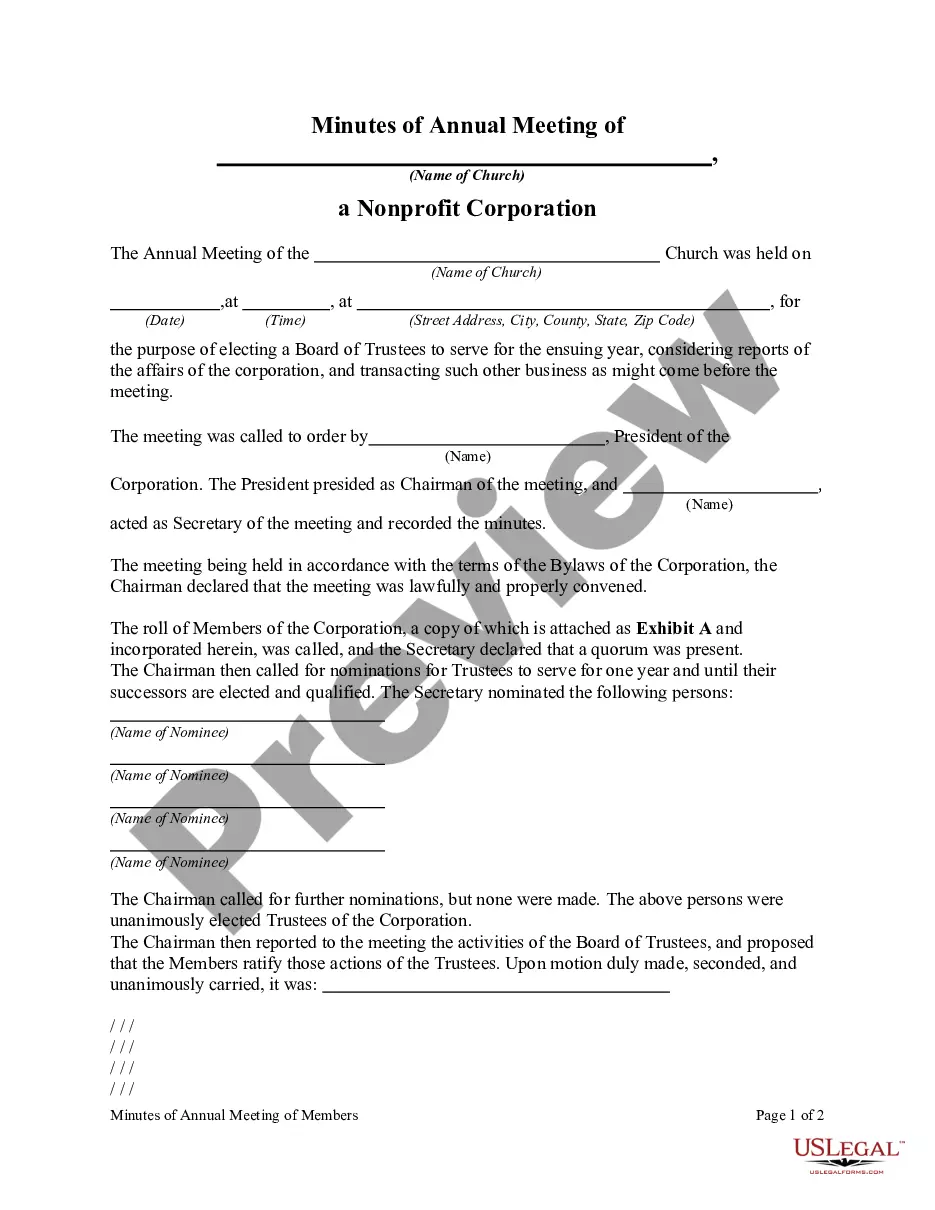

Generally, the members of a nonprofit corporation must exercise their control of corporate policies at regularly called meetings of the members. A corporation has a duty to keep a record of the meetings of its members, showing the dates such meetings were held and listing the members present or showing the number of voting shares represented at the meeting in person or by proxy. It is the duty of the secretary to prepare and enter the minutes of such meetings in the corporate records.

Rhode Island Minutes of Annual Meeting of a Non-Profit Corporation are crucial documents that capture the proceedings and decisions made during the yearly gathering of directors, officers, and members of a non-profit organization in Rhode Island. These minutes serve as an official record and provide a comprehensive account of the meeting discussions, actions taken, and voting results. Key elements that should be included in the Rhode Island Minutes of Annual Meeting of a Non-Profit Corporation are: 1. Organization Details: Begin by stating the full legal name of the non-profit corporation, along with its principal address in Rhode Island. 2. Meeting Information: Provide the date, time, and location of the annual meeting to establish the context for the minutes. 3. Attendees: List the names of the meeting participants such as directors, officers, and members present at the annual meeting. Also, mention any necessary introductions, or apologies for any absentees. 4. Call to Order: Record how the meeting was officially called to order, mentioning the person who conducted the meeting. This could be the chairperson, president, or any other authorized individual. 5. Verification of Quorum: State whether the quorum requirement was met or not, indicating the number of attendees needed for the meeting to proceed legally. 6. Approval of Agenda: Document the approval or amendment of the proposed meeting agenda by the members present. 7. Approval of Previous Minutes: If applicable, include a section to approve the minutes of the previous year's annual meeting. 8. Reports: Summarize any reports or presentations made during the meeting by board members, committee heads, or guest speakers. This may include the financial report, operational update, and any significant achievements or challenges. 9. Old Business: Outline any pending matters or unresolved issues from previous meetings that were discussed, deliberated upon, and decisions made. 10. New Business: Record in detail any new matters brought up for discussion, along with the opinions, suggestions, and decisions made by the members. This part might include changes to the organization's bylaws, election of new board members, or major program initiatives. 11. Voting Results: Document the outcome of any voting that took place during the meeting, specifying the motion, the number of votes in favor, against, and any abstentions. The results should be clear and accurately reflect the outcome of the voting. 12. Adjournment: State the time at which the meeting was adjourned and any additional activities or events that followed. Different types of Rhode Island Minutes of Annual Meeting of a Non-Profit Corporation might include: 1. Special Annual Meeting Minutes: These are minutes specifically for an extraordinary annual meeting called to address urgent matters or significant changes within the non-profit organization. 2. Board of Directors Meeting Minutes: Separate minutes may be kept for regular or special meetings held specifically for the board of directors, focusing primarily on their discussions, decisions, and actions. 3. Committee Meeting Minutes: If the non-profit corporation has various committees, minutes should be maintained for each committee's annual meeting, highlighting their activities and recommendations. 4. Joint Annual Meeting Minutes: In the case of non-profit organizations merging or collaborating, minutes may be necessary for joint annual meetings held to discuss shared objectives, partnership terms, or any other collaborative efforts. Remember, it is essential to consult legal and non-profit governance professionals to ensure compliance with Rhode Island state laws and regulations while preparing the Minutes of Annual Meeting for a Non-Profit Corporation.