Rhode Island Contract for the International Sale of Goods with Purchase Money Security Interest

Description

How to fill out Contract For The International Sale Of Goods With Purchase Money Security Interest?

Have you ever found yourself in a situation where you require documents for either business or personal purposes almost every day.

There is an abundance of legal document templates available online, but locating ones that you can trust is challenging.

US Legal Forms offers thousands of template documents, including the Rhode Island Contract for the International Sale of Goods with Purchase Money Security Interest, specifically designed to meet federal and state requirements.

Choose the pricing plan you want, provide the necessary details to create your account, and complete the transaction using your PayPal or credit card.

Select a preferred document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can download a new copy of the Rhode Island Contract for the International Sale of Goods with Purchase Money Security Interest anytime, if necessary. Just follow the necessary steps to download or print the document template.

Utilize US Legal Forms, the largest collection of legal forms, to save time and minimize mistakes. The service provides expertly crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Rhode Island Contract for the International Sale of Goods with Purchase Money Security Interest template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/state.

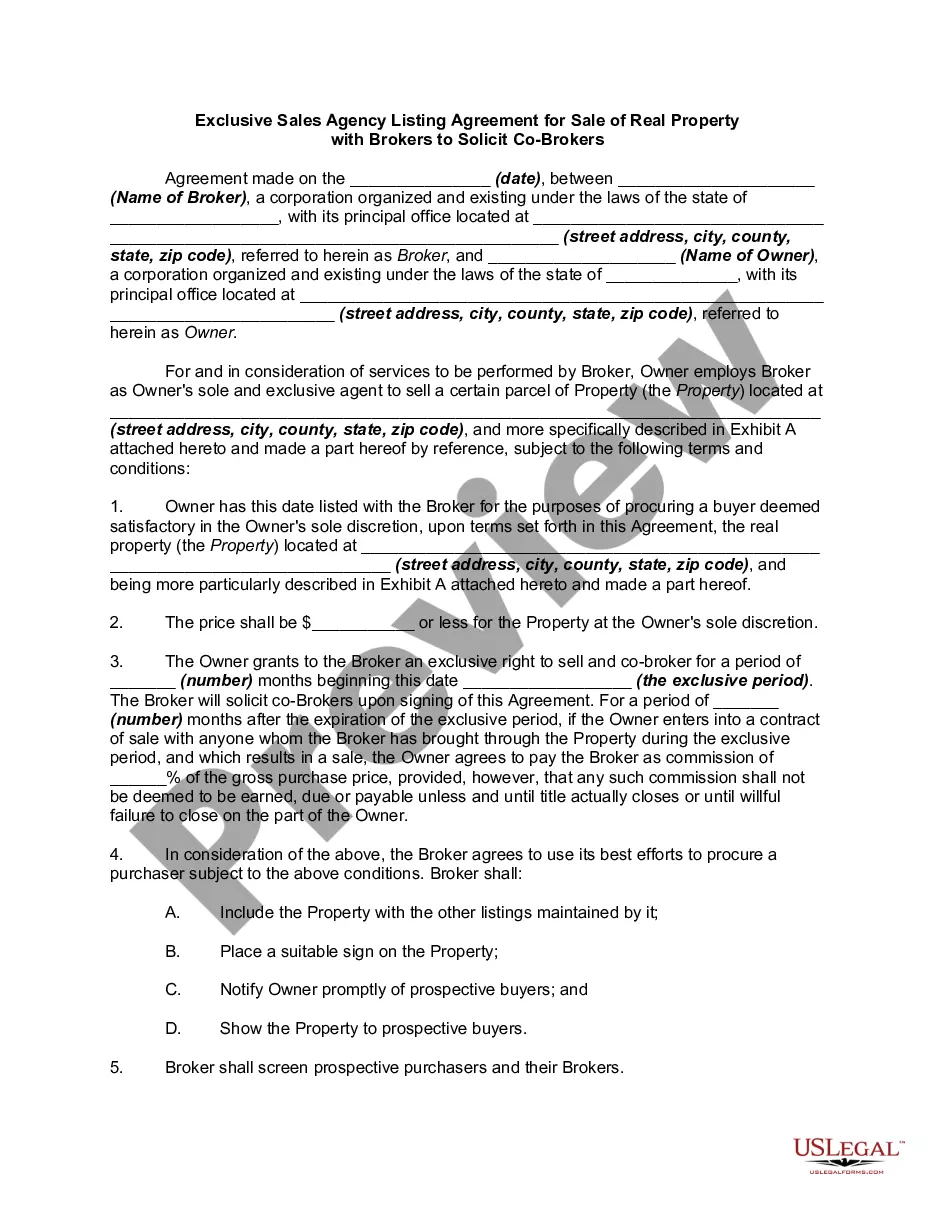

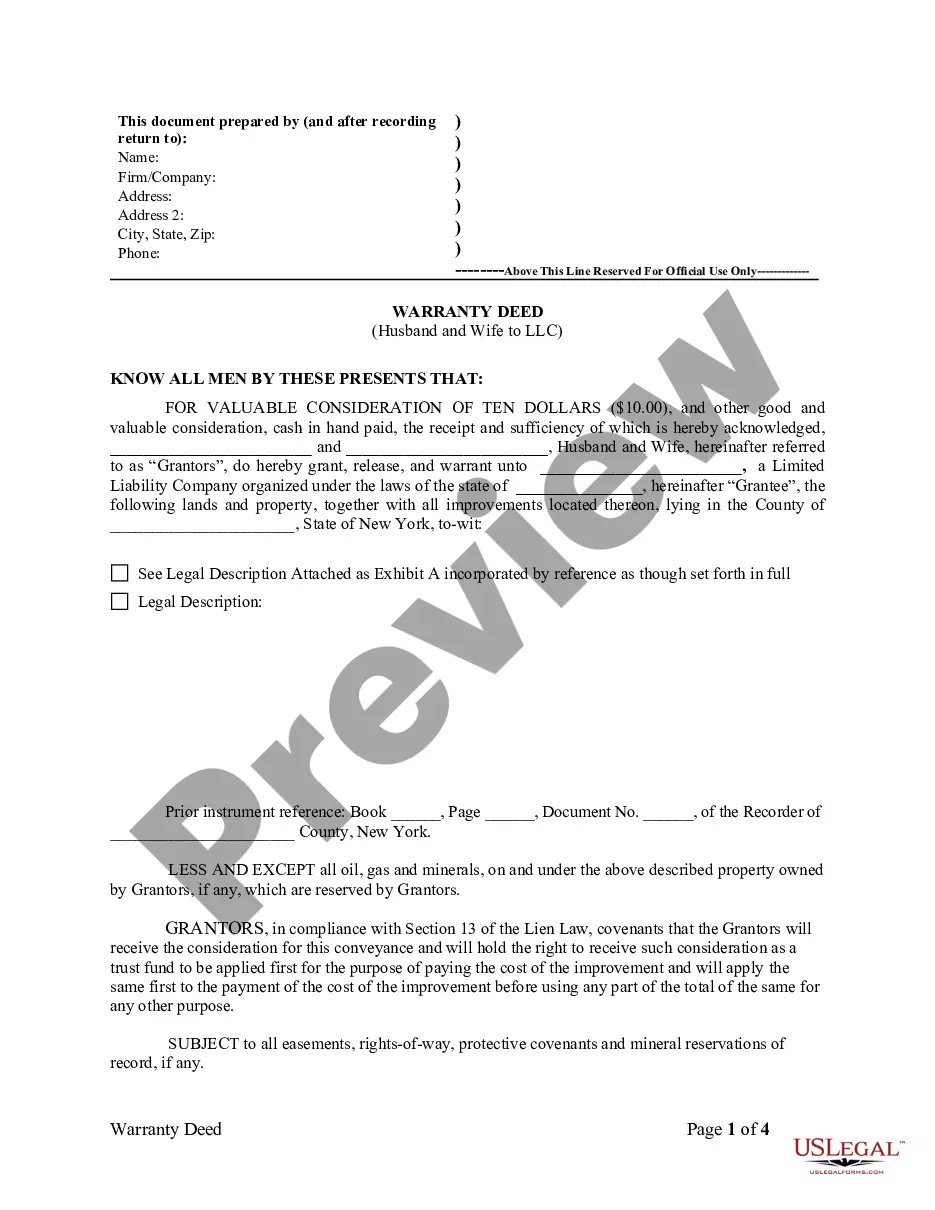

- Utilize the Review button to assess the document.

- Check the summary to ensure you have selected the correct template.

- If the document does not meet your needs, use the Search box to find the template that fits your criteria.

- Once you have obtained the correct document, click Get now.

Form popularity

FAQ

