If you have to total, acquire, or print lawful record templates, use US Legal Forms, the largest selection of lawful varieties, that can be found online. Use the site`s basic and convenient research to obtain the files you need. Numerous templates for enterprise and personal purposes are sorted by types and suggests, or search phrases. Use US Legal Forms to obtain the Rhode Island Application and Loan Agreement for a Business Loan with Warranties by Borrower in just a number of mouse clicks.

In case you are currently a US Legal Forms customer, log in to your bank account and click the Download switch to get the Rhode Island Application and Loan Agreement for a Business Loan with Warranties by Borrower. You can even entry varieties you in the past acquired from the My Forms tab of your own bank account.

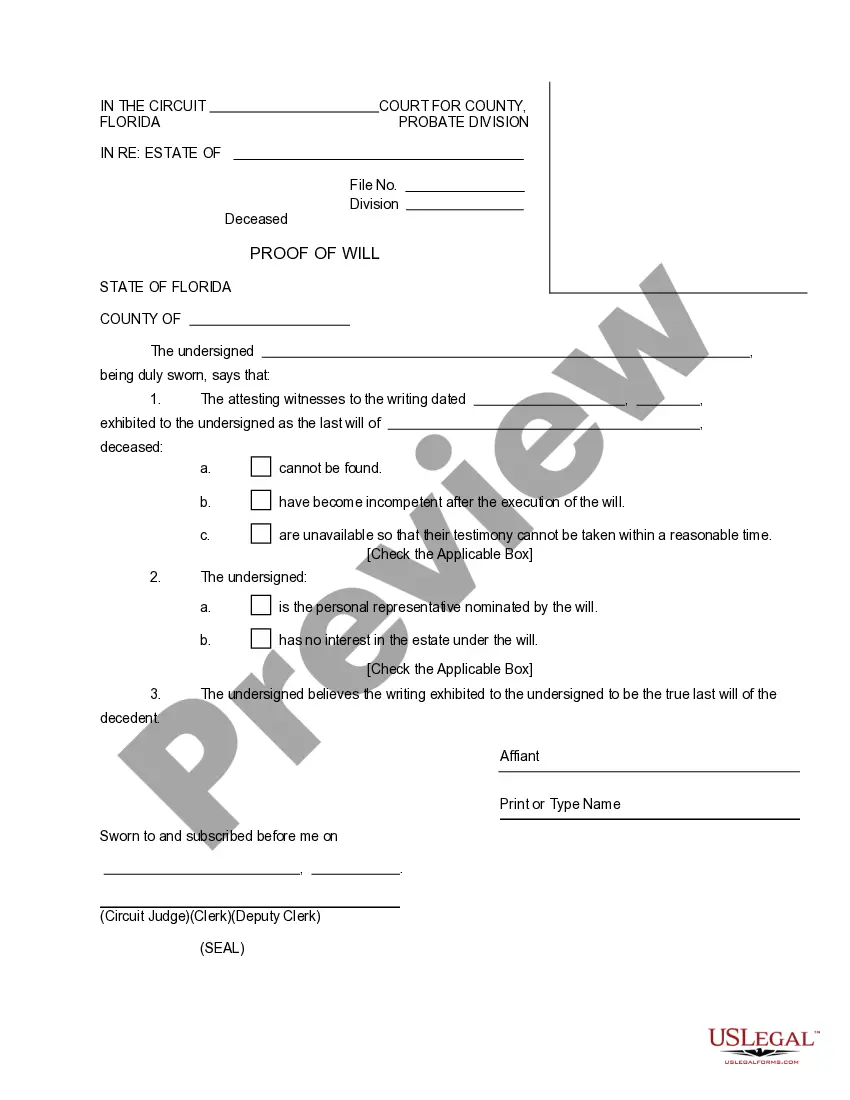

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for the proper town/nation.

- Step 2. Take advantage of the Review choice to examine the form`s content. Never neglect to see the outline.

- Step 3. In case you are not satisfied with the develop, take advantage of the Search industry at the top of the display to find other types from the lawful develop web template.

- Step 4. Upon having located the form you need, click the Buy now switch. Opt for the pricing program you prefer and add your references to register to have an bank account.

- Step 5. Method the purchase. You may use your bank card or PayPal bank account to perform the purchase.

- Step 6. Pick the structure from the lawful develop and acquire it on your own device.

- Step 7. Complete, edit and print or indicator the Rhode Island Application and Loan Agreement for a Business Loan with Warranties by Borrower.

Every lawful record web template you acquire is your own property forever. You have acces to each develop you acquired within your acccount. Select the My Forms portion and pick a develop to print or acquire yet again.

Compete and acquire, and print the Rhode Island Application and Loan Agreement for a Business Loan with Warranties by Borrower with US Legal Forms. There are thousands of specialist and condition-distinct varieties you can use for the enterprise or personal needs.