Rhode Island Invoice Template for Lecturer

Description

How to fill out Invoice Template For Lecturer?

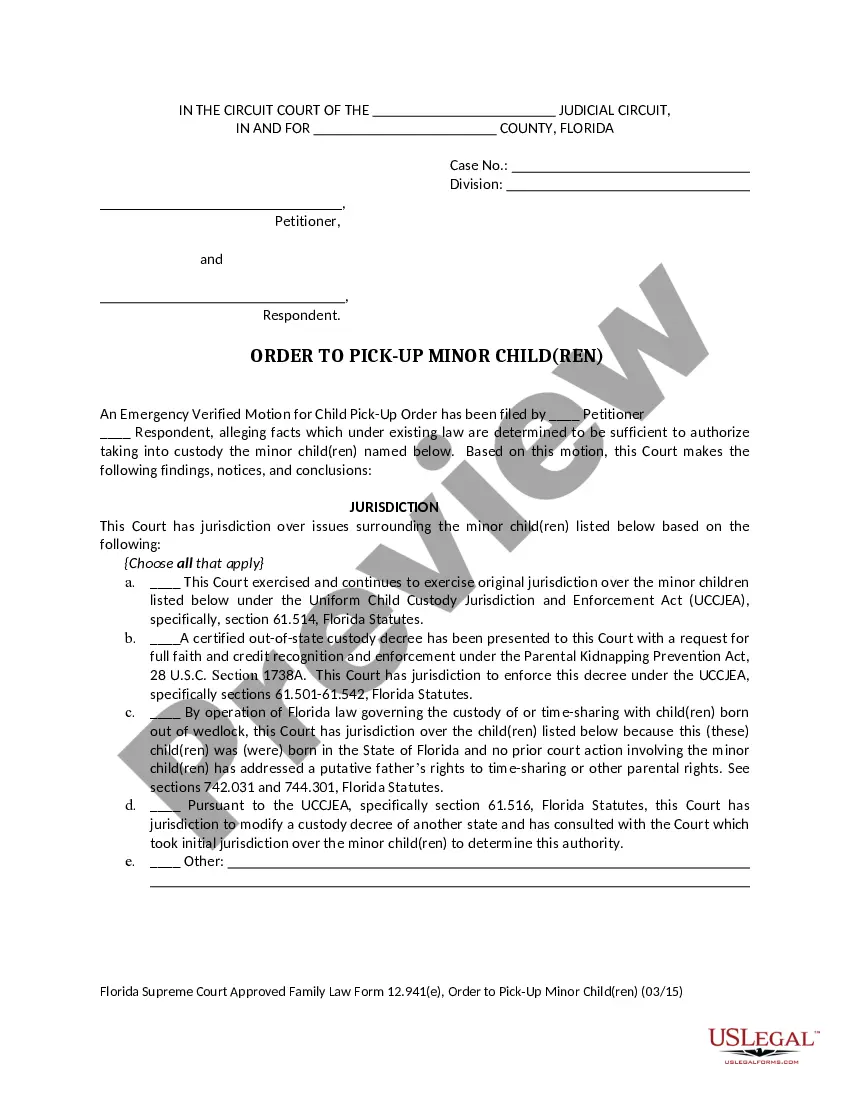

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad array of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or search terms. You can find the latest updates of forms like the Rhode Island Invoice Template for Lecturer within moments.

If you are already registered, Log In to download the Rhode Island Invoice Template for Lecturer from the US Legal Forms database. The Download button will be visible on every form you examine.

Next, select the pricing plan you desire and provide your information to register for an account.

You can make the payment via credit card or PayPal to finalize the transaction. Choose the format and download the form to your device. Edit the document, complete it, and print and sign the saved Rhode Island Invoice Template for Lecturer. Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Rhode Island Invoice Template for Lecturer with US Legal Forms, the most comprehensive library of legal document templates. Utilize countless professional and state-specific templates that meet your business or personal needs.

- You have access to all previously saved forms within the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for the city/county.

- Click the Preview button to review the form’s details.

- Read the form description to ensure you have chosen the right document.

- If the form does not fulfill your requirements, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Purchase now button.

Form popularity

FAQ

Individuals and businesses earning income in Rhode Island are required to file a tax return, which includes residents and non-residents. Additionally, certain thresholds may apply depending on the type of income earned. If you are using a Rhode Island Invoice Template for Lecturer, make sure to assess your filing requirements to stay compliant and avoid issues.

The mandate for Rhode Island involves various tax regulations and reporting requirements designed to maintain financial integrity and support state services. Compliance with these mandates ensures that businesses contribute to the state's economy. When working with a Rhode Island Invoice Template for Lecturer, ensure your invoicing practices align with these mandates to avoid penalties.

Yes, e-filing is mandatory for certain tax returns and forms in Rhode Island, as it accelerates processing times and enhances accuracy. This requirement makes it easier for taxpayers to comply with state regulations. Utilizing an efficient Rhode Island Invoice Template for Lecturer can streamline your e-filing process, making compliance simpler.

The R.I. 1065 form must be filed by partnerships operating within Rhode Island, regardless of their income levels. This form reports the business income, deductions, and credits for each partner. If you're managing an educational partnership using a Rhode Island Invoice Template for Lecturer, filing this form accurately is crucial for compliance.

Yes, Rhode Island requires businesses to issue a 1099 form for certain payments made to independent contractors and non-employees. These forms report income not subject to payroll taxes, ensuring compliance and proper reporting. When using a Rhode Island Invoice Template for Lecturer, keep in mind the importance of 1099 forms for any payments you receive.

Rhode Island mandates electronic filing for specific forms and tax returns to streamline the process and enhance efficiency. This requirement applies to businesses filing returns with higher revenue thresholds. If you are using a Rhode Island Invoice Template for Lecturer, ensure you are aware of e-file options to simplify your filing experience.

The Rhode Island Pass-Through Entity (PTE) tax is a tax imposed on the income of pass-through entities, such as partnerships and S corporations. This tax enables entity owners to deduct the state tax from their personal returns. If you're a lecturer working with a Rhode Island Invoice Template for Lecturer, understanding this tax can help you manage your finances better.