Rhode Island Credit Card Application for Unsecured Open End Credit Introduction: The Rhode Island Credit Card Application for Unsecured Open End Credit is a financial tool that allows individuals to apply for a credit card without the need for collateral or security. It provides users with the flexibility to make purchases and payments on an ongoing basis, maintaining a revolving line of credit. This detailed description will highlight the features, benefits, and various types of Rhode Island Credit Card Application for Unsecured Open End Credit available in the market. Features of Rhode Island Credit Card Application for Unsecured Open End Credit: 1. No collateral required: Unlike secured credit cards, the Rhode Island Credit Card Application for Unsecured Open End Credit does not necessitate any form of collateral or security deposit. 2. Revolving credit limit: Users are provided with a predetermined credit limit, allowing them to make purchases up to that limit. As payments are made, the available credit is replenished. 3. Purchase flexibility: The credit card can be used for making purchases at various merchants, both online and offline, providing users with convenience and ease. 4. Payment options: Cardholders have the flexibility to make minimum payments or pay the entire balance by the due date, depending on their financial circumstances. 5. Interest charges: If the user carries a balance, interest charges may apply based on the card's Annual Percentage Rate (APR). 6. Additional benefits: Some Rhode Island Credit Card Application for Unsecured Open End Credit options may offer additional benefits such as rewards programs, cashback offers, travel insurance, or purchase protection. Types of Rhode Island Credit Card Application for Unsecured Open End Credit: 1. Standard credit cards: These are traditional credit cards that provide users with a predetermined credit limit, which they can utilize for purchases and repayments as per the terms and conditions. 2. Rewards credit cards: These types of credit cards offer users the opportunity to earn rewards or points for every transaction made. These rewards can then be redeemed for various benefits like cashback, travel discounts, or gift cards. 3. Balance transfer credit cards: These cards allow users to transfer balances from other credit cards or loans to save on interest charges. Users often benefit from promotional interest rates for a specified period on the transferred amounts. 4. Secured credit cards: Although not unsecured, secured credit cards can be mentioned as an alternative option. They require a security deposit as collateral, which becomes the credit limit. These cards are beneficial for individuals with a limited credit history or a poor credit score. Conclusion: The Rhode Island Credit Card Application for Unsecured Open End Credit provides individuals with the opportunity to access credit without the need for collateral. With features like revolving credit limits, payment flexibility, and various types of credit card options such as rewards, balance transfers, and secured cards, users can choose a card that suits their financial needs and goals. It is essential to carefully review the terms and conditions of each card application before making a decision to ensure it aligns with one's financial situation and objectives.

Rhode Island Credit Card Application for Unsecured Open End Credit

Description

How to fill out Rhode Island Credit Card Application For Unsecured Open End Credit?

Are you in the placement the place you require paperwork for either company or individual functions virtually every day? There are a variety of legal record layouts available on the Internet, but getting kinds you can rely on is not straightforward. US Legal Forms delivers thousands of form layouts, such as the Rhode Island Credit Card Application for Unsecured Open End Credit, that happen to be written in order to meet state and federal demands.

If you are already familiar with US Legal Forms web site and possess a merchant account, simply log in. Next, it is possible to down load the Rhode Island Credit Card Application for Unsecured Open End Credit web template.

If you do not have an profile and need to begin using US Legal Forms, abide by these steps:

- Discover the form you will need and make sure it is for the appropriate area/area.

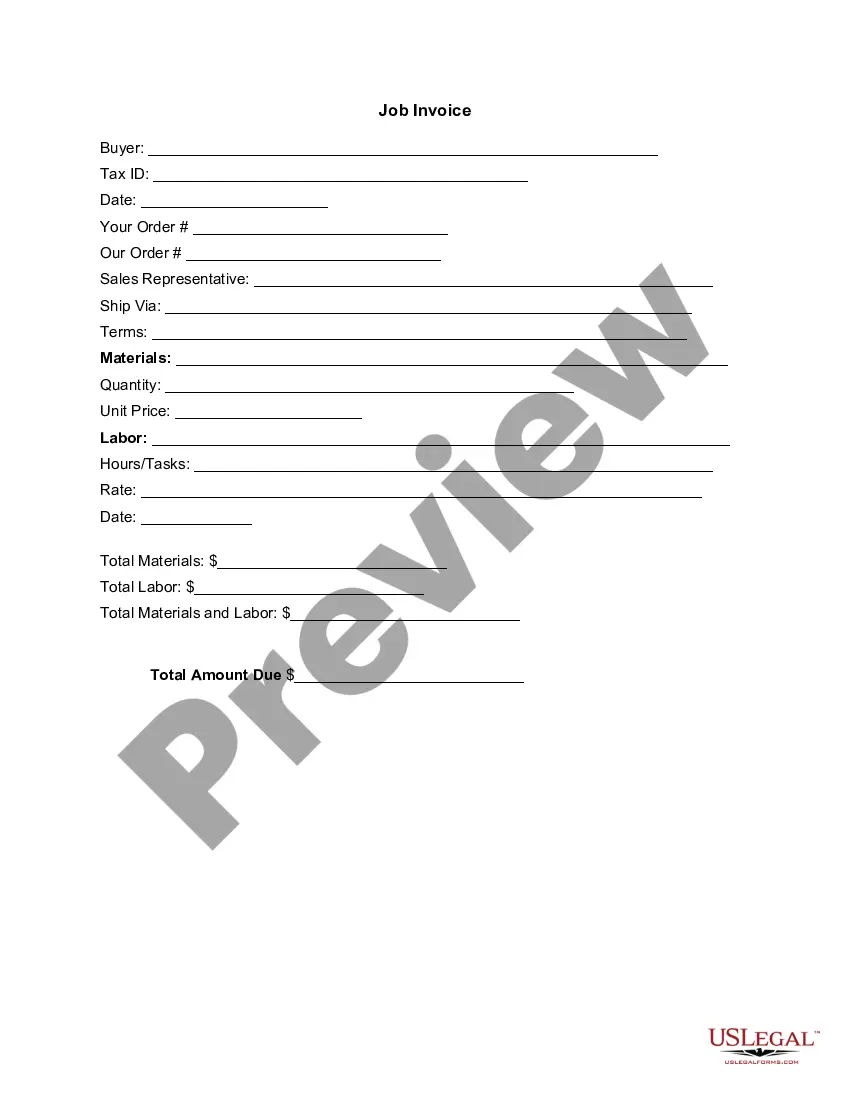

- Take advantage of the Review button to examine the shape.

- Browse the outline to actually have selected the appropriate form.

- In case the form is not what you`re trying to find, use the Research industry to obtain the form that fits your needs and demands.

- If you get the appropriate form, simply click Acquire now.

- Choose the pricing prepare you want, fill in the required information and facts to create your account, and buy an order utilizing your PayPal or credit card.

- Choose a convenient paper structure and down load your version.

Discover each of the record layouts you may have purchased in the My Forms menu. You can obtain a extra version of Rhode Island Credit Card Application for Unsecured Open End Credit at any time, if necessary. Just click the necessary form to down load or printing the record web template.

Use US Legal Forms, one of the most comprehensive assortment of legal varieties, in order to save time as well as steer clear of faults. The assistance delivers expertly made legal record layouts that can be used for a variety of functions. Make a merchant account on US Legal Forms and start generating your life a little easier.