Rhode Island Receipt and Withdrawal from Partnership

Description

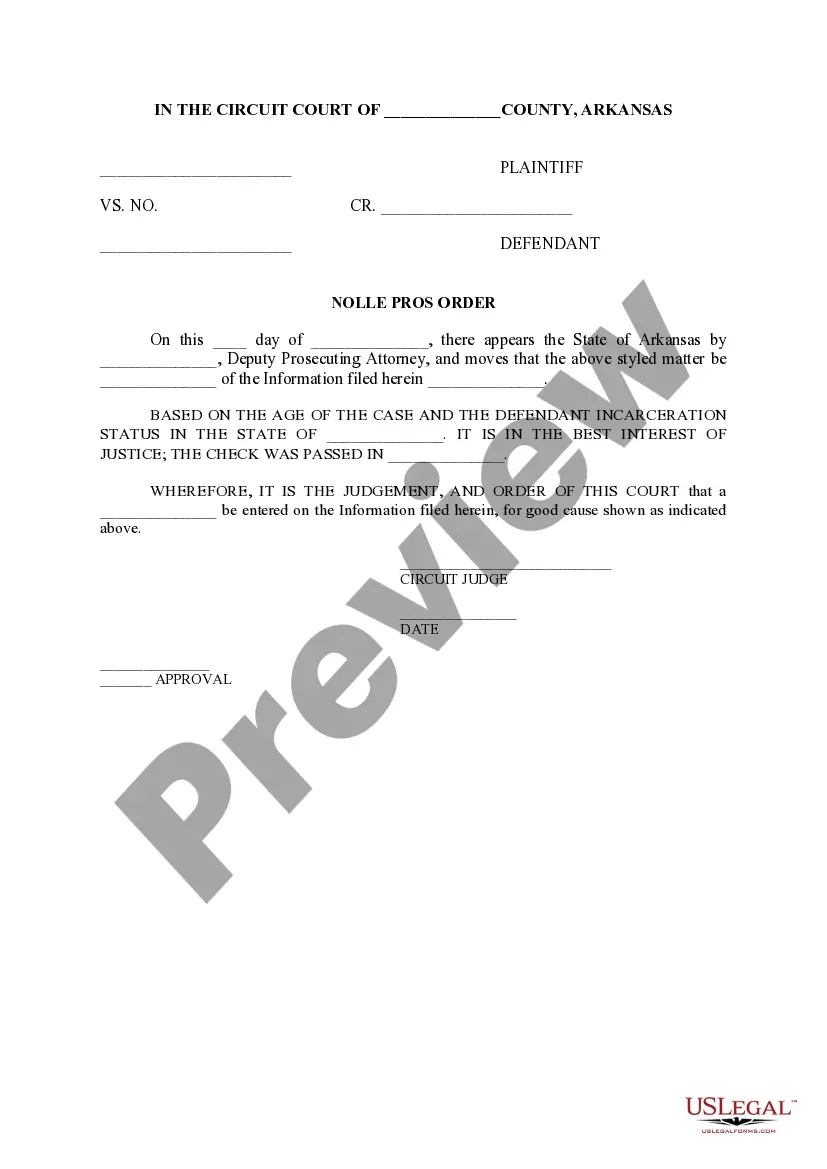

How to fill out Receipt And Withdrawal From Partnership?

You might spend numerous hours on the web trying to discover the proper legal document format that meets the requirements of state and federal regulations you need.

US Legal Forms offers a vast array of legal templates that can be reviewed by professionals.

You can easily download or print the Rhode Island Receipt and Withdrawal from Partnership from the service.

If available, utilize the Preview button to view the document format simultaneously.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Rhode Island Receipt and Withdrawal from Partnership.

- Every legal document format you obtain is yours indefinitely.

- To receive another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, adhere to the simple instructions below.

- First, ensure that you have chosen the correct document format for the state/city you select.

- Review the form description to make certain you have selected the appropriate form.

Form popularity

FAQ

With 1040NOW, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if: You live in Rhode Island and your federal adjusted gross income for 2021 was $32,000 or less.

Every business corporation, joint stock company or association exercising corporation functions or otherwise doing business in this state is required to file an annual tax return using Form RI-1120C and is subject to the income tax (minimum $400.00) under R.I. Gen. Laws § 44-11-2.

If your business is organized as a partnership, your income tax return or extension is due by the 15th day of the 3rd month after the end of your tax year. For example, if your partnership is a calendar year taxpayer, with a December 31 year end, you must file a 2021 tax return or extension request by March 15, 2022.

Partnerships must file copies of the K-1 forms with their Form 1065. The filing deadline for Form 1065 is March 15th. Most partnerships can file the forms either electronically or by mail.

Extensions - Rhode Island allows an automatic extension to October 15 if no additional tax is due and if a federal extension is filed.

Rhode Island has a graduated individual income tax, with rates ranging from 3.75 percent to 5.99 percent. Rhode Island also has a 7.00 percent corporate income tax rate.

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

Entities treated as partnerships for federal tax purposes must file Form RI-1065.

For corporations operating on a calendar year, this deadline is on April 15. To file an extension for Form RI-1120C, apply for an extension using Form RI-7004 on or before the same date the business tax return is due. Form RI-7004 grants an automatic 6-month extension of time to file Form RI-1120C.

EFile your Rhode Island tax return now We last updated Rhode Island Schedule W in February 2021 from the Rhode Island Division of Taxation. This form is for income earned in tax year 2021, with tax returns due in April 2022.