A PMSI is used by some commercial lenders and credit card issuers as well as by retailers who offer financing options. It effectively gives them collateral to confiscate if a borrower defaults on payment for a large purchase. It also is used in business-to-business (B2B) transactions.

In other words, a PMSI is created when a creditor loans money to a debtor to finance the purchase of certain goods. And in return, the debtor grants the creditor a security interest in those goods.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

A security interest granted by a buyer of goods to the seller thereof that secures the deferred payment of the purchase price would generally be a PMSI, as would a security interest granted by a buyer to a lender that advances funds to the buyer to enable the buyer to buy goods from a seller to secure such advances.

PURCHASE-MONEY SECURITY INTEREST; APPLICATION OF PAYMENTS; BURDEN OF ESTABLISHING. (a) Definitions. In this section: (1) "purchase-money collateral" means goods or software that secures a purchase-money obligation incurred with respect to that collateral; and.

However, generally speaking, the primary ways for a secured party to perfect a security interest are:by filing a financing statement with the appropriate public office.by possessing the collateral.by "controlling" the collateral; or.it's done automatically upon attachment of the security interest.

A PMSI is automatically perfected when the security agreement attaches to collateral that is consumer goods. Consumer goods are goods primarily for personal use by the purchaser rather than for business use or resale.

Related Content. A special type of security interest provided for under the Uniform Commercial Code (UCC) that enables a seller who sells goods on credit to obtain a superpriority security interest in the goods to secure the buyer's obligation to pay the deferred purchase price.

According to UCC Article 9, a purchase money security interest (PMSI) is a special type of security interest that enables those who finance a debtor's acquisition of goods to acquire a first priority security interest in the purchase-money collateral.