to comprehensive, edit, printing, or indicator the Rhode Island Sample Letter for Explanation of Insurance Rate Increase. Every single lawful file design you purchase is yours forever. To obtain one more version for any purchased develop, go to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms site for the first time, stick to the basic recommendations beneath:

- Initial, make sure that you have chosen the best file design to the county/city of your liking. Read the develop explanation to ensure you have selected the right develop. If accessible, use the Preview option to look throughout the file design as well.

- In order to get one more version in the develop, use the Research discipline to obtain the design that meets your needs and needs.

- After you have discovered the design you need, click Get now to carry on.

- Choose the costs prepare you need, key in your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You should use your charge card or PayPal accounts to purchase the lawful develop.

- Choose the structure in the file and obtain it in your device.

- Make modifications in your file if needed. You are able to comprehensive, edit and indicator and printing Rhode Island Sample Letter for Explanation of Insurance Rate Increase.

Acquire and printing a huge number of file web templates using the US Legal Forms website, that offers the biggest variety of lawful forms. Use skilled and status-distinct web templates to tackle your company or personal needs.

Form popularity

FAQ

In Rhode Island, you must carry minimum limits of bodily injury liability - $25,000 per person and $50,000 per accident. This means you have coverage up to $25,000 for damages incurred by any one person and up to $50,000 in any one accident should more than one person be involved.

Car Accident Claim Law in Massachusetts Unlike our neighbor State, Massachusetts, Rhode Island is not a no-fault state and does not maintain PIP coverage. Additionally, there are no injury thresholds in Rhode Island.

The Insurance Act 1973 (Cth) sets minimum capital and solvency requirements for companies wanting to enter or operate in the insurance market.

Renewal Policy an insurance policy issued to replace an expiring policy.

The Insurance Contracts Act 1984 seeks to ensure that a fair balance is struck between the interests of insurers, insured parties and other members of the public and so that the provisions included in such contracts, and the practices of insurers in relation to such contracts, operate fairly.

Rated Policy a life insurance policy that is issued at a premium rate higher than standard to cover an individual classified as a substandard risk. A rated policy may also contain special limitations and exclusions. Also known as a rate up policy.

If the notice is given less than 60 days before the renewal date, the new terms or premium200b increase will not become effective until 60 days (45 days for personal lines property and casualty policies) have elapsed from the date the notice is given.

Here are the required minimum auto insurance coverages and limits in the state of Rhode Island:Bodily injury liability coverage: $25,000 per person and $50,000 per accident.Property damage liability coverage: $25,000 per accident.Uninsured/Underinsured motorist coverage: $25,000 per person and $50,000 per accident.More items...

Explanation: The minimum insurance required by law is third-party cover. This covers your liability to others involved in a collision but not damage to your vehicle. Basic third-party insurance also won't cover theft or fire damage.

By law, these health insurance rate increases must be approved by the Insurance Department before an insurance company may increase their prices to their customers. Small Employer Plans (1 50 Employees): The Insurance Department reviews health insurance rates used in calculating premiums for small employer plans.