Partnership agreements are written documents that explicitly detail the relationship between the business partners and their individual obligations and contributions to the partnership. Since partnership agreements should cover all possible business situations that could arise during the partnership's life, the documents are often complex; legal counsel in drafting and reviewing the finished contract is generally recommended. If a partnership does not have a partnership agreement in place when it dissolves, the guidelines of the Uniform Partnership Act and various state laws will determine how the assets and debts of the partnership are distributed.

Rhode Island Partnership Agreement Between Accountants

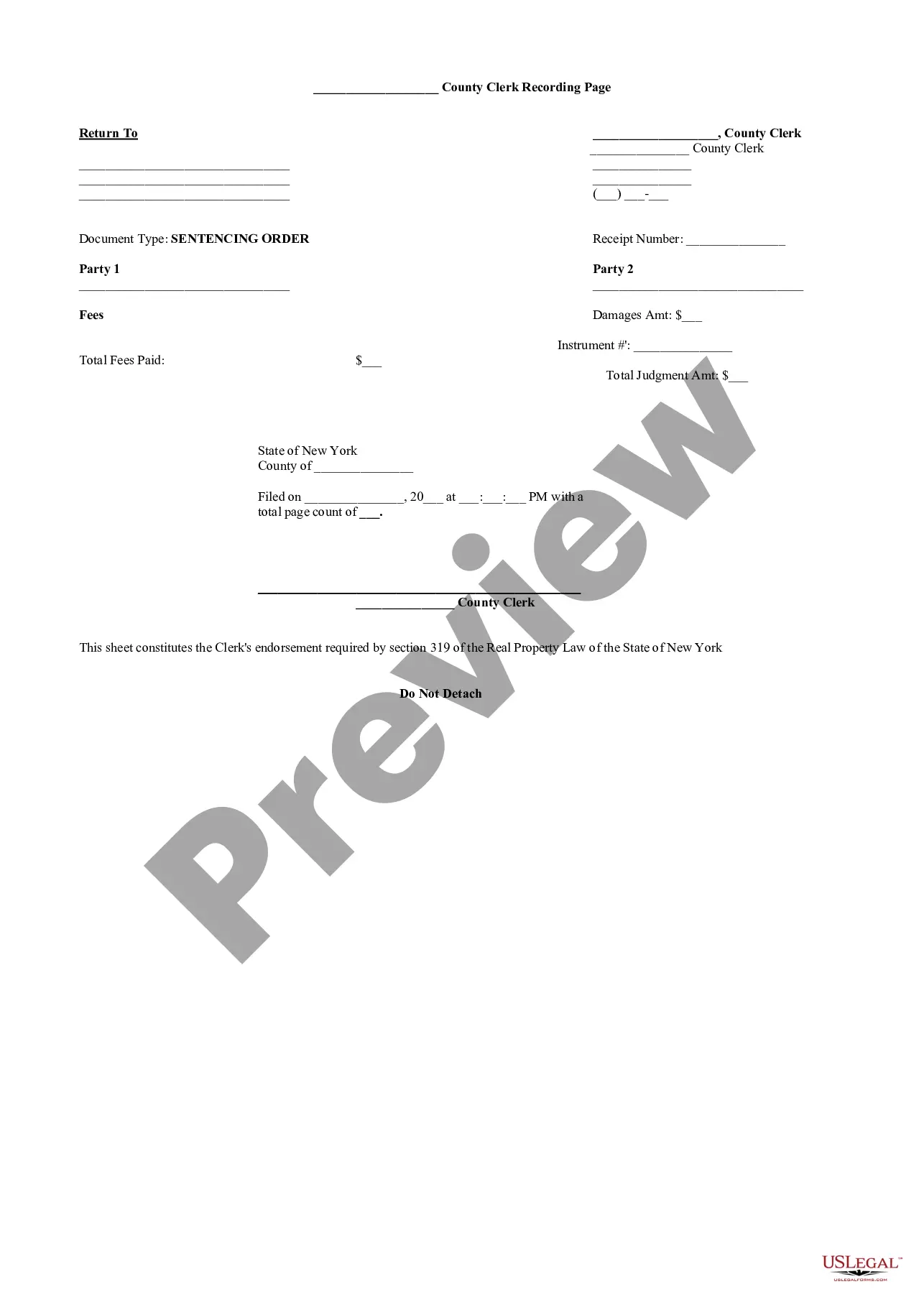

Description

How to fill out Partnership Agreement Between Accountants?

