[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Executor's Name] [Executor's Address] [City, State, ZIP] Subject: Rhode Island Sample Letter for Decedent's Real Estate Transaction Dear [Executor's Name], I hope this letter finds you well during these challenging times. I am writing to provide you with a detailed description of the Rhode Island Sample Letter for Decedent's Real Estate Transaction, which will help guide you through the necessary steps as you navigate the intricate process of settling the estate. 1. Introduction to the Rhode Island Sample Letter for Decedent's Real Estate Transaction: — This sample letter serves as a template specifically designed for real estate transactions involving a deceased individual in Rhode Island. — It aims to provide a comprehensive and legally compliant framework for the executor to follow while maintaining transparency and professionalism throughout the process. — The letter is typically used when a decedent's property needs to be sold, transferred, or otherwise disposed of as part of the estate administration. 2. Key Components of the Rhode Island Sample Letter for Decedent's Real Estate Transaction: a. Salutation and Introduction: — Start the letter by addressing the intended recipient, the executor, with a respectful salutation. — Introduce yourself and your relationship to the decedent, such as an attorney, real estate agent, or interested party. b. Property Details: — Clearly state the full address, legal description, and any other identifying information of the property held by the decedent. — Include relevant information regarding the property's title, any existing liens or mortgages, and the estimated fair market value. c. Executor's Authorization: — The letter should include a statement declaring that the executor is authorized to act on behalf of the decedent's estate in matters regarding real estate transactions. d. Intentions of Real Estate Transaction: — The executor must outline their intentions for the real estate transaction, whether it involves selling, transferring, or otherwise disposing of the property. — If the decision is to sell the property, mention the method of sale, listing agreements, planned open houses, and any necessary repairs or improvements. e. Compliance with Rhode Island Laws: — Emphasize the importance of adhering to Rhode Island state laws and regulations governing real estate transactions, ensuring that all legal requirements are met throughout the process. f. Contact and Communication Details: — Provide all essential contact information, including your address, phone number, and email address. — Encourage the executor to reach out with any questions or concerns they may have regarding the real estate transaction. 3. Example Types of Rhode Island Sample Letters for Decedent's Real Estate Transaction: — Sample Letter for Decedent's Real Estate Sale Transaction — Sample Letter for Decedent's Real Estate Transfer Transaction — Sample Letter for Decedent's Real Estate Disposition Transaction Please note that the provided description and sample letters serve as a general guideline, and it is crucial to consult with legal professionals or real estate experts to ensure compliance with specific Rhode Island laws and regulations that may apply to your unique situation. Thank you for your attention to this matter. If you need further assistance, please do not hesitate to reach out. We are here to support you through this challenging process. Sincere regards, [Your Name]

