An A-B trust is a revocable living trust which divides into two trusts upon the death of the first spouse. This type of trust makes use of both the estate tax exemption ($3.5 million per person in 2009) and the marital deduction to make it so that no estate taxes are due upon the death of the first spouse. The B Trust is also known as the Bypass trust and it contains the amount of that years applicable exclusion amount. The A trust is the marital deduction trust which will typically contain both the surviving spouse's separate property and one half community property interests but also the residue of the deceased spouse's estate after the estate tax exemption has been utilized by the B trust. The use of an A-B trust ensures that both spouse's applicable exclusion amounts are effectively used, thereby doubling the amount of property which can pass to heirs free of Federal Estate Taxes.

Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B

Description

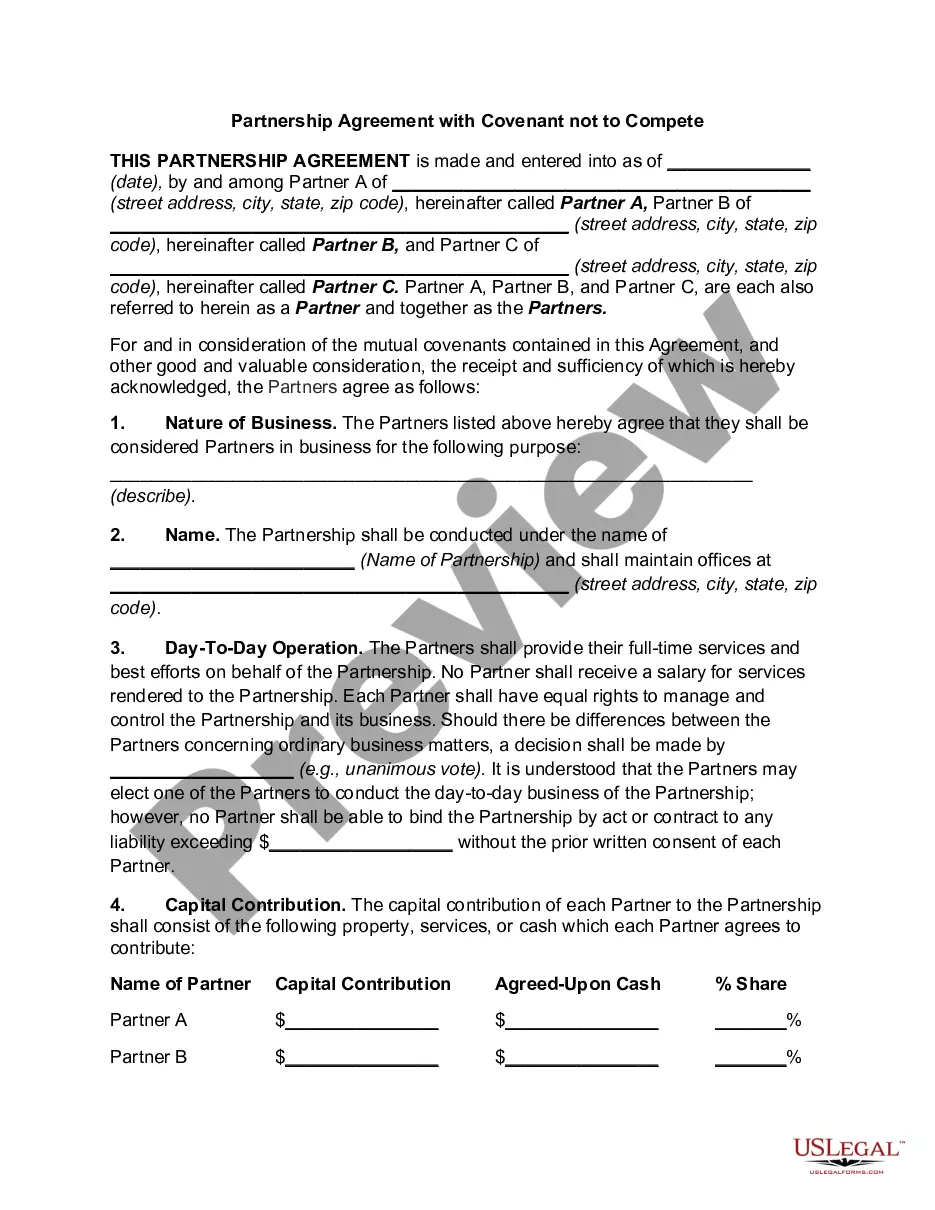

How to fill out Marital Deduction Trust - Trust A And Bypass Trust B?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a vast selection of legal template files that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal use, categorized by categories, states, or keywords. You can find the most current versions of forms such as the Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B in just a few moments.

