Rhode Island Equity Share Agreement

Description

How to fill out Equity Share Agreement?

Are you currently in a scenario where you require documents for either business or personal reasons every single day.

There are numerous legitimate document templates available online, but locating ones you can rely on is not simple.

US Legal Forms provides thousands of form templates, such as the Rhode Island Equity Share Agreement, designed to comply with state and federal regulations.

Select the pricing plan you prefer, complete the necessary information to set up your account, and make the payment using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Rhode Island Equity Share Agreement template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

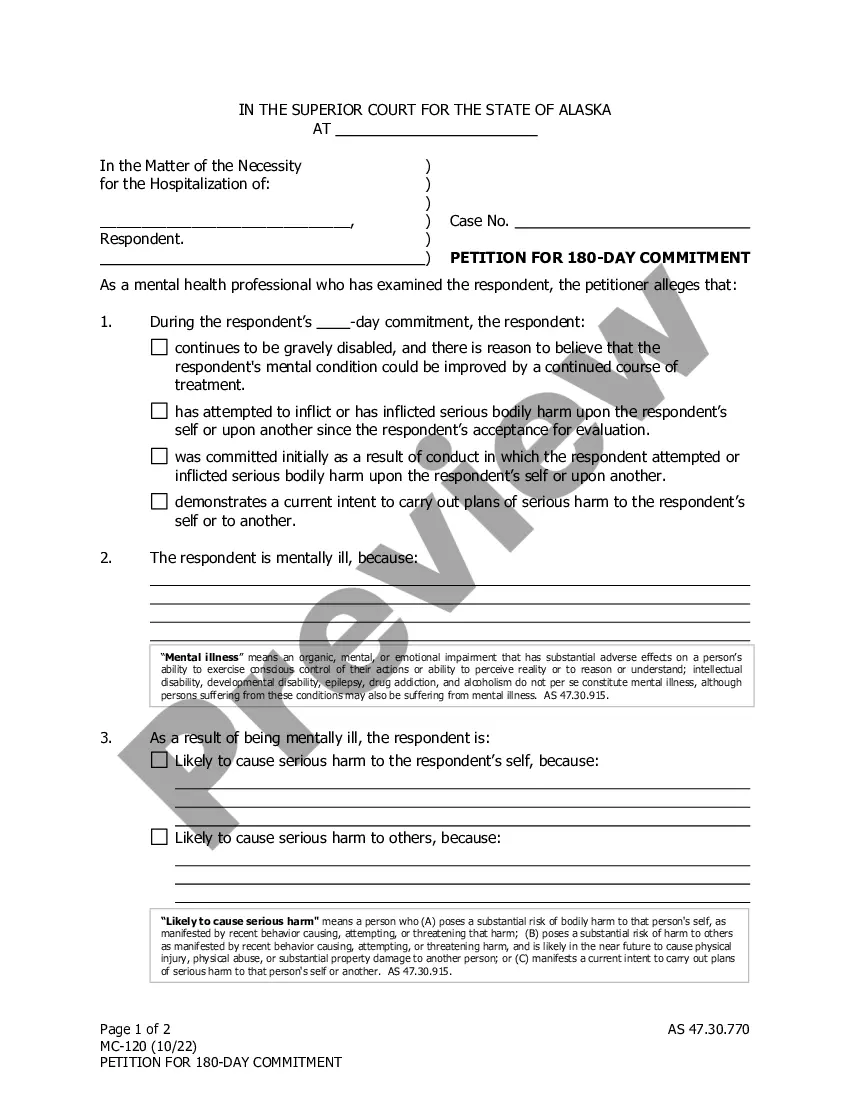

- Use the Review option to verify the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you are looking for, utilize the Search area to find the form that fits your needs and requirements.

- Once you find the appropriate form, click on Buy now.

Form popularity

FAQ

A shared equity agreement can be a smart choice for many individuals looking to invest in real estate. By implementing a Rhode Island Equity Share Agreement, you can reduce upfront costs and share responsibilities with trusted partners. This approach allows you to enter the market more easily while benefiting from collective resources. However, it's essential to carefully evaluate the terms and conditions to ensure it aligns with your goals.

An equity share agreement is a legal contract between parties that outlines the terms of shared ownership in a property. In the context of a Rhode Island Equity Share Agreement, it allows individuals to invest in real estate without the burden of full ownership costs. This arrangement clearly defines the rights and responsibilities of each party, making it easier to manage the investment. Ultimately, a well-structured equity share agreement can facilitate collaboration while minimizing financial risks.

In Rhode Island, any partnership that has income, gains, losses, or deductions must file the RI 1065. This includes situations involving a Rhode Island Equity Share Agreement where multiple parties collaborate on property investment. Timely and accurate filing of this form is important to ensure compliance with state laws and to prevent penalties. Leveraging tools on the uslegalforms platform can simplify this filing process.

A RI estate tax return is necessary for estates whose value exceeds the Rhode Island exemption limit. Executors or personal representatives should file this return to assess taxes owed on the estate. If real estate is involved, especially in a Rhode Island Equity Share Agreement, it’s crucial to understand how the estate tax impacts ownership shares. Seeking guidance from a qualified attorney or tax specialist can streamline this process.

The RI-1065 form is required for partnerships that conduct business in Rhode Island. If your business relationship involves a Rhode Island Equity Share Agreement, ensure you are accurately reporting your income and expenses using this form. Additionally, partners need to file their individual income returns to report their share of the partnership income. Consulting with professionals can help clarify these responsibilities.

Entities such as partnerships and limited liability companies that operate as partnerships must file Form 1065. This form reports income, deductions, gains, and losses from the business activities. If you are engaging in a Rhode Island Equity Share Agreement, understanding these filing requirements is essential to maintain compliance. Always consult with a tax advisor if you are uncertain about your obligations.

Whether a Home Equity Agreement (HEA) is a good idea largely depends on individual circumstances. A Rhode Island Equity Share Agreement offers opportunities to invest in property without full ownership risks, benefiting those who may not qualify for traditional loans. However, it's crucial to assess the dynamics between co-investors, financial commitments, and market conditions before proceeding. Evaluate your options through platforms like USLegalForms to simplify the process.

Disadvantages of a home equity agreement include potential conflicts between investors and the shared responsibility for liabilities. The Rhode Island Equity Share Agreement can tie you to another party's financial decisions, which may affect your investment. Additionally, should the property need extensive repairs, both parties must agree on how to manage costs, which can lead to misunderstandings. Thorough communication is essential.

To write an effective equity agreement, start by clearly defining the roles and contributions of each party. The Rhode Island Equity Share Agreement should include vital details like financial investments, ownership percentages, and maintenance responsibilities. Make sure to incorporate terms regarding profit-sharing and exit strategies. It's advisable to consult with a legal professional to ensure everything is legally binding.

A significant downside of a home equity agreement, such as the Rhode Island Equity Share Agreement, is the potential for disagreements between parties. If the property value declines, both investors may face losses. Additionally, sharing equity can complicate future transactions with third parties. It's crucial to consider these factors carefully before entering into any agreement.