Corporations must be formed under the enabling legislation of a state or the federal government, since corporations may lawfully exist only by consent or grant of the sovereign. Therefore, in drafting pre-incorporation agreements and other instruments preliminary to incorporation, the drafter must become familiar with and follow the particular statutes under which the corporation is to be formed.

Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association

Description

How to fill out Resolution To Incorporate As Nonprofit Corporation By Members Of A Church Operating As An Unincorporated Association?

If you desire to fill, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available on the web.

Make use of the site's simple and user-friendly search to find the documents you need.

Various templates for business and personal needs are organized by categories and states or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church functioning as an Unincorporated Association with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then hit the Acquire button to obtain the Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church functioning as an Unincorporated Association.

- You may also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/country.

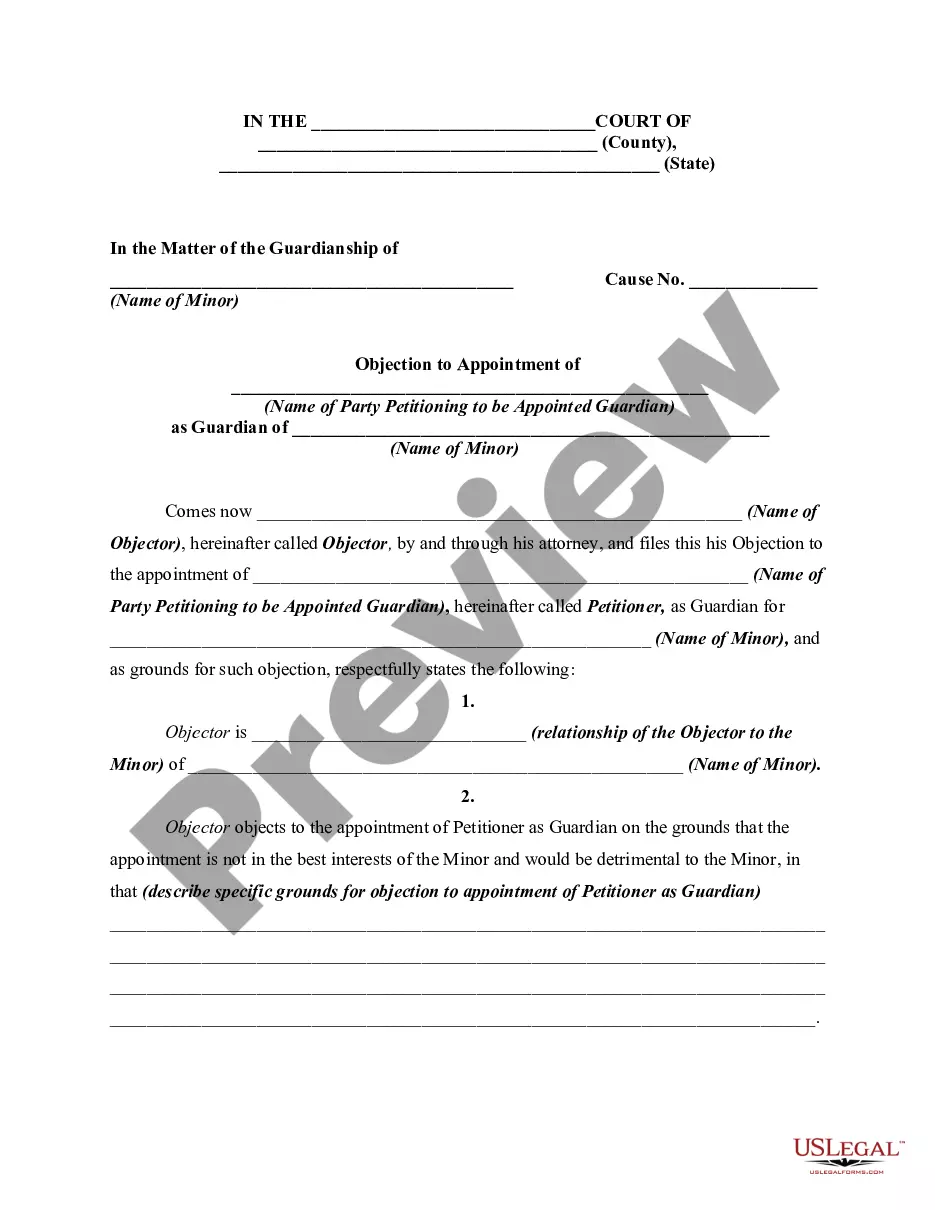

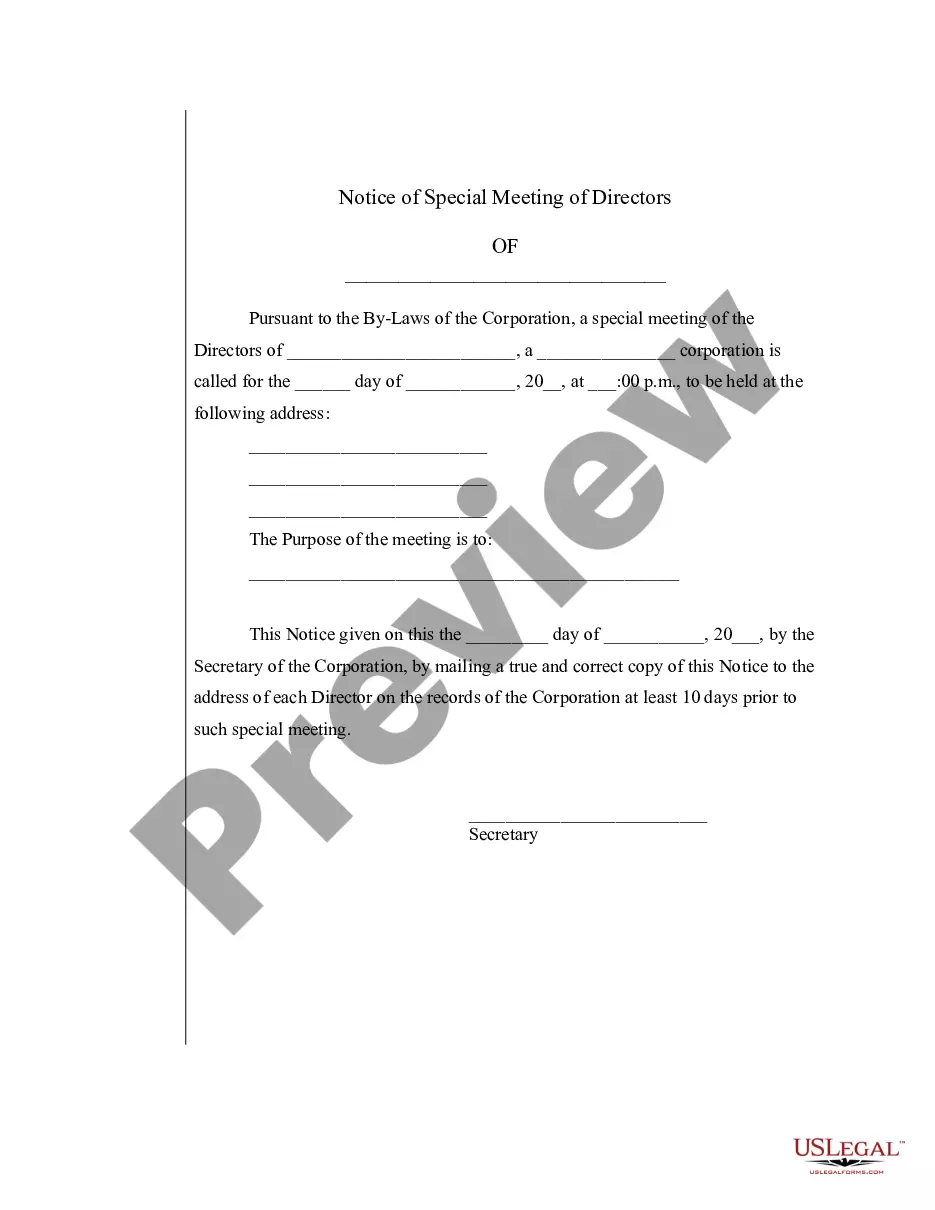

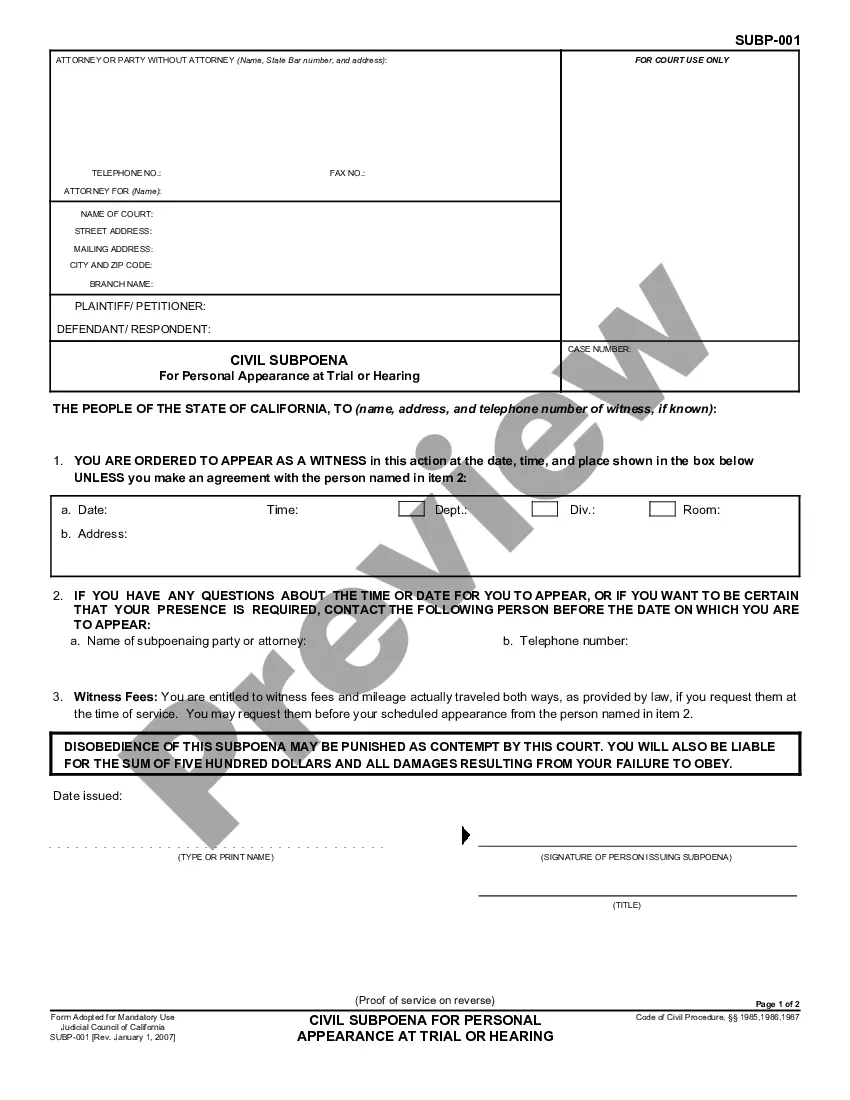

- Step 2. Utilize the Preview option to review the form's content. Don’t forget to read the details.

- Step 3. If you are not content with the form, use the Search bar at the top of the screen to find alternative versions of the legal form format.

Form popularity

FAQ

Churches can be registered as nonprofits, enabling them to operate under state and federal nonprofit regulations. The Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association is an essential step toward achieving this status. This resolution not only supports the church in gaining tax-exempt benefits but also offers legal protection for its members. Therefore, registering as a nonprofit is a strategic decision for any church seeking to formalize its operations.

