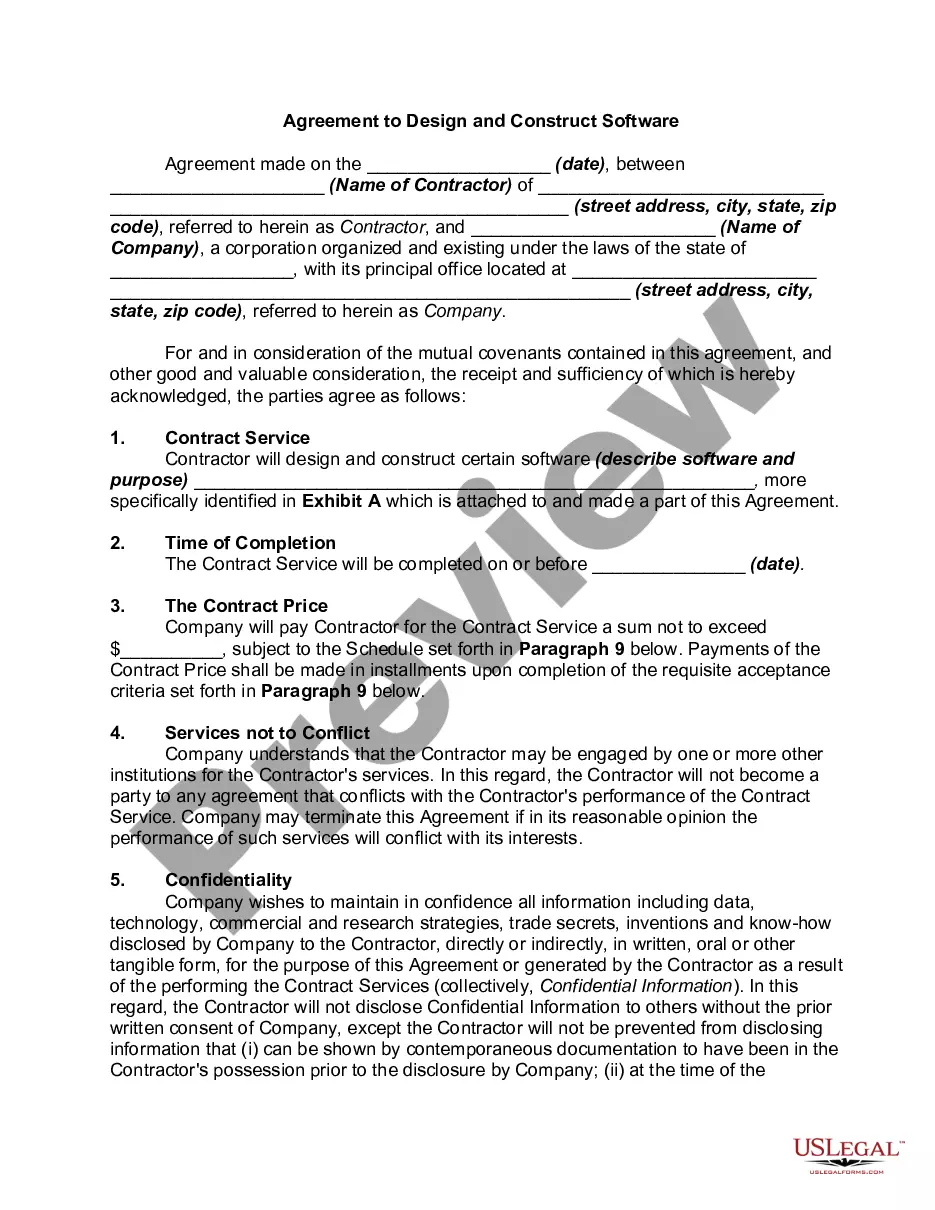

Rhode Island Agreement for Development of Software to Specifications

Description

How to fill out Agreement For Development Of Software To Specifications?

