Rhode Island Blind Trust Agreement: A Comprehensive Overview In Rhode Island, a Blind Trust Agreement refers to a legally binding contract established to manage and protect assets while ensuring the removal of any potential conflicts of interest. This trust arrangement enables individuals to separate themselves from the management and control of their assets, thereby preserving confidentiality, minimizing direct influence, and promoting ethical conduct. Key elements of Rhode Island Blind Trust Agreements include: 1. Purpose: The primary objective of a Blind Trust Agreement is to maintain the separation of an individual from their assets, preventing them from having knowledge or control over the trust's investments and decision-making processes. This separation is critical to avoid conflicts of interest in situations where trust assets could influence the individual's decision-making ability. 2. Trustee: A Blind Trust Agreement requires the appointment of an independent and impartial trustee. The trustee assumes full responsibility for managing the trust's assets, making investment decisions, and undertaking transactions solely in the best interest of the beneficiaries. The trustee must possess the necessary qualifications and expertise to prudently administer the trust. 3. Confidentiality: Confidentiality is a paramount aspect of this agreement. The person establishing the trust (the settler) relinquishes any knowledge or control of investment decisions, ensuring that they are unaware of the trust's holdings, transactions, and performance. This confidentiality provision is designed to eliminate conflicts of interest and promote impartiality. 4. Reporting: Although the settler of a Blind Trust Agreement is unaware of the trust's activities, regular reporting on the trust's financial status is crucial. The trustee must regularly update the beneficiaries regarding investment performance, key financial decisions, and any other material information. This reporting fosters transparency and accountability. Types of Rhode Island Blind Trust Agreements: 1. Political Blind Trust: This type of trust agreement is commonly used by politicians and public officials to avoid conflicts of interest while in office. By placing their assets into a blind trust, politicians can eliminate potential bias or influence that may arise from their personal investments, ensuring the public's trust and confidence. 2. Financial Blind Trust: Financial Blind Trust Agreements are often created by individuals who possess substantial wealth or hold significant positions in corporations. By entrusting their assets to a blind trust, they can prevent any personal benefits from influencing their financial decisions, thus promoting fairness and ethical conduct. 3. Testamentary Blind Trust: A Testamentary Blind Trust is established through a person's will and comes into effect upon their death. This type of trust allows individuals to provide ongoing management and protection for their assets even after their demise, ensuring that beneficiaries receive the benefits without any conflicts of interest. In conclusion, a Rhode Island Blind Trust Agreement is a legally binding arrangement designed to eliminate conflicts of interest and promote impartial asset management. Whether utilized by politicians, high-net-worth individuals, or as a testamentary arrangement, these trusts ensure the separation of the individual from their assets, safeguarding confidentiality and ethical conduct.

Rhode Island Blind Trust Agreement

Description

How to fill out Rhode Island Blind Trust Agreement?

