Any interested party in an estate of a decedent generally has the right to make objections to the accounting of the executor, the compensation paid or

proposed to be paid, or the proposed distribution of assets. Such objections must be filed within within a certain period of time from the date of service of the Petition for approval of the accounting.

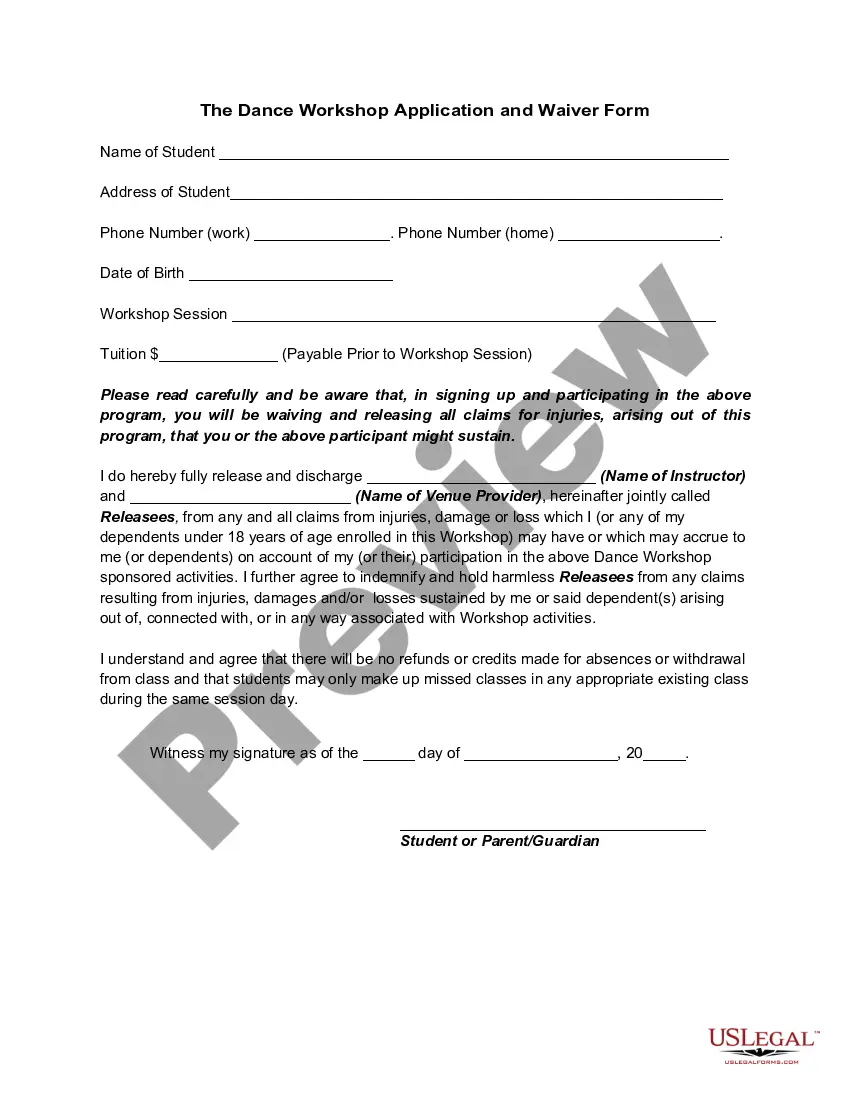

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Rhode Island objections to allowed claims in accounting refer to the legal challenges raised by the state of Rhode Island regarding certain claims in accounting proceedings. These objections are mainly aimed at ensuring accuracy, fairness, and compliance with relevant laws and regulations. Rhode Island objections to allowed claims play a crucial role in maintaining the integrity of accounting processes and protecting the interest of the state. One type of Rhode Island objection to allowed claims in accounting is the Challenge to Claim Amount. In this type of objection, Rhode Island questions the accuracy and validity of the claimed amount. The state may argue that the amount submitted does not align with supporting documents or lacks proper justification. By raising these objections, Rhode Island seeks to eliminate any potential errors or exaggerations that might result in an unfair financial burden on the state. Another type of Rhode Island objection to allowed claims is the Ineligibility Objection. Here, the state argues that the claimant is not eligible to receive compensation or benefits as per the applicable laws or regulations. Rhode Island may challenge the claimant's legal standing, qualification criteria, or any other relevant factors to dispute the eligibility of the claim. Rhode Island may also raise objections related to Procedural Deficiencies. These objections focus on the claimant's failure to follow the correct accounting procedures, including filing deadlines, document submission requirements, or any other procedural steps. The state may argue that non-compliance with these procedures can render the claim invalid or unenforceable. Additionally, Rhode Island objections to allowed claims may involve Fraud or Misrepresentation. In such cases, the state suspects that the claimant has provided false or misleading information intentionally. These objections aim to uncover and rectify any fraudulent activity, ensuring that the state's resources are not misused or wrongly disbursed. Overall, Rhode Island objections to allowed claims in accounting encompass various aspects, including the accuracy of claimed amounts, claimant eligibility, adherence to procedural requirements, and tackling potential fraud. By actively scrutinizing and challenging claims, Rhode Island aims to maintain accountability, protect its financial interests, and promote fair accounting practices.