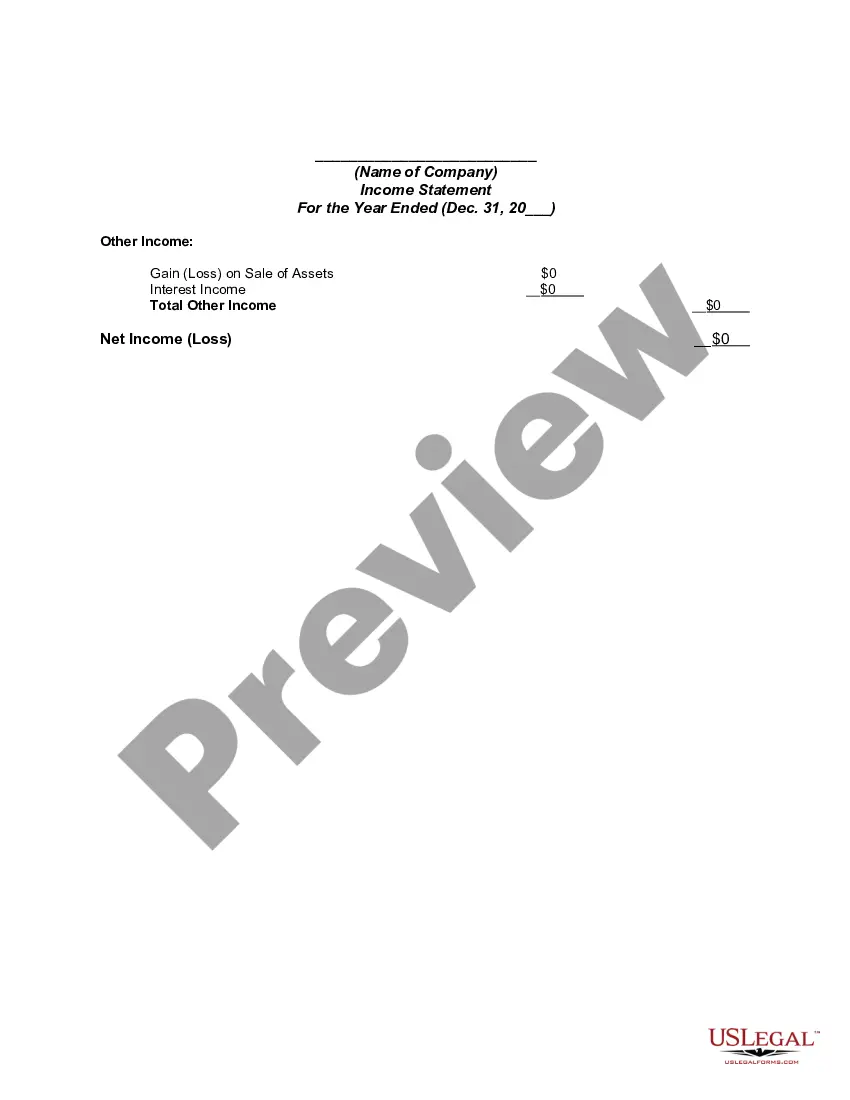

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Rhode Island Income Statement: A Comprehensive Overview Keywords: Rhode Island, Income Statement, Revenue, Expenses, Financial Reporting, Accounting, Types. Introduction: The Rhode Island Income Statement is a crucial financial report that provides an overview of an entity's revenues, expenses, gains, and losses over a specific period. This statement plays a vital role in evaluating the profitability and financial performance of businesses, organizations, or individuals residing in Rhode Island. It allows stakeholders, such as investors, creditors, and management, to assess the company's ability to generate profits and effectively manage expenses. Components of the Rhode Island Income Statement: 1. Revenues: This section showcases the total income earned by the entity during a specific period. It encompasses sources such as sales of goods or services, rental income, interest earned, and other operating revenues. The revenue section helps understand the primary activities generating income for the entity. 2. Cost of Goods Sold (COGS): This category includes the direct costs incurred to produce or deliver the goods or services sold. It incorporates expenses such as raw materials, direct labor, and manufacturing overheads directly related to the production process. The COGS are particularly relevant for manufacturing or retail businesses operating in Rhode Island. 3. Operating Expenses: Operating expenses include all the costs incurred to run day-to-day operations, excluding COGS. These expenses cover various activities like administrative expenses, selling expenses, marketing expenses, and research and development costs. Common examples of operating expenses in Rhode Island might include employee salaries, rent, utilities, insurance, and advertising costs. 4. Non-Operating Revenues and Expenses: This section comprises any revenue or expense not directly associated with the entity's core operations. Non-operating revenues might include income from investments, gains from asset sales, or rental incomes not generated through the usual course of business. Conversely, non-operating expenses might include interest paid on loans, loss on sale of assets, or legal settlements. 5. Pre-Tax Income: It calculates the entity's earnings before considering income taxes. It represents the overall profitability of the entity and is crucial for determining tax liabilities in Rhode Island. 6. Income Tax Expense: This item reflects the taxes that the entity owes to the state of Rhode Island. The tax rate applicable to the entity influences the final amount of tax expense reported. 7. Net Income: Net income represents the final profit or loss earned by the entity after considering all the revenue, expenses, and taxes. It is a critical metric for assessing the financial performance of the organization. Types of Rhode Island Income Statements: Although the general structure and components of the income statement remain the same across entities, there might be specific formats or classifications prescribed by different regulatory bodies or accounting standards. Some variations in the Rhode Island Income Statement may include: 1. Single-step Income Statement: This format presents all revenues and gains in one section and all expenses and losses in another without categorizing them further. It provides a concise and straightforward representation of the income statement. 2. Multi-step Income Statement: This format classifies revenues and expenses into different categories, allowing for a more detailed analysis of the entity's financial performance. It typically includes operating revenues, COGS, and various types of operating expenses. Conclusion: The Rhode Island Income Statement is a fundamental financial report that provides an overview of an entity's financial performance over a specific period. Revenue, expenses, gains, and losses form the core components of this statement. Understanding and analyzing the income statement help stakeholders make informed decisions, assess profitability, and evaluate the financial health of businesses or organizations operating in Rhode Island.