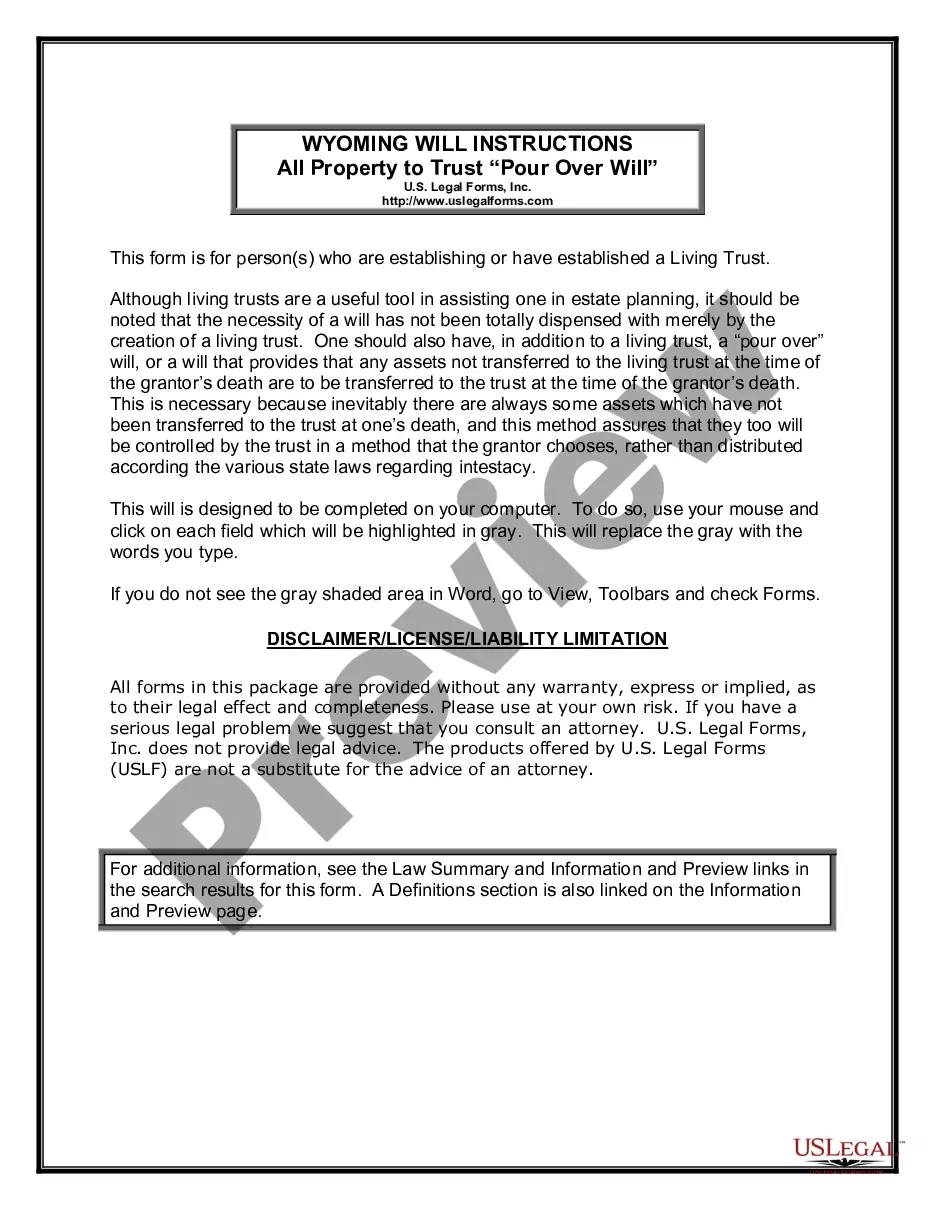

Finding the right authorized file format can be quite a struggle. Naturally, there are a variety of layouts accessible on the Internet, but how would you obtain the authorized kind you want? Use the US Legal Forms website. The assistance gives a huge number of layouts, for example the Rhode Island Blind Trust Agreement, that you can use for enterprise and personal demands. All the kinds are checked by experts and satisfy state and federal specifications.

When you are previously listed, log in to the bank account and click on the Down load button to get the Rhode Island Blind Trust Agreement. Make use of your bank account to search through the authorized kinds you might have purchased formerly. Proceed to the My Forms tab of your respective bank account and acquire one more copy in the file you want.

When you are a new user of US Legal Forms, listed here are simple instructions so that you can comply with:

- Initial, ensure you have chosen the right kind to your city/state. You can examine the shape while using Review button and look at the shape information to guarantee it will be the right one for you.

- In the event the kind will not satisfy your expectations, make use of the Seach area to get the correct kind.

- When you are certain that the shape is suitable, go through the Acquire now button to get the kind.

- Choose the rates plan you would like and enter in the needed info. Build your bank account and purchase the transaction making use of your PayPal bank account or charge card.

- Select the document format and down load the authorized file format to the system.

- Comprehensive, modify and produce and signal the obtained Rhode Island Blind Trust Agreement.

US Legal Forms is definitely the biggest local library of authorized kinds where you can find numerous file layouts. Use the company to down load appropriately-produced papers that comply with condition specifications.

Form popularity

FAQ

A Rhode Island Blind Trust Agreement operates by placing assets under the control of a trustee, who makes decisions without the input of the beneficiaries. This means the trustee handles investments, distributions, and any changes to the trust. The beneficiaries remain unaware of specific details, which helps to eliminate any personal bias and potential conflicts of interest.

One of the most common mistakes parents make with a trust fund is neglecting to properly outline the terms of the trust. Without a clear Rhode Island Blind Trust Agreement that details how funds should be managed and distributed, misunderstandings can arise among beneficiaries. Always consider working with a legal expert to avoid these pitfalls and ensure your wishes are accurately reflected.

A Rhode Island Blind Trust Agreement typically includes certain key properties. First, the trust assets are managed by an independent trustee, who has full discretion over investment choices. Second, the beneficiaries do not have knowledge of the specific assets held within the trust, enhancing privacy and reducing potential conflicts.

While a Rhode Island Blind Trust Agreement can offer privacy and minimize conflicts of interest, it also comes with drawbacks. One significant con is the lack of control over the trust assets. Beneficiaries cannot influence investment decisions, which may lead to undesirable outcomes if the trustee does not act in the best interest of the beneficiaries.

A trust should file tax returns in the state where it is created or where it resides. If your trust is a Rhode Island Blind Trust Agreement, it must file in Rhode Island. This is essential for ensuring compliance with local regulations and taxation. If you're unsure, consulting with a tax professional can help clarify the requirements specific to your situation.

Creating a trust in Rhode Island involves several steps, including identifying your goals and selecting a trustworthy trustee. You will need to draft a Rhode Island Blind Trust Agreement that clearly articulates your wishes and instructions. For guidance in this complex process, consider utilizing resources from USLegalForms to ensure compliance with state laws and to simplify the documentation.

A blind trust agreement is a legal arrangement where the trustee manages the assets without the beneficiary’s knowledge about the trust's holdings. This setup ensures that beneficiaries can avoid conflicts of interest, especially in financial matters. Implementing a Rhode Island Blind Trust Agreement can protect your interests while providing peace of mind. Understanding its terms is vital for all parties involved.

Yes, Rhode Island does accept federal extensions for tax filings. If you have filed an extension federally, you will automatically receive the same extension for your Rhode Island Blind Trust Agreement submissions. This can alleviate stress and give you more time to prepare your tax documents thoroughly. It is important to stay informed about any specific state requirements regarding this process.

To set up a trust in Rhode Island, start by defining the trust’s purpose and selecting a trustee. Once you have a clear vision, you can draft the Rhode Island Blind Trust Agreement, outlining all terms and conditions. For legal verification and assistance, consider using platforms like USLegalForms to ensure a smooth and compliant setup process tailored to your needs.

Yes, you can file for an extension for a trust tax return. This allows you additional time to gather necessary financial information without incurring penalties. However, it is important to note that an extension does not delay the due date for any taxes owed. Ensure that you meet all requirements to maintain the integrity of your Rhode Island Blind Trust Agreement.