If you require to calculate, acquire, or create official document templates, utilize US Legal Forms, the leading repository of legal forms, accessible online.

Take advantage of the website's straightforward and user-friendly search feature to locate the documents you need.

A variety of templates for corporate and personal purposes are organized by categories and regions, or keywords.

Step 4. After finding the form you need, click on the Purchase now button. Select your preferred pricing plan and enter your details to create an account.

Step 5. Complete the transaction. You can use your Мisa or Ьastercard or PayPal account to finalize the payment.

- Use US Legal Forms to find the Rhode Island Partnership Agreement Between Accountants in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Rhode Island Partnership Agreement Between Accountants.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If it’s your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct state/region.

- Step 2. Use the Preview option to review the form's content. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to explore other versions of the legal form template.

Form popularity

FAQ

The four primary types of partnerships are general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type comes with distinct features and liabilities for the partners involved. Understanding these structures can help you make informed decisions when drafting a Rhode Island Partnership Agreement Between Accountants, ensuring your partnership is set up correctly for your specific needs.

member LLC in Rhode Island does not typically need to file Form 1065, as it is considered a disregarded entity for tax purposes. However, if the singlemember LLC has elected to be treated as a corporation, different filing requirements may apply. For proper guidance on this matter, consider consulting with your accountant or using resources related to the Rhode Island Partnership Agreement Between Accountants.

Getting a partnership agreement can be straightforward. Start by identifying the partners and capturing their agreements regarding the partnership terms in a written document. Opt for a Rhode Island Partnership Agreement Between Accountants template from US Legal Forms to ensure your agreement adheres to local laws and is comprehensive enough to protect all partners' interests.

Acquiring a partnership agreement typically involves drafting a document that outlines the terms of the partnership, including roles, responsibilities, and profit-sharing. You can create a Rhode Island Partnership Agreement Between Accountants using templates available on online legal platforms, such as US Legal Forms, to ensure that all legal requirements are met. It is wise to consult with a legal professional if you have specific concerns.

To obtain proof of partnership, you should first ensure that your Rhode Island Partnership Agreement Between Accountants is properly drafted and signed by all parties involved. This agreement acts as official documentation of the partnership's existence and terms. If you need further assistance, consider using platforms like US Legal Forms to generate an appropriate agreement tailored to your needs.

To structure a partnership agreement effectively, start by defining the roles and contributions of each partner. Include details about profit-sharing ratios, decision-making processes, and procedures for resolving conflicts. Utilizing a service like USLegalForms can help you create a comprehensive Rhode Island Partnership Agreement Between Accountants that covers all necessary elements, ensuring your partnership runs smoothly.

A partnership agreement in accounting is a detailed document specifying the operational and financial arrangements of a partnership. It addresses aspects like profit sharing, decision-making authority, and the distribution of responsibilities among partners. Creating a Rhode Island Partnership Agreement Between Accountants ensures that all critical financial details are transparent and agreed upon, aiding in smoother business operations.

An example of a partnership agreement could include stipulations about capital contributions, how decisions will be made, and the processes for dissolving the partnership. For accountants in Rhode Island, a Rhode Island Partnership Agreement Between Accountants might specify the division of labor along with how profits and losses will be shared among the partners. This clarity helps to streamline operations and promotes a healthy working relationship.

Yes, partnership agreements are generally enforceable as long as they comply with state laws and regulations. In Rhode Island, a properly drafted partnership agreement between accountants will hold legal weight and can be upheld in court if disputes arise. Having this legal document in place protects the interests of all partners involved.

The meaning of a partnership agreement lies in its role as a legal framework guiding a partnership's operations. It lays down the terms that partners agree upon, including their investment, profit sharing, and conflict resolution strategies. A Rhode Island Partnership Agreement Between Accountants is crucial for smooth collaboration and long-term success.