The difference primarily lies in the legal status and structure. A nonprofit organization can refer to any group pursuing a charitable purpose, while a nonprofit corporation is a legally defined entity that operates within a specific framework. By utilizing the Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, your church can achieve the benefits of legal protection and tax-exempt status. Understanding this distinction is vital for effective organizational planning.

One disadvantage of a nonprofit corporation is the increased paperwork and regulatory requirements compared to an unincorporated association. The Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association provides important benefits, but it also obligates the organization to adhere to state laws and maintain compliance. It is essential to weigh these obligations against the legal protections and advantages gained from incorporation.

Yes, nonprofits do have corporate resolutions, which serve as formal documents that record decisions made by the board. Incorporating through the Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association allows churches to adopt these resolutions. This process establishes a clear governance structure and helps ensure accountability within the organization. Corporate resolutions also assist in documenting strategic directions and important decisions.

A nonprofit corporation is a specific legal entity formed under state law, whereas a nonprofit organization is a broader term that includes all organizations operating for a nonprofit purpose. The Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association focuses on creating a formal structure, which can enhance credibility and provide legal protections. Understanding this distinction can help your church make informed decisions about its legal status.

An unincorporated association, like a church, can qualify for 501c3 status, but it must meet specific requirements. The Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association can help streamline this process. By incorporating, the church can gain legal recognition and access to tax-exempt benefits. Thus, this resolution aids in achieving compliance with IRS guidelines.

Yes, a corporation can be a member of a nonprofit organization. This can facilitate collaborations and shared goals between different entities. If your church is exploring the Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, understanding membership structures can be very helpful.

Associations generally benefit from having an EIN, especially when dealing with financial transactions and tax responsibilities. This number simplifies reporting and helps maintain transparency. If you are part of a church looking to operate under the Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, obtaining an EIN is advisable.

While it is not strictly required, obtaining an EIN for an unincorporated association is often beneficial for various administrative tasks. An EIN can help with tax filings and enable the association to open bank accounts. If you're part of a church considering the Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, securing an EIN is a smart and strategic move.

A nonprofit corporation is a legal entity that is separate from its members, providing limited liability and formal governance structures. In contrast, an unincorporated nonprofit association lacks this formal structure and legal recognition. Understanding these distinctions is essential, especially when considering the Rhode Island Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association.