If you have to comprehensive, acquire, or printing legitimate record layouts, use US Legal Forms, the biggest selection of legitimate forms, that can be found on the web. Utilize the site`s basic and convenient lookup to obtain the files you require. Numerous layouts for company and specific functions are categorized by classes and states, or keywords and phrases. Use US Legal Forms to obtain the Rhode Island Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement in a handful of mouse clicks.

Should you be already a US Legal Forms client, log in to the accounts and click the Acquire button to have the Rhode Island Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement. You can even gain access to forms you in the past saved in the My Forms tab of the accounts.

If you are using US Legal Forms the first time, refer to the instructions beneath:

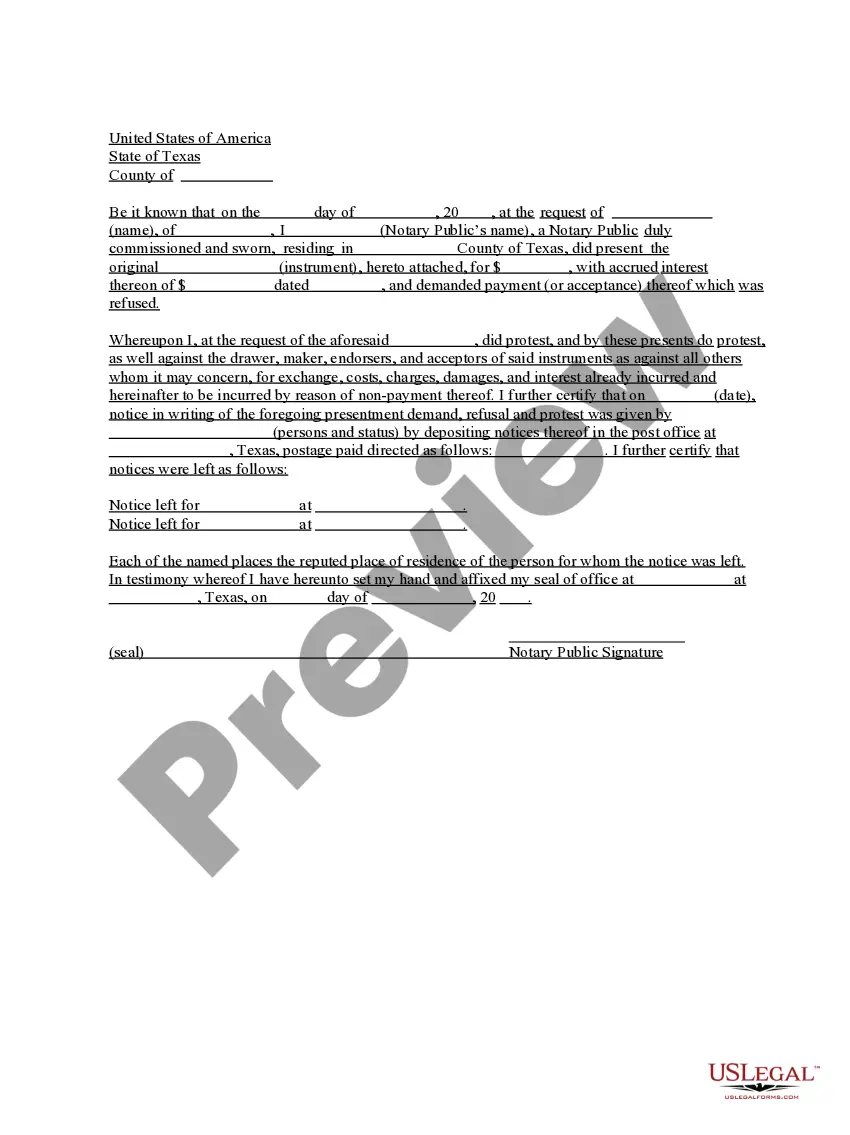

- Step 1. Be sure you have chosen the shape to the proper area/land.

- Step 2. Utilize the Preview choice to examine the form`s content material. Don`t forget about to see the explanation.

- Step 3. Should you be unhappy with the form, make use of the Lookup field on top of the screen to get other models from the legitimate form template.

- Step 4. When you have found the shape you require, click the Buy now button. Opt for the rates strategy you choose and include your accreditations to register for the accounts.

- Step 5. Procedure the financial transaction. You should use your charge card or PayPal accounts to finish the financial transaction.

- Step 6. Select the formatting from the legitimate form and acquire it on your product.

- Step 7. Total, revise and printing or signal the Rhode Island Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement.

Every single legitimate record template you get is yours permanently. You might have acces to every form you saved in your acccount. Go through the My Forms section and decide on a form to printing or acquire yet again.

Remain competitive and acquire, and printing the Rhode Island Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement with US Legal Forms. There are thousands of professional and status-specific forms you can utilize for your personal company or specific needs.