Rhode Island Sample Letter for Decedent's Real Estate Transaction

Description

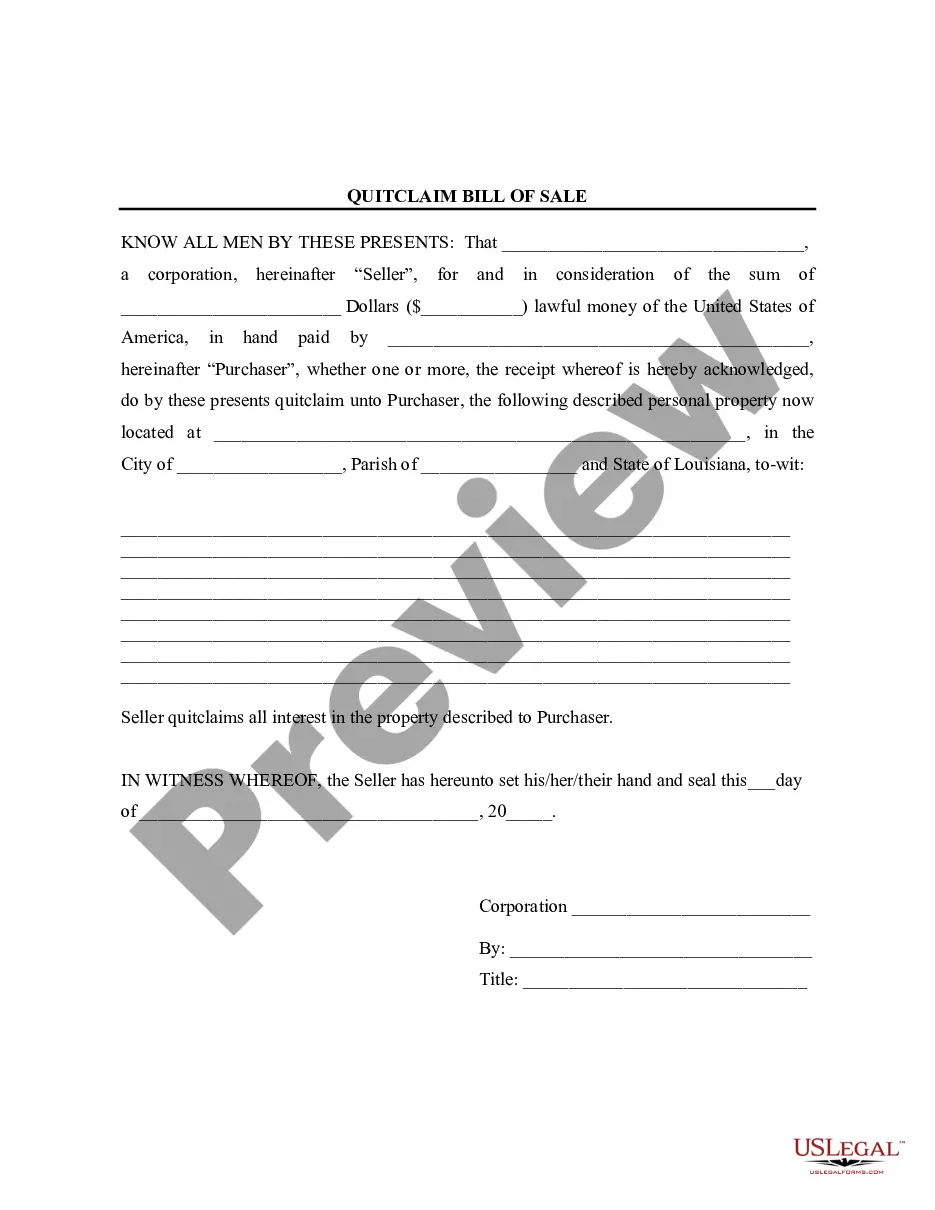

How to fill out Rhode Island Sample Letter For Decedent's Real Estate Transaction?

US Legal Forms - among the greatest libraries of legal forms in the United States - provides a wide range of legal document web templates it is possible to down load or printing. While using web site, you can find 1000s of forms for business and individual purposes, categorized by types, suggests, or search phrases.You will find the latest variations of forms much like the Rhode Island Sample Letter for Decedent's Real Estate Transaction in seconds.

If you already possess a subscription, log in and down load Rhode Island Sample Letter for Decedent's Real Estate Transaction from the US Legal Forms catalogue. The Obtain key will appear on every single form you perspective. You gain access to all earlier acquired forms from the My Forms tab of your own accounts.

In order to use US Legal Forms initially, allow me to share simple recommendations to obtain began:

- Be sure to have chosen the right form for your town/area. Click the Preview key to examine the form`s content. See the form explanation to ensure that you have chosen the proper form.

- If the form doesn`t satisfy your specifications, utilize the Look for discipline on top of the monitor to get the the one that does.

- In case you are content with the form, validate your selection by visiting the Acquire now key. Then, choose the rates strategy you prefer and supply your accreditations to register for an accounts.

- Method the deal. Use your Visa or Mastercard or PayPal accounts to perform the deal.

- Pick the formatting and down load the form in your device.

- Make adjustments. Complete, edit and printing and signal the acquired Rhode Island Sample Letter for Decedent's Real Estate Transaction.

Each format you included in your money lacks an expiry date and is the one you have for a long time. So, if you wish to down load or printing another duplicate, just go to the My Forms area and click on about the form you require.

Get access to the Rhode Island Sample Letter for Decedent's Real Estate Transaction with US Legal Forms, probably the most considerable catalogue of legal document web templates. Use 1000s of specialist and status-specific web templates that meet up with your small business or individual requirements and specifications.

Form popularity

FAQ

For decedents dying on or after January 1, 2023, the credit amount is $80,395, exempting from taxation the first $1,733,264 of an estate. This means that, in general, if a decedent passes away in 2023, a net taxable estate valued at $1,733,264, or less, will not be subject to Rhode Island's Estate Tax.

There is no inheritance tax in Rhode Island. It is possible, though, that the laws of another state could apply to you if the person passing money on to you died there. In Pennsylvania, for example, the inheritance tax applies to out of state heirs for in-state decedents. Rhode Island also has no gift tax.

Here are 4 ways to protect your inheritance from taxes: See if the alternate valuation date will help. For tax purposes, the estates are evaluated based on their fair market value at the time of the decedent's death. ... Transfer your assets into a trust. ... Minimize IRA distributions. ... Make charitable gifts.

Inheritances aren't considered income for federal tax purposes, but subsequent earnings on the inherited assets, including interest income and dividends, are taxable (unless it comes from a tax-free source).

Rhode Island Estate Tax Exemption The estate tax threshold for Rhode Island is $1,733,264. If your estate is worth less than that, you owe nothing to the state of Rhode Island. If it is worth more than that, there is a progressive ladder of tax rates that will determine how much you owe.

Form 706 is used by an executor of an estate to calculate the amount of tax owed on estates valued at more than $12.06 million if the decedent died in 2022 ($12.92 million in 2023).

For decedents dying on or after January 1, 2023, the credit amount is $80,395, exempting from taxation the first $1,733,264 of an estate. This means that, in general, if a decedent passes away in 2023, a net taxable estate valued at $1,733,264, or less, will not be subject to Rhode Island's Estate Tax.

While there is no inheritance tax in Rhode Island, a deceased person's estate may be subject to state and federal estate taxes. Unlike inheritance tax, estate taxes are paid by the estate of the person who died, not by the heirs and beneficiaries.