If you need to aggregate, acquire, or produce legal document templates, utilize US Legal Forms, the most extensive assortment of legal documents available online.

Take advantage of the site’s straightforward and user-friendly search function to locate the documents you need.

Various templates for business and personal purposes are classified by categories and states, or keywords. Use US Legal Forms to find the Rhode Island Agreement for Development of Software to Specifications in just a few clicks.

Every legal document template you purchase is yours for a lifetime. You will have access to every document you acquired within your account. Navigate to the My documents section and select a document to print or download again.

Stay competitive and acquire, and print the Rhode Island Agreement for Development of Software to Specifications using US Legal Forms. There are countless professional and state-specific templates available for your business or personal requirements.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to obtain the Rhode Island Agreement for Development of Software to Specifications.

- You can also access documents you previously acquired in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Review option to examine the form’s details. Don't forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other variations of the legal document format.

- Step 4. Once you have identified the form you need, select the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Rhode Island Agreement for Development of Software to Specifications.

Form popularity

FAQ

In Rhode Island, certain items and services are exempt from sales tax, including sales for resale and specific types of manufacturing equipment. Additionally, some specialized services may qualify for exemptions. When engaging in a Rhode Island Agreement for Development of Software to Specifications, researching exemptions can potentially reduce your tax burden on eligible expenses. Be proactive in seeking expert advice on exemptions relevant to your situation.

Software does indeed incur sales tax in Rhode Island. This includes any custom software created through a Rhode Island Agreement for Development of Software to Specifications. It is essential to clarify tax responsibilities when negotiating such agreements, as the tax landscape can affect overall project costs. Consulting with tax professionals can provide guidance tailored to your situation.

Yes, software is generally considered taxable in Rhode Island. The state applies sales tax to most software sales, whether it is delivered electronically or physically. If you are entering into a Rhode Island Agreement for Development of Software to Specifications, it is crucial to factor in potential tax obligations on the software developed under the agreement. This will ensure compliance and help you avoid unexpected costs.

In Rhode Island, various services are subject to sales tax. For instance, services related to telecommunications, utility services, and certain repair services are taxable. When entering into a Rhode Island Agreement for Development of Software to Specifications, you may need to consider tax implications depending on the nature of the services provided. Understanding the taxability of services can help in budgeting and compliance.

No, single member LLCs do not file Form 1065, as this form is only applicable to partnerships. Instead, income and expenses are reported directly on the owner's personal tax return using Schedule C. This rule applies regardless of whether your LLC is involved in a Rhode Island Agreement for Development of Software to Specifications.

No, a single member LLC is not considered a partnership. It is a distinct legal entity that offers limited liability protection to its owner. If your business engages in agreements like the Rhode Island Agreement for Development of Software to Specifications, understanding your LLC's structure is crucial to ensure proper legal protections.

Yes, software is generally subject to sales tax in Rhode Island, whether it is purchased or leased. This includes custom software developed under a Rhode Island Agreement for Development of Software to Specifications. It’s important to factor in taxes when budgeting for software projects, and services like UsLegalForms can help you navigate compliance smoothly.

No, a single member LLC does not file Form 1065, as this form is reserved for partnerships. Instead, most single member LLCs will report their income through Schedule C on their personal return. If you are engaging in a Rhode Island Agreement for Development of Software to Specifications, ensure all related income is accurately reported to avoid issues.

Yes, a single member LLC is considered a disregarded entity for federal tax purposes, which means you typically report your business income on your personal tax return using Schedule C. However, if you elect to be treated as a corporation, different filing requirements apply. For those entering into a Rhode Island Agreement for Development of Software to Specifications, it’s wise to consult a tax professional to ensure all obligations are met.

To mail your Rhode Island Sales Tax Registration (STR), you will send it to the Rhode Island Division of Taxation. The address is available on their official website, which ensures you get the most accurate and updated information. If your business involves the Rhode Island Agreement for Development of Software to Specifications, keeping these documents organized is crucial for efficient tax filing.