If you already have an account, Log In to access Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B from your US Legal Forms collection. The Download button will be available on every form you view. You can access all previously saved forms under the My documents section of your account.

Make modifications. Fill out, edit, and print/sign the saved Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B.

Every template you upload to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or create another copy, simply navigate to the My documents section and click on the form you need. Access the Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you are using US Legal Forms for the first time, here are easy instructions to assist you in getting started.

- Ensure you have selected the correct form for your local area/state. Click the Review button to examine the form's content. Review the form description to confirm you have selected the correct form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Download now button. Then, select the pricing plan you prefer and provide your details to sign up for an account.

- Proceed with the purchase. Use a credit card or PayPal account to complete the transaction.

- Select the file format and download the form to your system.

Form popularity

FAQ

A bypass trust can be an excellent strategy for many individuals, especially if you are concerned about estate taxes and protecting your assets. It allows you to retain control over your assets while benefiting your heirs, effectively using the Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B to minimize tax burdens. However, considering your unique circumstances is crucial, and an estate planning professional can help determine if this approach is right for you.

Creating a bypass trust involves drafting a legal document that outlines the trust's terms and conditions. After defining how the assets are to be managed, you must transfer assets into the trust to ensure it operates as intended. Working with an expert in the Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B can provide guidance and help streamline this process. This careful attention to detail lays the foundation for effective estate planning.

Income generated within a bypass trust is generally subject to taxation at the trust's tax rate. Since a bypass trust is irrevocable, it has its own tax identification number and must file its own tax returns. However, distributions to beneficiaries may allow them to report the income on their personal tax returns. Consulting with a tax professional can help clarify the implications of the Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B on your situation.

To set up a bypass trust, you first need to work with an estate planning attorney who understands the nuances of the Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B. The attorney will help you draft the trust document, detailing how the assets will be managed and distributed. After that, you will fund the trust by transferring assets into it, ensuring it meets legal requirements. Finally, proper setup ensures seamless management for your beneficiaries.

A marital deduction trust allows the surviving spouse to benefit from the entire trust body without immediate tax consequences, ensuring they have access to the estate. Conversely, a Bypass Trust keeps assets separate from the surviving spouse's estate, which can effectively reduce taxes. Both serve distinct roles in estate planning, and leveraging the Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B can clarify which option best suits your needs.

A QTIP (Qualified Terminable Interest Property) Trust allows a surviving spouse to receive income from the trust during their lifetime, with the principal going to other beneficiaries after their death. On the other hand, a Bypass Trust provides tax benefits by keeping the trust’s assets out of the surviving spouse’s estate. Both trusts serve different estate planning purposes, but the Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B integrates these strategies for effective estate management.

A marital deduction trust allows assets to pass to a surviving spouse without incurring estate taxes at the time of the first spouse's death. This type of trust can provide significant financial advantages, enabling the surviving spouse to receive the full benefit of the deceased spouse's estate. It is an essential tool in estate planning, especially when considering options like the Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B.

A trust generally allows an individual to manage their assets for the benefit of beneficiaries. A B trust, also known as a Bypass Trust, specifically helps couples by providing tax benefits. When one spouse passes away, the B trust shelters a certain amount from estate taxes, ensuring more wealth remains for the surviving spouse. Understanding the nuances of the Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B can help in effectively managing your estate.

A marital trust typically provides for a surviving spouse, allowing them to receive income during their lifetime, while the bypass trust helps reduce estate taxes for heirs. The Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B can serve both purposes effectively. By clearly defining the roles of these trusts, individuals can tailor their estate plans to fit their needs.

Pass-through trusts are taxed at the beneficiary level, meaning the income 'passes through' to the beneficiaries who report it on their personal tax returns. This structure can offer tax advantages because the trust itself is not subject to tax on that income. When managing a Rhode Island Marital Deduction Trust - Trust A and Bypass Trust B, individuals should understand how this taxation works to optimize tax outcomes.